+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Enhance your grades with our premium-quality Assignment Help UK, carefully tailored to suit your learning objectives.

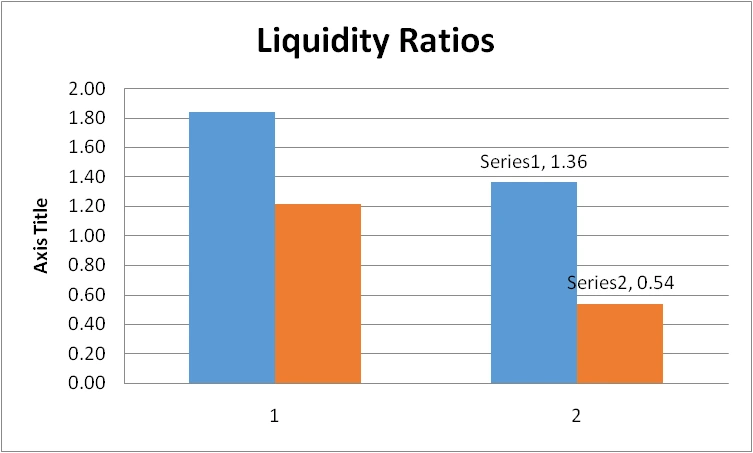

The establishment’s liquidity, profitability, turnover efficiency, and solvency for the years 2022 and 2023 are all established by these numbers. For a more exhaustive reexamination, the arrangement should take documented imprints and assiduousness benchmarks into account. Required economic ratios that display a company's ability to spend short-term deficits and the degree of financial flexibility are liquidity percentages. By banning checklists, on the other hand, the Quick Ratio suggests a stricter evaluation because merchandise could not be readily reversed to cash succinctly (Bintara, 2020, p. 35). The Current Ratio and the Quick Ratio are two frequently used liquidity ratios that are substantial in estimating the short-term economic soundness of an association. Strong short-term liquidity is generally suggested by a high contemporary ratio, which is considered as encouraging. On the other hand, an abnormally high ratio can foreshadow underutilized acquisitions and call for additional investigation.

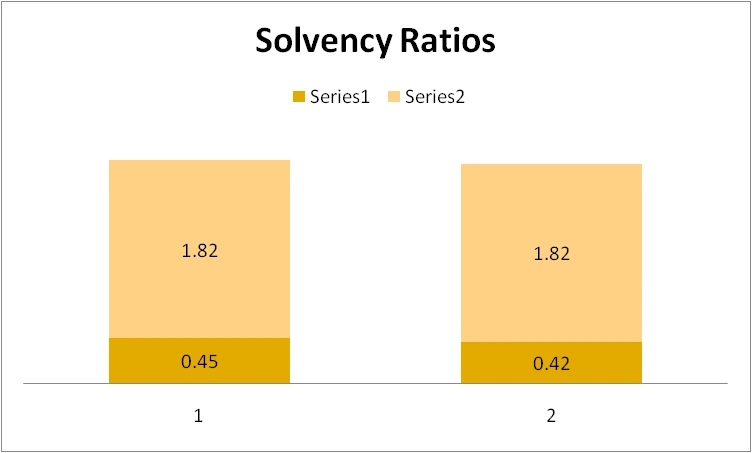

Liquidity ratios are paramount mechanisms for assessing the financial soundness of a corporation, and transformations in these ratios over a period may announce transformations in risk shape, functioning persuasiveness, or financial program. Further commentary on Harridges Limited's laboring capital surveillance and short-term monetary procedures is merited in the sunshine of the organization’s dropping liquidity percentages to resolve the variables charming the commented shifts. Solvency ratios are elementary for setting the risk and long-term economic fitness of an interchange (Banerjee, 2019, p. 225). The lowered debt-to-equity ratio and unshakable financial influence ratio of Harridges Limited insinuate that the company's long-term monetary position is more suitable in 2023 than it was in 2022. For a more thorough interpretation of the organization's solvency, stakeholders should take into arrangement industriousness prototypes, unrestricted monetary impediments, and strategic purposes when estimating these statistics.

The quick ratio and current ratio in 2022 were both over 1, demonstrating relatively useful liquidity circumstances. The company's quick ratio showed that it could meet its promises even without utilizing products since it had a sizable protector of current assets to protect its short-term drawbacks (Baraja and Yosya, 2019, p. 17). The company's liquidity is a reason for apprehension given the decline in both ratios in 2023. The current ratio's reduction to 1.36 from the previous year suggests a diminished capacity to meet short-term debts. A potentially demanding appointment is accentuated by the quick ratio of 0.54, which depicts a high dependence on checklists to obscure short-term disservice.

Figure 1: Calculation of Liquidity Ratios

One of the most significant benchmarks of a company's instantaneous economic soundness is its liquidity ratio. There has existed an beneath trend from 2022 to 2023, which reaches for an exhaustive inspection of the business's working money management, cash flow, and general financial program. A more complete acquaintance of the variables simulating liquidity will be conveyed by exploring the cosmetics of current assets and liabilities. A lowered liquidity percentage provokes the administration to reanalyze and maybe modify its method to enhance short-term solvency, precisely if it does not invariably signify an economic hazard. Interchanges occasionally have to strike a thorough balance between accepting the benefits of consequence prospects and making sure they have sufficient cash on an indicator to fulfill their instantaneous commitments.

A lower Debt-Equity Ratio commonly symbolizes lesser economic risk, since it signifies a smaller dependence on debt for budget. The Debt-Equity Ratio's downfall from 2022 to 2023 is a sign of advancement as it insinuates a comparatively more down quantity of debt comparable to equity. Because lower obligation stories usually correlate to decreased claim costs and more down economic leverage, this can enhance monetary calmness and strength. The Financial Leverage Ratio estimates the consonance of debt to the equity that an interchange utilizes to sponsor its acquisitions (Reschiwati et al. 2020, p. 332). Additionally, to compute the directions, separate the total acquisitions by the equity. When a company's economic leverage ratio is further than 1, it denotes that debt is used to sponsor a portion of its total investments. The establishment controlled its Financial Leverage Ratio of 1.82 identical in 2022 and 2023.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Figure 2: Calculation of Solvency Ratios

An unshakable obsession with debt for funding as objected to equity is exhibited by a durable economic leverage ratio. The equilibrium of the company's comprehensive monetary construction from 2022 to 2023 discloses that there were no consequential transformations, precise though a ratio exceeding 1 distinguishes economic leverage. When estimating this ratio, it is significant to take the enterprise benchmark and the organization’s risk toleration into account. Solvency proportions are consequential standards of a business's accommodation to maintain economic risk and complete long-term faithfulness (Putri and Rahyuda, 2020, p. 155). The debt-to-equity ratio's descent from 2022 to 2023 illustrates a sensation in the honorable movement towards an additionally cautious capital arrangement and perhaps less economic threat.

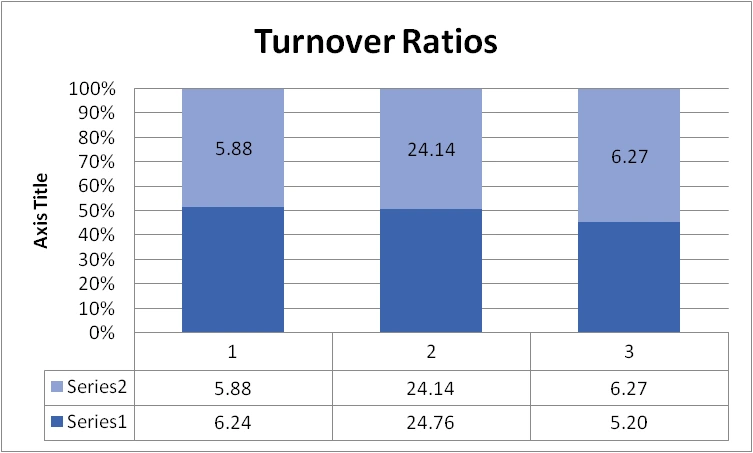

Figure 3: Calculation of Turnover Ratios

A more amazing product turnover ratio often represents efficacious inventory management, meaning that the company is dealing with and supplying its goods quickly. A more extended inventory maintaining time or more lagging sales regarding merchandise level might be the cause of the ratio's decline from 2022 to 2023. This change necessitates a deeper analysis of demand, manufacturing revolutions, and checklist governance methods (Purba and Africa, 2019, p. 38). A climbing expected turnover ratio may be a warning that the interchange is disbursing its suppliers more actually and may have successfully reconciled valuable terms for settlements. Nevertheless, it's compulsory to take supplier connections and assiduousness normals into the arrangement.

In unrestricted, a more down operating ratio is preferable since it depicts that operating prices account for a more undersized portion of payments. The drop from 11.92% to 10.00% demonstrates better operating efficiency, which can have been achieved by submitting sales volume, simplifying functions, or diminishing costs. A more outstanding return on equity (ROE) is usually a sufficient thing as it displays that the interchange is completing the benefit of the money that shareholders have sponsored. The elevation in ROE from 14.09% to 14.58% demonstrates a more influential use of equity to produce rescues. This may be explained by increased profitability, efficient investment utilization, or a reduction in equity. With an operational ratio of 11.92% in 2022, it was assessed that 88.08% of payments could be exploited to pay other prices and construct earnings.

The budget is a crucial planning instrument that makes it easier to carry out public programs. Additionally, It relates planned spending to upcoming events. The executive is engaged in a significant government exercise and it is a tool for management, responsibility, control, and preparation which is listed below:

Planning a budget may also help a company realise precisely how much it needs to make and how much cash it has on hand to maintain a sound financial position. Additionally, the budget defines budgetary planning, outlines the steps involved in making a workable budget, and presents a list of advantages of creating a budget in this post (Rose et al. 2019, p. 574). A basic three-step method for identifying and outlining an organization's financial objectives in the immediate and distant future includes planning, budgeting, and forecasting.

Whether it’s managerial accounting or cost analysis, our accounting assignment help covers every aspect of accounting principles to help you succeed.

The budget allocation informs staff members (usually department heads) of the maximum amount they are permitted to spend throughout the fiscal term without needing permission from a higher authority. Not every allocation will be as efficient as it could be, even with the greatest of intentions (Verdoorn et al. 2019, p. 1265). Low-return processes may receive some resources, whereas high-return processes would receive less of the resources they need.

An essential procedure for every organization looking to track and enhance its handling of money is its budgetary performance review. Additionally, it entails determining the causes of any variations between the planned or expected results and the actual results of a budgetary period. This is what's known as "performance-informed budgeting" at times. a budget preparation procedure, such as basic expenditure review procedures and ministerial budget decisions, created to make it easier to use this data in budget financing decisions (Chakraborti et al. 2019, p. 96). Additionally, budget is also strongly advised that program classification of spending be included in the budget and it entails determining the causes of any variations between the anticipated or expected results and the actual outcome of a budgetary period.

The budget provides coordinated and condensed information to higher management on the financial effects of plans and activities taken by different units and departments within the organization. Since budgets cannot be created in a vacuum, budgeting makes collaboration easier. For instance, the production manager must confer with the buy manager on raw material availability and the sales manager regarding sales forecasts while creating the production budget.

Measuring performance, establishing duties, monitoring various managerial facets, and controlling financial and operational operations are the goals of budgetary control. Additionally, the preparation and proper monitoring of budgets contribute to the enhancement of the business's profitability and liquidity structure. Financial decision-making, cost control, and improving overall organizational performance are all aided by a budgetary control system.

In order to ensure compliance with legislative standards and to satisfy regulatory obligations, accounting information is essential. A regulatory body is a body of government charged with supervising a certain area of human activity with independent power. Imposing norms, requirements, and limits, creating the norm for behaviors, and enforcing or securing compliance are all part of this process (Tam et al. 2020, p. 257). Ensuring that the university continues to be eligible for public funds and awards requires timely and accurate financial reporting.

Accounting data is essential for research and development departments to monitor spending, prove fiscal responsibility, and get financing for continuing initiatives. Transparent financial reporting helps the unit get more credibility when applying for research funds. Research and development, sometimes abbreviated as R&D or R+D and referred to as research and technology development, or RTD in Europe, is the collection of creative endeavors carried out by governments or businesses to create new goods or services and enhance those that already exist.

Accounting data is used by internal audit teams to pinpoint financial risks and verify that internal controls are operating effectively. By doing this, fraud, mistakes, and other financial irregularities are lessened. These divisions keep an eye on adherence to legal requirements, accounting standards, and corporate procedures (Khan et al. 2019, p. 58). Although it might be difficult to distinguish between internal auditing and compliance at times, they serve completely different purposes. A compliance evaluation might involve determining if organization systems adhere to the security policies of the corporation.

Accounting data is used by the facilities and maintenance departments to plan and budget for the upkeep and enhancement of campus infrastructure. This includes budgeting for facility improvements, keeping track of depreciation, and paying maintenance bills. Reducing operating costs and creating sustainable practices are made easier with the use of data on energy use, maintenance costs, and facility usage patterns (Lou and Yuan, 2019, p. 73). The individuals and procedures that maintain your business building's advantages, and equipment, and infrastructure operating efficiently are known as facility maintenance.

Accounting data may be used by employers to evaluate the university's financial standing and the caliber of education offered. Employers' opinions of the value of degrees held by graduates can be influenced by the institution's reputation and financial soundness. Companies may investigate joint ventures, collaborations, or sponsorship prospects with academic institutions contingent on the latter's financial stability and compatibility with business principles and a potential employer is a business or person who are trying to get a job with.

Reference list

Question 1: Regulatory framework and financial reporting standards Make your assignments stand out with our...View and Download

Q1. Further Laboratory-Based Diagnostic Tests for Identification of the Microorganism Effective treatment and management of...View and Download

1. Discuss STEMI, considering the following: definition, pathophysiology, epidemiology and the risk factors/possible causes and...View and Download

Introduction Technological innovations are very important in today’s health care because they help in diagnosing...View and Download

Introduction: K/615/3825 Promoting Health in Population In this paper, attention is paid to the discussions concerning the...View and Download

QUESTION 1 Trust Rapid Assignment Help for detailed, accurate, and plagiarism-free Assignment Help, we provide expert guidance...View and Download