+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

This chapter introduces the overall research topic and provides the foundation for the study. It outlines the background of financial planning, the research rationale, aims, objectives, and research questions, with a specific focus on Mace Company. The chapter establishes the importance of financial planning in achieving long-term organisational sustainability and sets the direction for the subsequent chapters. This research focuses on Financial Planning and Its Impact on The Long-Term Sustainability: A Case Study of Mace Company, with particular emphasis on strategic financial practices that support long-term organisational stability.

Financial planning is important to save money, control expenses, and reach financial goals. It can also help to make some potential and significant plans to be financially stable appropriately for the future. The research mainly helps and supports understanding the impact of financial planning for long-term sustainability within a case study of Mace Company. Most importantly this significant research topic represents the background of the topic, research aims, objectives, and questions these mostly help to generate good quality of depth to the overall research.By adopting a structured and evidence-based approach to analysing financial planning and long-term sustainability, this research aligns with insights commonly highlighted by the best assignment helper which emphasise clarity, critical analysis, and real-world organisational relevance in academic research. Also, through the research rationale, it was easy to recognise the main concept of the research by representing what is the issue, why it is an issue, why it is an issue now, and how this discussion spreads light on this issue.

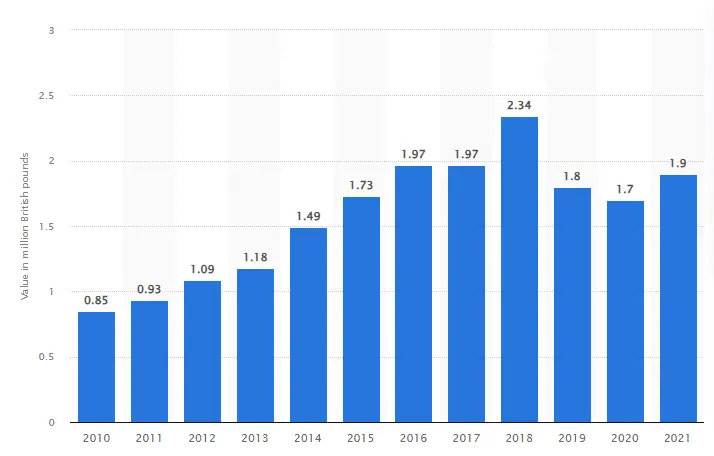

Financial planning is much more important and effective in helping many organisations and individuals reach their financial goals by delivering a structured process to operating income, expenses, obligations, and investments, to better prepare for the future (Lone and Bhat (2022)). Also, it helps reduce financial stress and a higher chance of achieving long-term objectives such as retirement savings. Moreover, the research analyses the impact of financial planning on long-term sustainability within the Mace Company is significantly important. Also, a construction consultancy organisation such as Mace requires concentrated financial planning to effectively execute high projects, navigate market changes, optimize resource distribution, make knowledgeable investment decisions, mitigate financial risks, and provide long-term sustainability. Especially when the organisation effectively deals with difficult, increased-value projects across various international locations, which are core elements of their business model. Most importantly in 2021, the Mace Group increased by 200,000 British pounds however the organisation significantly targeted to achieve £3bn of revenue by 2026 (macegroup.com, 2025).

Figure 1: Mace Group's annual revenue in 2010-2021

The Mace Group mainly utilises a debt management financial planning strategy through this significant strategy Mace, achieving record revenue and profit before tax in 2023 over the year, the organisation recorded income of around £2.36bn, surpassing that of 2022 and operating profit of around £64.3m (macegroup.com, 2025).

What is the issue?

Unlike many companies, Mace Company also faces significant challenges in establishing strong financial planning techniques that provide strength and adaptability in the face of different external pressures. Most importantly in today's rapidly transforming financial landscape, financial planning has appeared as a necessary element for the long-term sustainability of companies (Allioui and Mourdi 2023). The case study of Mace Company emphasises this essential issue, especially in light of current global financial uncertainties, turning consumer behaviors, and technical advancements. Financial planning concerns predicting future financial performance, comprehending market dynamics, and distributing resources efficiently, which are necessary for maintaining operations and promoting growth. Without proper financial planning, the organization can face cash flow issues, incapacity to invest in the creation, and business failure.

Why it is an issue?

This issue is important because insufficient financial planning can have wide effects in managing the suitability for the long term. Companies like Mace, which are parts of a positively competitive industry, can face issues in managing their sustainability due to fluctuations in business. The incapacity to predict financial requirements and market changes can result in missing opportunities and reduced market share (Szabó-Szentgróti et al. 2021). Poor financial control can delay a business's growth prospects, hindering its capacity to respond to new challenges and customer needs. In expansion, the lack of a strategic financial plan defines the organisation's ability to attract investment, commit stakeholders, and improve shareholder value.

Why it is an issue now?

Now, the applicability of financial planning is highlighted by several aspects. The international economy is seeing volatility, with inflation rates fluctuating, supply chain disruptions lasting, and geopolitical uncertainties concerning trade (Asadollah et al. 2024). Businesses are made to be agile and ready for unexpected challenges. For Mace Company, now is a critical time to reassess financial strategies to ensure they are trained not only to survive but to succeed in this unexpected background. Moreover, the fast progress of technology suggests that companies must incorporate digital tools and data analytics into their financial planning strategies to remain competitive.

How this discussion spreads light on this issue?

This discussion radiates a light on the significance of financial planning by reading its direct importance on the sustainability of businesses such as Mace Company. Through this case study, it was easy to aim and identify best practices in financial strategy, analyse how useful planning can lead to enhanced decision-making, and highlight the advantages of aligning financial goals with more general organisational objectives (Ghonim et al. 2022). Also, by focusing on real-world applications and outcomes, this research highlights the need for proactive financial management and strategies in promoting long-term sustainability.

1.4.1 Research Aim

The main aim of this research is to significantly analysis the impact of financial planning for long-term sustainability within the Mace Company.

1.4.2 Research Question

How does financial planning impact the long-term sustainability of Mace Construction Company?

1.4.3 Research Objectives

1.5 Summary

The introduction chapter mainly helps to understand the importance of financial planning with an organisation such as Mace Company. As per this chapter, it was easy to understand this research is important because, in the current situation, most organisations face issues regarding rapid fluctuation in financial growth. Most importantly the Mace group significantly targeted to achieve a good quality of financial revenue within 2026 which is why this organisation needs to robust some financial strategies. Also, the research has an appropriate aim which is to significantly analysis the impact of financial planning for long-term sustainability within the Mace Company.

This chapter critically reviews existing academic literature related to financial planning and long-term sustainability. It examines relevant theories, conceptual frameworks, and prior studies to understand how financial planning influences organisational performance and resource allocation. This chapter supports Financial Planning and Its Impact on The Long-Term Sustainability: A Case Study of Mace Company by reviewing relevant theories, empirical studies, and conceptual frameworks related to financial planning and sustainability.

Literature review mainly presents the view of existing research on specific topics which mainly discloses the analysis of previous literature. That chapter presents the analysis of the previous literature which is mainly based on the case study of Mace company in Financial Planning and Its Impact on Long-Term Sustainability. Furthermore, this research study critically discusses Mace's relationship between financial planning and resource allocation, key challenges of financial planning, and the ways to mitigate them. A strong financial foundation that can maintain Mace's competitiveness and stay ahead of its rivals. This chapter presents a conceptual theoretical framework and critically analyses the using crucial theories for the Mace company and the analysis of research gaps.

The Mace organisation is an international construction and consultancy company that focuses on financial planning strategies that aim for efficient cash management robust risk management, and strategic cost control across the project lifecycle. According to Kalra et al.,2023, Mace's three priorities, guide it in leading the way to a more connected and sustainable world. In mace strategy, they drive to become a purpose-led business. Mace aims to redefine the ambition boundaries. Its 2026 strategy is built on a successful foundation. Its purpose is based on its vision and legacy of shaping cities and creating a sustainable society. It has expanded its footprint of geographical in new local and also strengthened its service to customers across new sectors and markets. On the way, it has provided iconic projects in entire the world for internationally recognized clients and continues to boost its reputation as the world's world-leading brand (strategy.macegroup.com,2025). Mace also made several specific strides toward its 2026 business strategies target in 2023. It is investing £68 million in research and development which increase by 20% in (2022). It achieved huge progress in its commitment to social value and 2026 value.

Pursue a suitable world

Mace's drive to accelerate the built environment response to the climate emergency continued in 2023. It was a carbon-neutral business having minimized its carbon emissions and offset the staying via gold standard offsets (macegroup.com, 2025). This planet has reached a tipping point. The built environment holds many of the keys to a sustainable world, in an industry that has been slow to maintain. It's taking the lead by committing itself to bigger, bolder goals so that its clients and partners are all part of building a world where communities thrive and for germination to come.

Grow together

Mace, people are the heart of its business while it shares ambitions as a collective, it also has ambitions as an individual. this organisation inspires the best practice in everyone to make it the best place for collagenous from all professional backgrounds to develop their careers. Mace continued to invest in its most crucial asset including our asset. As a business that has developed considerably over the last 32 years and has an ambitious plan to expand more. Mace is investing heavily to ensure that it has the right systems and processes in place to support its people.

Deliver distinctive value

Building on a culture, which fosters creativity at every level, Mace established an invention fund that allocated economic assets to reward new views and approves. Moreover, investment in innovation arrived in the shape of new technology that provides it drives productive improvements. It creates new benefit offerings for clients and allows more unassailable wording.

Mace's financial planning and resource allocation process are closely intertwined. with the organization's financial plan and its resource allocation decisions. Moreover, there are several areas where Mace can improve its relationship between resource allocation and financial planning. In the strength, there are clear financial objectives of Mace including increasing revenue and reducing cost (Manero and Mach, 2023,). The part form that all of these objectives guide the company's resource allocation decision. According to LAWSON, (2021), Mace has a comprehensive budgeting process that includes all departments and levels of management. It ensures that everyone is aligned with the organisation's financial objective. Mace regularly monitors its financial performance which enables it to identify areas where resources can be reallocated to improve financial performance. As per the comment of Foss and Klein, (2022), Mace's financial plans and resource allocation decisions are sometimes inflexible making it complex for the company to respond quickly to challenges in the new market. According to the Goyal et al., (2021), financial planning and resource allocation have a significant relationship that increases financial budgeting. Mace ‘s financial planning and resource allocation decisions are sometimes divine solely by financial considerations, without sufficient consideration of non-financial factors including employee morale, environmental impact, and consumer satisfaction. There is often inadequate communication between departments and levels of management regarding financial plans and resource allocation decisions which can lead to misunderstandings of resources. It has been stated by Macfarlan et al., (2023), that Mace can implement a more flexible budgeting process that evolves for quicker adjustments to changing market and economic conditions. Mace can improve communication between departments and levels of management regarding financial plans and resource allocation decisions. Mace can implement a roiling that allows for quicker adjustments to changing market and financial conditions.

There are several challenges of financial of Mace has and some ways that mitigate them. Resized is throughout the supply chain as businesses prepare for challenges that potentially lie ahead (Paul et al.,2021). It is a major difficulty to build the extent to which manufacturing of construction products. Mace operates globally which exposes it to cash functions. Changes in exchange rates can affect the organisation revenue, cash flow, and profitability. Mace's working capital requirements can be significant, specifically in its construction and infrastructure projects. To manage working effectively is important to provide the company's financial stability and liquidity, Mace operates in a complex and uncertain business environment which exposes it to various potential risks including marketing risks, operational risks, and credit risks. Managing these risks efficiently is important to ensure the company's financial stability and sustainability. As per the comment of Mace, (2023) Mace can use cash hedging strategies including forward contracts to mitigate the impact of cash fluctuations on its financial performance. Mace can diversify its revenue streams across various regions to minimize cash fluctuations. And regularly review its cash exposures and adjust its financial plans accordingly. According to Zampou et al (2022), The company operates daily potential hazard reviews to investigate several risks and improve them to reduce them. this company can execute management of inventory process and practice to reduce its levels and mitigate its operating capital needs This organisation can apply a strategy including supply chain management options like revealing to optimize its functioning management of capital that can alter streams and invest to reduce its vulnerability to market hazards and scepticism.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

The construction company of Mace and its financial planning allows predicting and designing for financial fluctuations like interest rate changes. based on a stable economic aim to miscalculate its vulnerability to potential complexities and provide its stability of economic. According to Okeke et al., (2024), this focus helps it to provide a marketplace by enabling it to invest in tactics like research and development (R&D). Through a strong position of economic foundation, this company can ongoing its high competitiveness and remain on its competitors. This plan helps to investigate and adjust potential hazards like operation, market and also credit risks. Based on the substantial hazards managed tactics, mace can prevent its vulnerability to provide its economic stability. According to DEMİR, (2024), investigating the potential areas in this plan or aim allows it to optimize its resource allocation, where it can align with efficiency. in addition, it can enhance its returns on investments and gain strategic goals by priorities on intently with the allocation of resources. Mace can improve its financial performance by setting clear financial goals to identify areas for cost reduction and optimizing its overall financial structure. By having a strong foundation, it can actively gain its financial objectives and build value for its shareholders. According to Frésarde et al., (2022), financial planning helps Mace to invest in the strategic initiative maintain its competitiveness and stay ahead of its rivals. Financial planning enables its resource allocation for the overall business of Mace company. The significance of financial planning of Mace helps to improve its financial performance to achieve its financial goals and build value for its stakeholders. It is important for Mace to mitigate economic fluctuations secure its market position and gain its strategic objective, by having a solid plan of financial in place this company can optimize its resource allocation and adjust comprehensive risks.

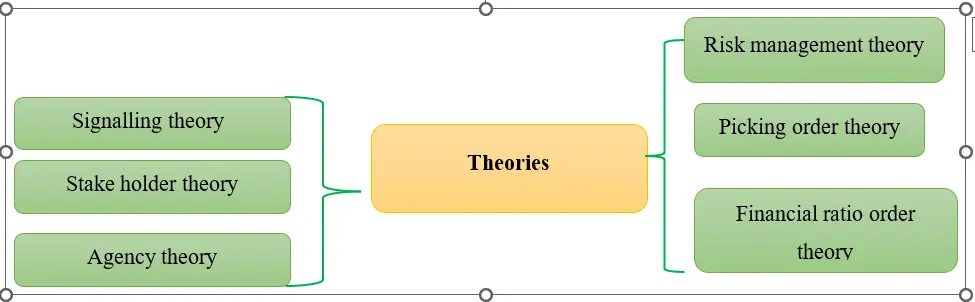

Figure 2: Theoretical framework

The main research gap has been founded taht there is limited research available reading to this selected organization Mace Company. These discussions hardly touch direct impacts of the financial factors in the process of financial analysis reading to this company. The previous research does not use data validations and data visualizations but in that research section data validation and data visualization are also used (Taherdoost,2023). Some researchers cannot find the relationship between financial planning and resource allocation, particularly in Mace company. This research study has also observed that most of these studies have conducted mace companies' purpose and sustainability growth.

2.8 Summary

The literature review, Chapter 2, discusses a case study of Mace company's Financial Planning and Its Impact on Long-Term Sustainability. Through this introduction, part was easy to describe the research-related elements. This chapter also significantly represents the research objects that effectively support the research to conduct the research impotence through the objectives. Some theories including agency theory, Stakeholder theory, Modigliani and Miller, and other theorists apply here to Mace company. Finally, this study presents a theoretical framework.

This chapter explains the research design and methods adopted to investigate the impact of financial planning on long-term sustainability at Mace Company. It outlines the research philosophy, approach, design, data collection methods, sampling techniques, and ethical considerations. The methodology ensures the reliability and validity of the research findings.

Research Methodology is a designed study process to obtain reliable and accurate outcomes. This methodology part has been described based on Mace Construction's financial planning and impacts. This chapter summaries the research methods that have been used in analyzing the practices of economic planning and their effect on the Mace Company's long-term sustainability. this chapter contains the research design, research philosophy, research approach, ethical considerations, and sampling techniques for conducting the investigation. A strong methodology is important as it provides the validity and dependability of the results. By describing the methods this chapter aims to deliver transparency on how this investigation was completed, qualifying for a thorough knowledge of the economic dynamics affecting sustainability actions within the Mace company.

Research philosophy is an underlying or the thinking, and it influences the researcher's thinking based on their observations and beliefs in process development (medium.com, 2024). The research philosophy embraced in this analysis is interpretivism.

Justification

Interpretivism research philosophy adopts facts that are socially subjective and constructed. This philosophy is related to the qualitative approach that underlines comprehension of the public's knowledge and understanding of the world such as interviews, ethnography, focus groups, etc. (medium.com, 2024). The uses of the preterist allow adopting the primary mixed methods, which is suitable for developing a complete understanding regarding t this discussion. The main advantage of adopting this philosophy is promotes support to maintain qualitative analysis through the interview process. This philosophy also helps to develop quantitative measurements or events through survey data collection (Mace-Moore, 2024). In order to develop the discussion regarding the significance of financial analysis by taking the case of the mace group, this particular method helps to gather the primary data by using the survey and interview.

The research approach is a process for examining, analysing, interpreting, and gathering data. This approach has a clear goal that summaries the actions an investigator will bring to complete their study (study.com, 2023). This part has been using a Deductive approach to achieve a holistic insight into the economic planning techniques at this Mace Company.

Justification

The deductive research approach can be used when researchers start their research with the present theory develop detailed views based on the theory and gather data to strain whether the ideas are denied or supported. This research method improves planning for making decisions to build an understanding regarding the critical evaluation of Mace Construction Company by incorporating the financial analysis. In the analysis of quantitative data with qualitative understandings, this particular approach shares its benefits (Atteneder and Rodriguez-Amat, 2024). This broad experience sustains knowledgeable decision-making, allowing this construction company to determine movements and handle challenges impactfully, eventually donating to long-term stability and sustainability in a competitive need in the market.

The research design process uses to answer the question of the research by interpreting, gathering, and analysing data. This research design is divided into two parts which are conclusive research and exploratory research. To analyses this part has been taken exploratory research.

Justification

Exploratory research helps to investigate new topics, recognise hypotheses, and collect insights. The exploratory research facilitates the numerical data investigation alongside subjective experiences and understandings of the involved stakeholders in the process of economic decision-making (Lnenicka et al., 2024). This research enables an in-depth dive into the Mace construction company's subsequent effects and economic planning processes on sustainability initiatives by engaging SPSS and NVIVO. The study method is especially practical in delivering contextual understandings and promoting a clear insight into the complexities affected by economic decision-making. By centering on a single company, this research design permits a deep analysis that can report wider importance for economic planning in parallel contexts.

The tools and methodologies such as surveys, interviews, SPSS, and NVIVO extremely influence Mace Company's long-term sustainability and economic planning to improve decision-making methods and data analysis (Soucy, 2023.). Jointly, the entire tools make a complete practice that sustains not only sustainable development processes over duration.

sampling techniques are used to select a usual subset of data points from the study's huge population. It allows the researchers to create assumptions about the entire population. This topic has been taken Random sampling to describe it properly.

Justification

This sampling technique is a process of selecting an individual subset from a huge population where all members get a similar chance of being selected to ensure that this sample is representative of the entire inhabitants and underestimating discrimination in research outcomes. In this research, 101 responses have been collected through Google form and also SPSS has been collected.

Ethical considerations are essential in achieving this study, particularly regarding the confidentiality of participants and notified support. Utilising the act requirements, the participants will be desired their approval to help with the analysis and their data to be analysed and recorded. All parties will be briefed regarding this study's objectives and their freedom to revoke at any moment without repercussions. There will be a requirement to obtain ethical clearance from the appropriate IRB before the research is conducted. Obscurity will be provided in data reporting, and all collected data will be safely accessible and stored only in the investigation unit.

3.8 Summary

The methodology chapter guides the analysis of the practices of economic planning at Mace Company. By using an Interpretivism philosophy and Deductive approach, the analysis aims to amalgamate qualitative understandings with quantitative data for a complete examination. The research design has been elaborated by exploratory research and also using SPSS, NVIVO, survey, and interview tools which helps to understand this topic more impactfully. This study has been designed random sampling method, and strict ethical considerations are all critical elements that provide findings validity and reliability. This methodology abstracted here not only sustains the objectives of research but also contributes to increasing knowledge in the economic sustainability area.

This chapter presents and analyses the data collected to examine the impact of financial planning on long-term sustainability at Mace Company. Both quantitative and qualitative data are analysed using tools such as SPSS and NVIVO to generate reliable findings. The chapter interprets statistical results and thematic insights to address the research objectives and answer the research question.

Chapter four is mainly dependent on analysis and findings through this significant chapter researcher can generate a good quality of depth to the overall research. In this chapter researcher significantly represents descriptive statistics, correlation, regression, and reliability through survey results. Most importantly the researcher also represents NVIVO by creating an interview transcript between three organisational managers. Also, the interview was mainly conducted regarding two different types of interview questions that are connected with the topic. The survey was mainly conducted with 101 responders to conduct the statistical analysis. Through survey and statistical analysis, it was easy to represent some numerical and real-life data for the research which made the research more significant in an appropriate way.

Descriptive analysis

Descriptive statistics are important in data research because they deliver a concise overview of the key elements of a dataset, permitting researchers to comprehend the main tendencies, spread, and allocation of data (Ahmed, 2025). This creates the basis for further research and understanding, making it more comfortable to imagine practices and trends within the data before proceeding to additional complicated statistical methods. As per the above figure, three key variables were collected from a sample of 101 respondents. The intermediate age of the respondents is about 2.13, meaning that participants are typically more youthful established on the coding of the age classifications. The low standard deviation (0.966) indicates that ages are fairly close to the mean, indicating moderate consistency among the ages reported. Also, the gender score of 2.24 suggests a small skew towards one gender classification, taking the coding to reflect binary or non-binary answers. The standard deviation of (0.666) indicates a minor conflict in gender declaration within the sample.

Moreover, the mean score of income is 2.43, indicating a tendency towards middle-income ranks among the respondents. The standard deviation of (1.043) shows a wider reach of income classifications than observed in age and gender, remembering more variability of income levels. However, the descriptive statistics show interesting understandings of the demographics of the respondents, with a concentration in younger age groups, a small gender skew, and a combination of income levels.

Correlation analysis

Correlation analysis is necessary because it allows for identifying connections between variables, which can guide better decision-making, enhanced business implementation, and better efficient models (Song et al. (2022)). It was easy to understand there is a strong positive correlation (r = 0.565, p < 0.001) between agreement on financial planning's effect on long-term sustainability and the different associated variables. This suggests that as perceptions of economic planning's energy increase, so does the exposure of its reputation for sustainability. A significant positive correlation (r = 0.810, p < 0.001) is emphasized between the integration of environmental considerations into financial planning and the overall sustainability of the organisation. This indicates that including these reviews leads to enhanced results in sustainability practices. Also, the correlation (r = 0.818, p < 0.001) between sensible financial planning and its significance for Mace's sustainability is extremely effective. It highlights the idea that useful, actionable economic strategies are essential for reaching sustainable results. Most importantly the relationship between resource allocation and financial planning is strongly positive because (r = 0.791, p < 0.001). Sufficient allocation of resources especially impacts financial planning strategies, thereby impacting sustainability.

Also, according to the correlation statistics, it was easy to understand there is a strong correlation (r = 0.784, p < 0.001) between the alignment of financial plans with sustainability strategies demonstrating that businesses that strategically align their financial goals with sustainable methods tend to reach long-term success. Moreover, the findings support that sufficient financial planning is important not only for the financial viability of Mace Company but also for providing its commitment to sustainability. Aligning financial systems with sustainable methods, employing stakeholders, and managing environmental problems is important for the organisation's long-term success.

Regression analysis

Regression research is a statistical method that allows specifying how variables connect to each other. It is employed in many areas, including trade, finance, and healthcare analysis. The regression model shows a correlation coefficient (R) of 0.678, demonstrating a strong positive relationship between the independent variables and the dependent variable involving financial planning and long-term sustainability. The R Square value of 0.460 suggests that about 46% of the variability in the conditional variable can be defined by the separate variables contained in the model. The modified R Square value of 0.372 demonstrates a reasonably good fit after changing the digit of predictors contained in the analysis, with a standard error of the estimate. Also, the ANOVA indicates that the overall regression model is statistically significant, with a Value of 5.235 and a p-value (Sig.) of 0.000. This suggests that there is a significant relationship between the independent variables and the dependent variable. Moreover, the variables determining the functional significance of financial planning, the integration of environmental concerns, and other independent variables either show no significant impact or are not statistically meaningful since their values exceed 0.05.

Reliability analysis

Reliability analysis is important because it helps determine possible weaknesses in a design or development by assessing the possibility of failures, permitting proactive modifications to improve overall system dependability, minimize downtime, and stop costly disorders by identifying critical elements that could seriously impact the version if they fail. Basically, it helps to optimize strategy and expect the lifespan of a design by quantifying the likelihood of failure across various features and operating requirements. Most importantly through this significant statistical analysis, it was easy to appropriately understand how many of the responders generated appropriate answers regarding survey questions. As per the reliability test, it was easy to understand that 0.952 candidates generated reliable answers regarding the topic because the reliability analysis ideal amount was around 0.80 or higher.

NVIVO

The use of NVIVO is utilized for the analysis of qualitative data to provide permission for the researcher to interpret, code, and organize massive amounts of textual data. In this chapter, this program shows Word Tree, Hierarchical, 3d cluster analysis, Whole ring lattice graph, and Hierhial Clustered analysis. This program helps to search, compare, store, explore, organise, and analyse data. researchers use this program for analysis of the data and coding strategies. This program also can research data from social media, surveys, interviews, and other things.

Word Tree

A word tree is a visualisation that shows how a word is utilised in a different context, it is a tree-like branch with a structure and provides facts about the context and frequency of phrases and words in the data (Axelsson and Engström, 2023). This word tree also helps to recognize findings and themes. through this word tree can discover recurring themes, examine the connections between words and recognise findings and themes.

Hierarchial Clustered analysis

The analysis of Hierhial Clustered is also a visualization process that groups identical points jointly based on shared features. It shows the connection between different clusters and permits the researchers to determine themes and patterns within their data. It helps to feature access, select data, interpret interpretation, and establish parallel metrics. To apply this analysis it can analysis content, recognising themes with qualitative data, segmentation of customers, and analysis social network data.

Whole ring lattice graph

This graph delivers details by visually showing the connection between different entities in the research data where every node is placed on a circular ring and allowing people to notice how various aspects of the data are interconnected at a glimpse especially underlining difficult connections within a system. Its key points are based on the connection visualised, the layout circular, connection interpreting, and cluster recognising (Ståhlbom et al., 2024). Interpretation is also a key point by researching the relationship and their viscosity within the circle, investigators can determine key pieces, potential patterns, and clusters in their data.

Hierarchical

Hierarchical provides details by visually depicting the connection between categories within the data and demonstrating how people are managed and nested at various levels and allowing for notice of the understanding and pattern in the structure of data. The key points of this Hierarchical are visual representation, a tree map, identification of patterns, and exploration of data (Bertucci et al., 2022). In the sunburst formats tree map can be selected to display hierarchical data as a map of a tree or sunburst depending on preference. these charts help to understand how various categories are nested and connected within each other and provide data structure overview. This chart also uses to represent the chain of position and command within this organisation.

Theme 1: Financial planning supports the company by increasing the organization's strength, adopting innovation, supporting suppliers, and advancing the decision-making process.

Economic planning operates as a cornerstone for the success of the organisation by helping its suppliers, maintaining stability, improving the process of decision-making, and promoting innovation. These factors are connected and create a strong framework that drives the company toward reaching its long-term plans. At first, economic planning improves a company's power by delivering a precise roadmap for resource distribution (Challoumis, 2024). Through a detailed examination of potential acquisitions, earnings streams, and expenses company can specify its financial constraints and capacities. This transparency enables to start of a stable basis upon which the company can create and develop. For example, a budget of well-devised permits the administration to concentrate on streamlining operations and vital projects finally improving general profitability and productivity.

This power is not only calculated in economic terms but also mirrors a company's capability to survive financial uncertainties and adjust to the instability of the market (Guo et al., 2024). In the next step, economic planning helps creation by giving help strategically. companies that priorities research and development within economic strategies can research services, modern technologies, or products that fulfil the growing requirements of customers. For instance, a company that positions aside funding for project innovation can experiment with the solutions of innovative and competitors stay ahead. This approach not only encourages creativity but also sets the company as a director in their area, which can draw innovative partnerships and top talent, also improving their competitive advantage.

Helping suppliers is also a crucial part where economic planning plays an essential role. By providing sufficient reserves and a healthy cash flow company can keep healthy connections with the suppliers (Hofmann et al., 2021). To pay salaries timely and dependable economic responsibilities create trust, which can guide to improved teamwork, better pricing, and enhanced service on joint ventures. In the ultimate step, economic planning particularly increases the decision-making procedure within a company. With complete economic data and projections, leadership groups can create informed options that align with the company's plans. Economic planning promotes an accountability culture, as managers can follow performance against projections and budgets. This clarity helps in determining places that need improvements, enabling a responsive and agile company atmosphere.

Theme 2: Challenges regarding adopting financial planning within the organisation reduced the scope of sustainability.

Financial planning adoption within a company usually faces many challenges that can enormously decrease the sustainability scope. One key challenge is opposition to change management and employees who may be reluctant to embrace new economic rules during familiarity with present techniques (Evans and Britt, 2023). This hesitation can restrict the integration of bearable economic plans into the company's culture. Also, limited expertise and resources can hinder useful economic planning. the company might lack the essential training or tools, making it challenging to execute complete economic frameworks that encourage sustainability. Similarly, short-term priority is another crucial problem, multiple company's priorities direct economic outcomes over the goals of long-term sustainability, which can damage efforts to create strong economic planning strategies. there are some factors that provides the huge impact in the changes of the financial analysis, which are fluctuation in financial analysation, continuous changes within the technology and regulatory issues. management regarding these particular issues can help the organisation to make some progress and develop their continuous development to set a complete innovative development.

Irregular alignment between a company's goals and economic planning can also create challenges. If economic procedures do not remember the company's sustainability objectives, it can lead to disconnected measures that fail to produce the planned outcomes (Moghrabi et al., 2023). Finally, insufficient stakeholder meetings can determine approval for the initiatives of financial planning, making it difficult to ensure investment in sustainable methods. Managing these challenges is important, as they play a significant role in deciding the financial planning effectiveness in promoting sustainable growth within the company.

4.3 Summary

This chapter is particularly dependent on the findings and research part via this chapter significantly shows regression, descriptive, correlation, and reliability research that create a good quality depth to the whole research, and via this significant research, it was easy to recognise the relationship between independent and dependent variables. Moreover, as per the reliability analysis, it was easy to recognize that 0.952 responders generated accurate answers regarding the topic because it was significantly higher than the ideal value of reliability which is higher than 0.80. as per the overall discussion it can be stated that the changes within the financial position can help to build an overall progress within the organisation. This discussion also justifies the overall management regarding to projects and share the complete progress within these tasks.

This chapter concludes the research by summarising the key findings in relation to the research objectives and literature review. It provides practical recommendations to enhance financial planning strategies for long-term sustainability at Mace Company. The chapter also outlines the limitations of the study and suggests directions for future research.

In today's time, financial planning is a very important aspect of the strategies of companies, as it helps to track revenue, savings, and expenses. It helps the company to find areas for improvement and find opportunities in the future. The study analysed the effectiveness of Mace's financial planning on long-term sustainability. The chapter analyses the objectives by linking them with chapter 2 of the literature review and chapter 4 of analysis and findings. Some recommendations will be given for the issues found out through analysis of the objectives of the research. Recommendations for the financial strategies to attain sustainable growth and strategies related to the mitigation of the challenges will be assessed in the chapter. The limitations of the study will be assessed to find out the drawbacks of the study and also to find out the scope of the future can also be explained. The analysis and recommendations presented in this chapter are derived from Financial Planning and Its Impact on The Long-Term Sustainability: A Case Study of Mace Company and its key research findings.

Linking with Objective 1

Mace has a diverse financial strategy to gain sustainable growth for the company, as the company gives priorities to large-scale projects across the international sectors to gain the maximum revenue for the company. The company aims to reach £3 billion in revenue by 2026, which can be identified through the analysis of the Chapter 2 literature review of 2.3. The demands of the clients are increasing day by day as per the current market change of the company, so the importance of getting the advantage of sustainable growth is identified through analysis of Chapter 4 analysis and findings by applying the method of correlation. The company is focusing on enhancing its consultation and construction services internationally to fulfil the diverse needs of the company to gain the advantage of wholesome revenue from the international market.

Linking with Objective 2

The relationship between financial planning and resource allocation plays an important role in the company as it allows the company to set goals and work dedicatedly for the goals to gain maximum profit. Financial planning helps to create a proper budget for the company and can help the company build proper strategies for controlling costs. The company has planned for the proper budget which can be identified in Chapter 2 of the literature review of 2.4, which states that the company has the financial objectives to ensure everyone is working by aligning with it. The importance of financial planning in attaining the maximum growth of the company can be identified in Chapter 4 of analysis and findings through the methods of correlation and regression.

Linking with Objective 3

The company deals globally so an issue regarding the exchange rates of the currency is one of the issues that can be identified in the objective. The issue regarding the currency rate fluctuations can be identified through the analysis of chapter 4 of the literature review of 2.5. Fluctuations in market trends can also affect the company's revenue and a shortage of labour can also affect the growth of the company. The company can expand its operations more significantly to gain more share of the market. Building strategies to increase the engagement of the employees in the company can be beneficial strategies for the company to cope with the problems of labour shortage.

Linking with Objective 4

The company has a financial strategy to deal with various problems in the market, a strong financial plan with a focus on research and development and taking initiatives as per the market trends can help the company. Significant financial planning can help the company to allocate proper resources for the company which can be identified through analysis of the chapter 2 literature review of 2.6. Chapter 4 of the analysis of findings of the dissertation in which the method so SPSS find out the significance of financial planning in making the company deal with different problems in the market.

To develop the study, primary qualitative and quantitative methods are used, which signifies that the dissertation used a mix of methods to analyse the aims and objectives of the study. To gain better insights into the study, a survey method has been used in the research. One of the foremost limitations of the primary qualitative is that the sample size of the data can be too small to get a proper conclusion of the study. It can be time-consuming to collect the data and then analyse it. One of the drawbacks of the mixed methods can be that an issue of conflict may arise and can result in delaying the result of the research.

Through this discussion, people can get details about the uses of the survey, SPSS, NVIVO, and thematic analysis. People can do more research regarding the topic of how to build strong financial planning and this research can be a medium for the researchers to provide information regarding the topic. The theories that are used in the literature review can help the researcher to build more knowledge regarding the topic and the uses of the theories in different conditions. The methods that are used in the research can be beneficial for the other researcher to build knowledge on what methods can be used to research the same topic or another.

Conclusion

This chapter concludes the study by highlighting that effective financial planning significantly contributes to long-term organisational sustainability through improved strategic decision-making and resource management. It also presents practical recommendations and identifies directions for future research.

References

1.1 Explanation of the Concepts: Strategic Fit of Culture and Structure in Care If you’re seeking expert guidance on...View and Download

Introduction: Reflective Practice in Teaching Reflective practice plays an important role in my teaching; it helps me understand...View and Download

Introduction Health and illness prevention are part of key components of nursing practice according to the Nursing and Midwifery...View and Download

Task 1: Techno Skill Analysis - IKEA’s Tech Skills & Digital Gap Insights Digital technology and skill-based gap...View and Download

Introduction Take a look at this well-organized and thoroughly researched assignment example. It showcases the kind of work our...View and Download

Chapter One: Introduction and Background 1.1 Introduction The concept of health system resilience is gaining prominence across...View and Download