+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

The booklet seeks to explain key features of taxation in the UK, especially for businesses and individuals. It relates to the various systems of taxation imposed by the government on citizens and business entities, focusing on the need to understand these two systems. Some of the areas discussed in the booklet include income tax obligations, corporation tax, capital gains tax, inheritance tax, overseas tax issues, trust taxation, and the exemptions and reliefs allowed. This book’s central purpose is to help readers gain a better understanding of the use of certain taxes within the UK taxation framework by providing clear descriptions and comprehensive calculations of selected taxes. It is an excellent resource for students seeking assignment help in taxation, offering clarity and practical insights to enhance academic performance in this complex subject area.

This section will cover the first major requirement of the assessment, focusing primarily on the advanced aspects of Corporation Tax and Value Added Tax (VAT) as they apply to diverse business structures and transactions.The analysis presented here models a high-quality response for the Unit R/617/9085 UK Taxation for Business and Individuals Advanced Assignment Sample, addressing the practical application of tax rules.

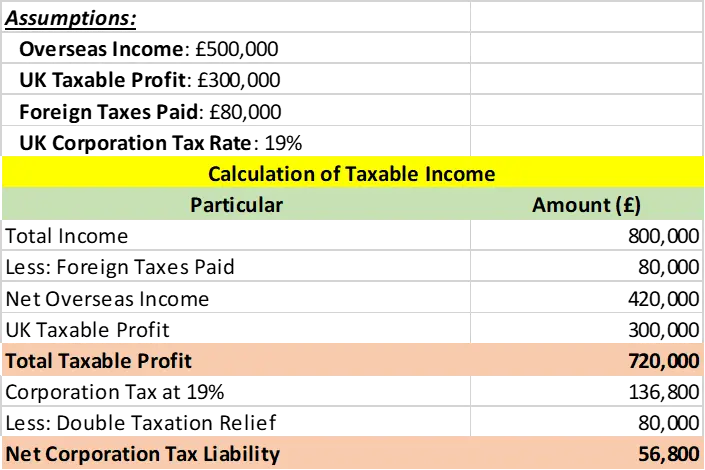

The foreign income earned needs to be declare as the part of the UK tax return for the organizations. The UK has an odd system of taxing global income but reliefs and exemptions such as DTAs can reduce the burden. These treaties mean that companies can reduce their UK tax bill by the amount that they have already paid to another country in tax. To combat transfer pricing, the laws of the United Kingdom state that prices of transactions between the UK and affiliated entities abroad must be at arm’s length. The changes particularly are capable of distorting reported income and thus adequate attention needs to be paid to it so that the right amount of taxes can be declared.

Foreign Income Exemption: Foreign income, for instance, the dividends from foreign subsidiaries are exempt from taxes under the following circumstances (Ftouhi and Ghardallou 2020). There are certain circumstances under which the UK tax residents are allowed exemptions from the foreign income for instance the dividends from overseas subsidiaries. This relief cuts down the quantity of foreign income, which is subjecte to UK tax, and therefore in a taxing of incomes more than once that are earned across the globe.

Research and Development (R&D) Tax Relief: Qualifying R&D activities can incur a tax credit that will decrease the amount of tax that the companies pay. It includes the domestic and foreign expenditure on R and D as long as the R and D activities satisfy the condition laid down by HMRC to avail this relief so that the company can get a huge amount of tax credit or tax deduction.

Capital Gains Tax (CGT) Relief: There are ways of relieving CGT such as Entrepreneurs’ Relief or Business Asset Disposal Relief applicable in using to offset gains from the sale of business assets or shares. This relief only applies to gain arising from any disposal of an asset whether such asset is situat in the country or outside the country of the resident under certain conditions and meeting particular thresholds.

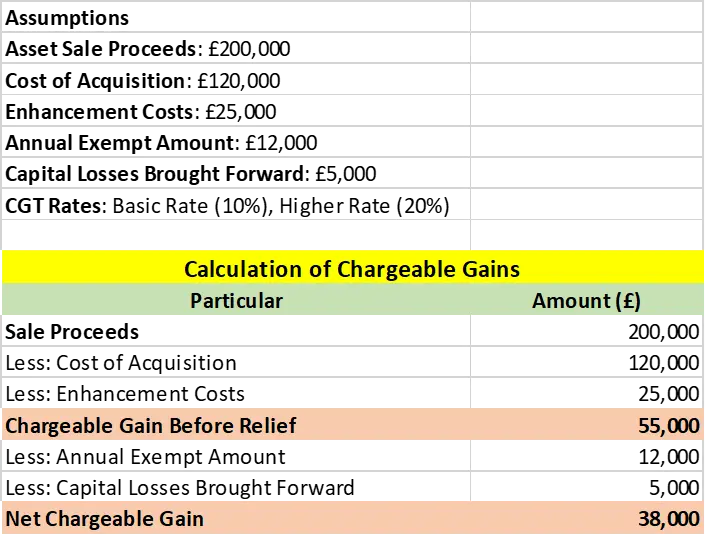

Chargeable Gains: It appears when the disposal by a chargeable person of an asset but in this case at a profit rather than the acquisition cost. This consists of the selling off, giving away, or disposing of assets.

Figure 1: Chargeable Gains

Capital Gains Tax (CGT): It arises when it is payable on the gain, which arises on the disposal of the asset. It is calculate on the net chargeable gain owned after the exemptions and reliefs that were allow. These liabilities are later on tax at applicable rates, which may be the basic rate, or the additional rates depending on the total gain.

-liabilitity_6904362f752a5.webp)

Figure 2: Capital Gains Tax (CGT) Liabilitity

Principles of Valuation

In the computation of IHT, the rate of taxation is base on the market value of the property of a deceased individual or at the time of transfer. This includes:

Reliefs Available

Reliefs:

Transactions between persons and trust, and between trusts

Trust Transfers:

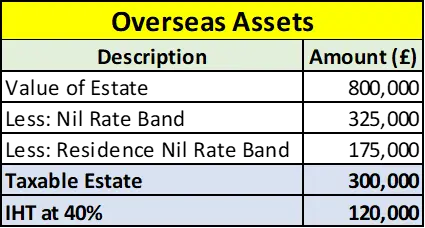

Overseas Aspects

Overseas Assets:

Example

Figure 3: Overseas Assets

Administration

Companies engaged in operations below the territorial waters of the United Kingdom need to report income and taxes under the UK laws.

The key elements include:

Overseas Income: Earnings derived from activities other than trading carried out in the United Kingdom such as profits arising from the exploitation of fixed assets situated in another state.

Double Taxation Relief: Concessions as to the taxes paid elsewhere to ensure that they do not pay taxes twice.

Figure 4: Taxable Income

Administration

Payment Due: After nine months of the accounting period.

Filing: CT600 has to contain information about the corporation’s income earned in other countries and tax credits.

Value Added Tax commonly referred to as VAT is an important component of the taxation systems in United Kingdom applicable to the sale of goods and services. It is accrue in the several stages, in the production and the supply chain stages, before sold to the consumer. VAT has to be charge by businesses on the sales, at the same time businesses have to recover VAT on the goods and services that they acquire (Clausing 2020). VAT types include the standard rate (20%) the reduced rate (5%) and the zero rate (0%). VAT has made the collection of taxes easy and put into practice in European nations. However the method used in some industries and undertakings can be complicated. Legal VAT management is very important to compliance and to keeping the internal cash flow of some businesses.

This section will address the second component of the assessment, typically involving the intricate rules surrounding Capital Gains Tax (CGT) and Inheritance Tax (IHT), with a focus on strategic tax planning for high-net-worth individuals and family estates. All advice and calculations align with the criteria set out for the Unit R/617/9085 UK Taxation for Business and Individuals Advanced Assignment Sample, emphasizing ethical and professional judgment.

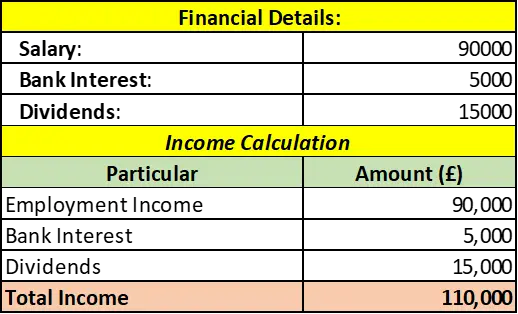

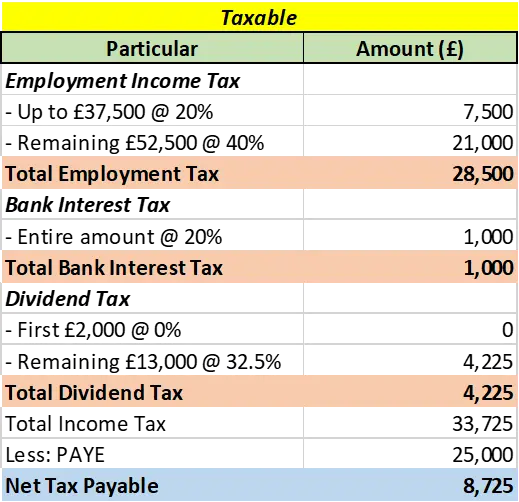

Scenario: Alexa's total gross earnings are £125,000 per annum £90,000 million as a salary, £5, 000 as interest on bank deposit, and £15 000 as a form of dividend.) Alexa’s total tax payable is £8,725.

Figure 5: Financial and Income

Alex's total income is less than £100000, and then the personal allowance is £ 12,570.

Figure 6: Taxable

Notes

| Tax Advantage | Tax Disadvantage | |

|---|---|---|

| Maximizing Pension Contributions | Tax Relief: Constituent contributions that go towards the financing of candidates and their campaigns directly lower one’s taxable income thus providing an immediate tax advantage (Advani, and Summers, 2020). For instance, a £10,000 donation results in a £10,000 deduction from the total taxable income. Employer Matching: Donations may add to the existing employer contributions giving a higher degree of savings (Okunogbe, and Santoro 2023). |

Contribution Limits: Breaching annual thresholds; for 2019/2020 tax on £ 40,000, attracts tax penalties. Access Restrictions: Money is attached till the retirement age is achieved (Nerudova, et al. 2020) |

| Investing in ISAs | Tax-Free Income: Under ISAs, interest, dividends,s and capital gains are exempt from tax. ISA annual allowance is £20,000. Flexibility: One may freely access and/or withdraw from the fund without facing any tax implications. |

Contribution Limits: An annual limit is set to prevent the build-up of tax-free funds No Tax Relief: Donations found not to detract an individual’s income subject to tax. |

| Utilizing Capital Gains Allowance | Tax-Free Gains: Individuals can now get the first £12,300 of their gains free from tax (2019/2020 tax year) (Adhikari 2020). Any additional collected beyond this limit is subjected to an additional rate of 10% or 20%. Effective Tax Planning: Enables one to plan when, where, how, and what he/she is going to acquire or spend to allow for maximum tax-free receipts and least tax charges |

Threshold Limit: Anything over the allowance is taxable and this can pose a problem when making very large transactions hence incurring a large tax. ● Complex Reporting: Stipulates a system of accounting where gain computations that are in excess of the allowance must be precise. |

Table 1: Tax Advantages and Disadvantages

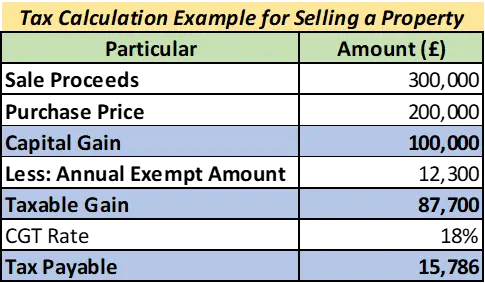

Figure 7: Selling a Property

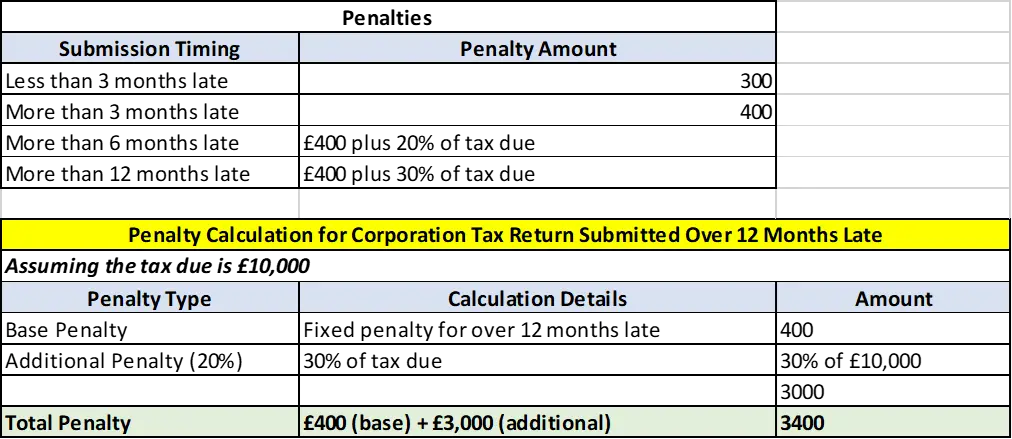

The Corporation Tax Return within 12 months starting with the close of its accounting period. It was fill over 12 months past the filing requirement for the return (Gale 2020). The following section discusses the statutory requirements of the legislation as well as the consequences of non-compliance with the provisions of the legislation.

Figure 8: Penalty for Tax returns in Corporations over 12 months late

Implications of Non-Compliance

Stakeholders are those people who have an interest in the performance and affairs of an organization and who therefore have legitimate expectations of it. This involves every part of an organization including investors, staff, and consumers because they all have their unique part to play in the organization (Shevlin, 2020). In the organizations must identify and meet their needs for things to run smoothly on the operational level. There are three main categories of stakeholders: Internal, related, and external. A part of the audience involved internally, are those individuals who are employed by this organization, they include the workers, clerks, managers, etc who have the responsibility and authority to determine and implement some or most activities within the organization. Strategic partners are companies that have some kind of contractual relationship or business association with other companies such as customers, suppliers, shareholders, etc.

Stakeholder engagement is very important and this through several methods including writing emails, reports, letters, and even physical or teleconferences. Communications with employees, for example, the management can be face-to-face discussions or through emails and other written means. Hence, it is relevant that such communications are precise, professional and, effectively convey information to colleagues to ensure that they contribute towards the organization and address matters as required (Alm 2021). On the other hand, communication might not always be direct especially when dealing with the external environment in this might involve writing or telephonic conversation. These exchanges have to be characteriz by a high level of professionalism and ethical standards.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Stakeholders are crucial to any business, and hence, there is a need to have proper communication with them. It helps in the decision-making process, motivates workers, and makes them feel valued and valued members of the consumer organization (Weaver et al. 2021). As for internal communications, assessment of what is currently available and potential ways that it could be better include, for example, using to measure its effectiveness. It is important to accept new approaches such as video conferencing to allow for the participation of individuals physically located far away while not underestimating the traditional approaches that include emailing and writing reports among others (Herijgers and van Charldorp 2021). The communication method must be appropriate to the organization’s structure depending on whether the employees are situate in the workplace or are working from home and depending on the extent of the privacy of information transmitted.

This section will complete the assessment by focusing on personal income tax considerations for company directors and employees, including employment benefits, pensions, and non-domiciled status. This final part demonstrates the depth of knowledge required for the Unit R/617/9085 UK Taxation for Business and Individuals Advanced Assignment Sample, concluding with a summary of key tax risks and opportunities.

Investment in tax-efficient vehicles like ISAs (Individual Savings Accounts) can significantly reduce tax liabilities. ISAs allow individuals to invest up to £20,000 annually without paying tax on interest, dividends, or capital gains (Hickland et al. 2020). For businesses, investing in research and development (R&D) can qualify for tax credits or enhanced deductions. For example, a company investing £100,000 in qualifying R&D can receive a tax credit of up to 33% of the expenditure, equating to a £33,000 reduction in taxable income. Additionally, contributing to pension schemes allows individuals to claim tax relief on contributions up to £40,000 annually, potentially reducing taxable income by this amount.

One of the legal ways of minimizing tax is through tax exemption is a legal way of reducing tax. For instance, it may be point out that through £12,000 annual capital gains tax relief, it is the position that the public is allow reliefs amounting to gains of up to £12,000 (Fan 2021). Firms to protect today’s profits behind other revenues, intelligently structured amid the past-loss deductions, may apply some of them, like tax depressions. The other kind of investment without a significant amount of taxes attached to it on either the dividends or the capital gains rather than income. Timing control on the disposal of assets or accrual of income can also assist in attaining tax optimization, or in other words, bring statements closer to low taxes or permitted reliefs.

Some of the forms of tax planning that may be relevant to the individuals include exemption of allowance that is tax-free, for instance, capital gain tax personal allowance of £12000 in the current financial year, and use of tax efficient milieu such as ISA (Edgley and Holland 2021). UK tax mitigation or planning for corporate entities consists of claiming all available deductions and credits which are as follows Expenditure allowance, £100, 000 for capital asset provides its tax relief in the current year. It is also helpful in decreasing liabilities, other tax commutative methods include structuring the business operations in a way that would qualify for tax reliefs or structuring expenditures in a way to the end of the tax year.

Conclusion

The present guide provides also a general description of business taxation, laws, and regulations. It enhance the current client relationships at the explain types of taxes and ways of getting relief, and depiction of taxes.

Reference List

Journal

Introduction of Lerner X Get free samples written by our Top-Notch subject experts for taking Assignment...View and Download

Introduction: Entrepreneurship and Small Business Management Struggling with entrepreneurship assignments? Assignment Help...View and Download

Introduction to Component Assessment Sample Research paper 1: Carr et al. 2017 Findings : This study aims to analyse the rate...View and Download

Introduction to Personal Leadership and Management Development Assignment Leadership abilities are those that...View and Download

1. Introduction to Challenges of Remote Work in the UK Public Sector Assignment 1.1 Title: Impact of working from home...View and Download

TASK 1- Portfolio Achieve your academic dreams with expert Assignment Help Online that guarantees top grades and timely...View and Download