+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

External environmental analysis is used as an important strategic tool for business entities to understand the external factors which can affect their operations. It provides proper assistance to business entities to make informed decisions and reduce the risk factors. Opportunities and growth can be identified through using external environmental analysis. The FINA 1035 External Report EasyJet highlights how EasyJet critically analyses its external environment using tools like PESTLE, Porter’s Five Forces, Ansoff Matrix, and Bowman’s strategic clock to identify threats and opportunities. EasyJet is a London based low-cost airline group. Critically analysing external environments of this business organisation through implementing Porter's five forces analysis, PESTLE, Ansoff Matrix and Bowman’s strategic clock is the primary focus of this study. It identifies the threats and opportunities for the business entity.

Structured samples are provided to help students understand academic requirements. With our UK assignment help, guidance is provided while maintaining originality. The FINA 1035 External Report EasyJet SFM Case Study presents a detailed case study of EasyJet’s business environment, analysing external factors, competitive strategies, and growth opportunities. These resources are intended solely for study and reference purposes.

The PESTLE analysis of EasyJet examines the key external factors affecting the airline industry. Political challenges like Brexit and regulatory requirements, economic fluctuations, societal trends in travel, technological advancements, legal obligations, and environmental concerns all influence EasyJet’s operations. Understanding these factors helps the company identify opportunities, mitigate risks, and make informed strategic decisions.

EasyJet is based in London and political instability is a major part of the UK in recent times. For instance, Brexit introduced challenges for business organisations within different sectors. Brexit highlights that UK based airline companies cannot operate as a domestic flight within the member states and the flights from member states cannot fly domestically within the UK[1]. It has decreased the overall attractiveness of low-cost airline companies like EasyJet. Employee shortage issues are also present in the UK due to the negative influence of Brexit as hiring employees from the member states became costly in the UK[2]. Lack of political stability is affecting the overall intention of business organisations to make long term strategies.

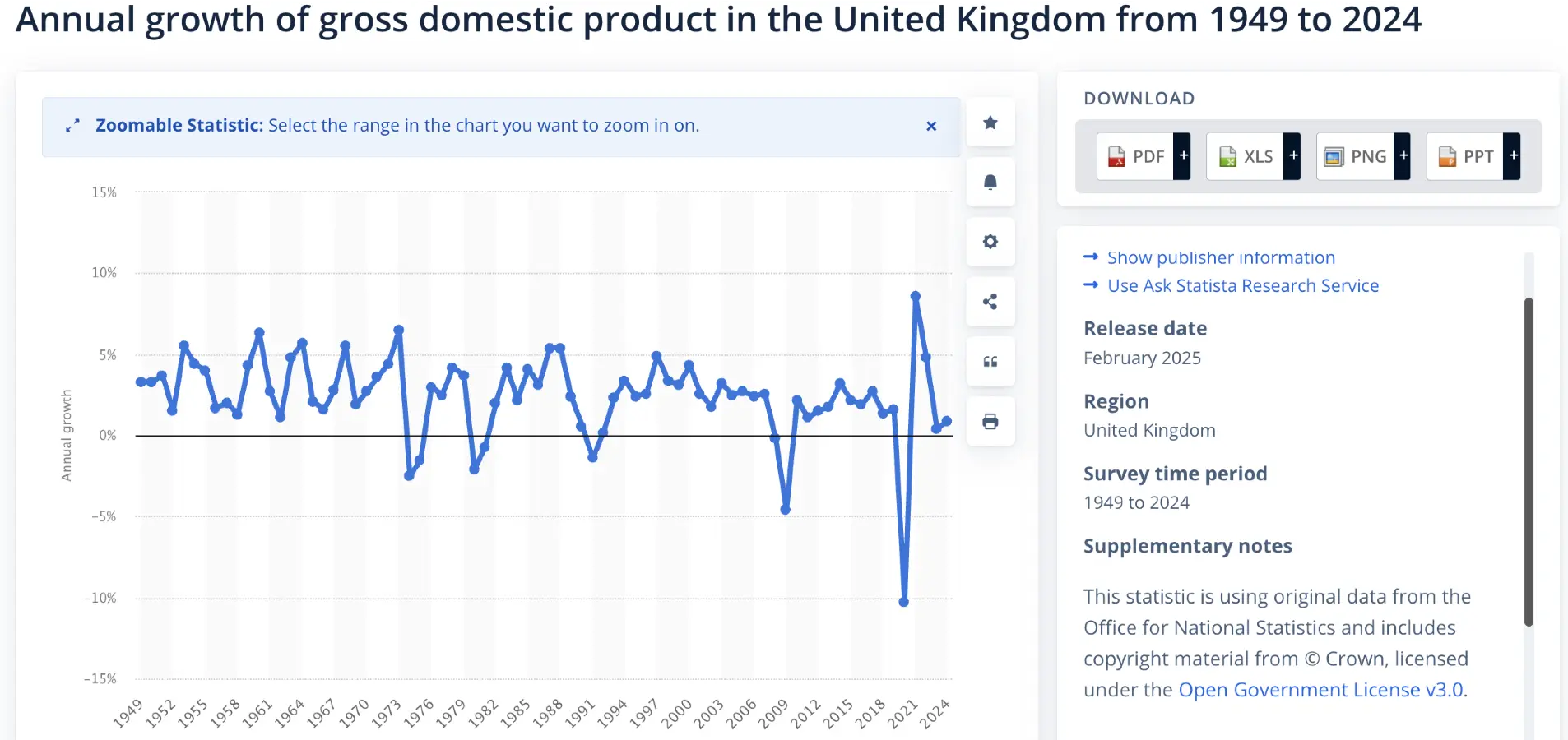

External factors like Covid have affected the overall characteristics of the airline industry. For example, the passenger rate has decreased by 90% during the initial phase of Covid outbreak in the airline industry of the UK[3]. It increased challenges for airline companies. The aviation industry experienced significant financial loss as the industry experienced more than 20 billion British pounds of financial loss in 2020[4]. However, the financial infrastructure of the UK offers stability to the airline industry and it highlights the strong purchasing capability of common people. For instance, the UK experienced 0.9% growth rate in GDP in 2024[5]. The steady financial growth rate ensures that people have proper capability to use flights on a regular basis. The airline industry experienced 10.4% growth in the air traffic rate sector in 2024 compared to previous year[6]. It enhances opportunities for airline companies in the UK.

Figure 1: GDP growth rate of the UK

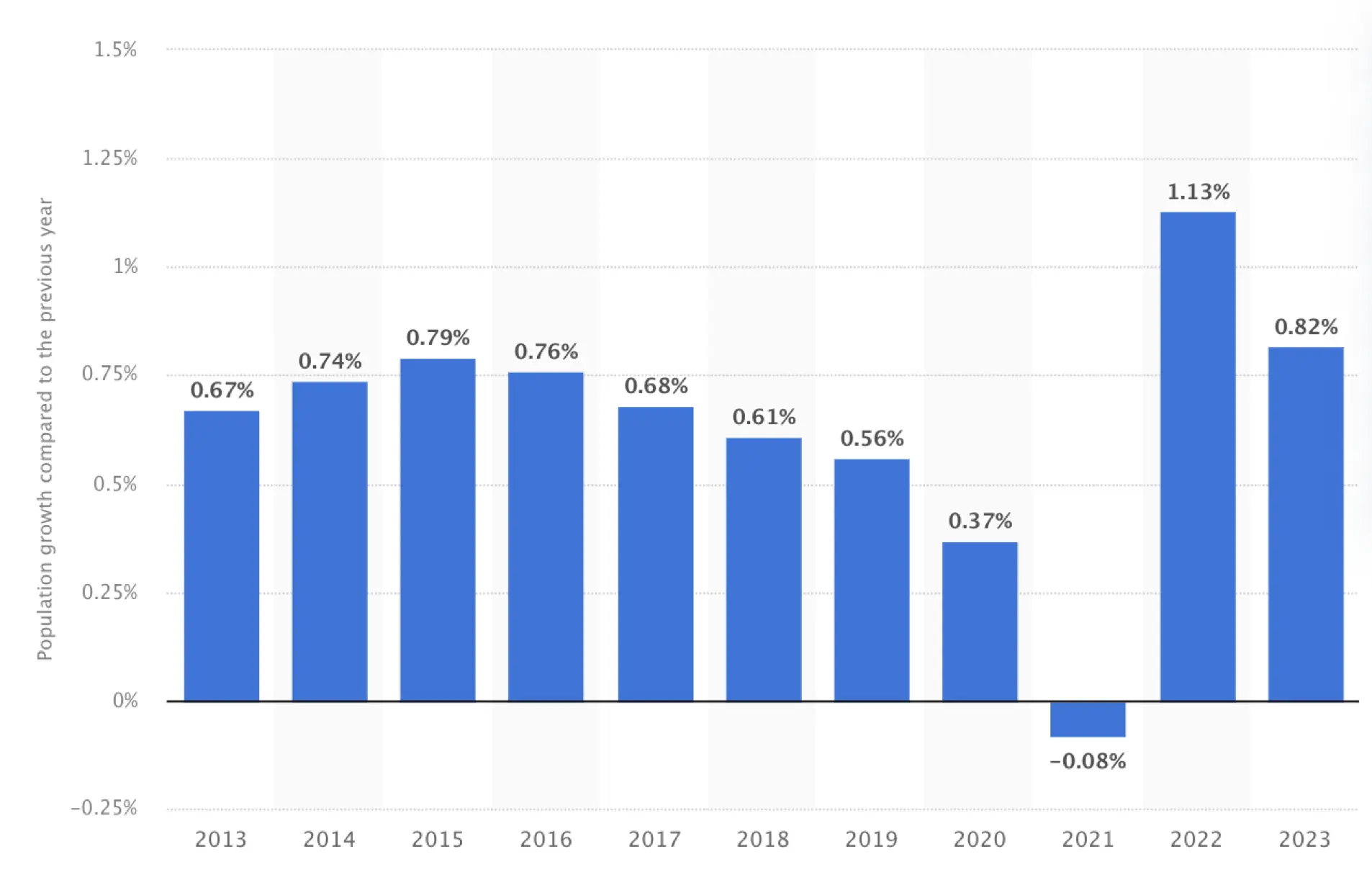

Current population is 68.3 million in the UK and it highlights a strong domestic market[7]. Airline companies have close relations with the travel and tourism industry as people use flights while making International or domestic travelling. The UK is known as a popular travel destination as over 38 million foreign people come to the UK in 2023[8]. Indicates that airline companies can experience a comparatively higher number of customers. The UK is known for its cultural diversity and it is important for airline companies in the UK to train their employees based on cultural diversity and integrity.

Figure 2: Population growth rate of the UK

Companies are integrating Technology within business operations. The UK is known as a technology-oriented Nation as internet penetration rate is 98%[9]. It is a great opportunity for airline organisations to use digital platforms to offer services to the users. It can enhance transparency as well as convenience. Business organisations have the opportunity to use digital marketing strategies which are cheaper than traditional marketing strategies.

The legal aspects of the UK offer attractive opportunities for airline companies. However, airline organisations need to follow health and safety standards of employees and customers. It can increase cost of operations for airline companies but it ensures transparency and integrity throughout the operations.

The aviation industry is a highly polluted industry. However, the UK introduced strategic policies to achieve carbon neutrality by 2050. It encourages business organisations from the aviation industry to follow sustainable standards and it can increase the overall operating cost of the company.

Porter’s 5 Forces analysis evaluates EasyJet’s competitive environment by examining industry rivalry, threats of new entrants and substitutes, and the bargaining power of suppliers and customers. High competition, limited new entrants, and supplier dependency shape the airline’s strategic decisions, helping EasyJet maintain competitiveness and identify growth opportunities.

Industry rivalry is significantly higher in the low-cost airline industry. It operates in the low-cost airline sector and there are more than 40 airline companies which offer affordable and attractive services. The companies use competitive pricing approaches to develop attraction within the target audience. It can force business organisations to keep the profit margin low to ensure competitive advantages.

Entering in the airline industry is a complicated task. Business organisations need to arrange strong investment to purchase aircrafts and the maintenance of aircrafts. There are major government policies which can generate barriers for new players to enter in the aviation industry. For instance, the UK introduced the Jet Zero plan and it has the aim to reduce greenhouse emission gas to 19.3 by the end of 2050 and this amount was 38.2 in 2019[10]. It influences business organisations to make investment in sustainability and it is a costly element. New companies might face challenges to make strategic investments and it enhances the overall attractiveness of the industry.

Public transports such as railways and personal transport options are the substitutes of airlines. However, it is hard to use public transport and personal transportation options to cover large distances within a shorter time frame. Airline companies are capable of offering High Quality services to the users and the punctuality is generating attraction within the target audience. The alternative options are not capable of offering as attractive facilities as the airline companies and it highlights those threats of substitutes is low.

The number of suppliers within the deviation industry is limited. The UK based aviation companies are dependent on imported products. For instance, the UK is known as the fourth largest importer of aircraft parts across the globe[11]. The exclusivity of suppliers enhances bargaining power. The operating cost of airline companies can be increased due to the cost of imported raw materials.

The airline industry is a highly cost intensive industry and managing profitability is critical in this industry. Customers might have multiple choice but there are comparatively lower price options.

EasyJet operates in a growing and competitive airline market, with opportunities driven by increasing passenger numbers and digital adoption. Critical success factors include cost efficiency, safety and reliability, sustainability initiatives, technology integration, and excellence in customer service, which together ensure the company’s competitiveness and long-term growth.

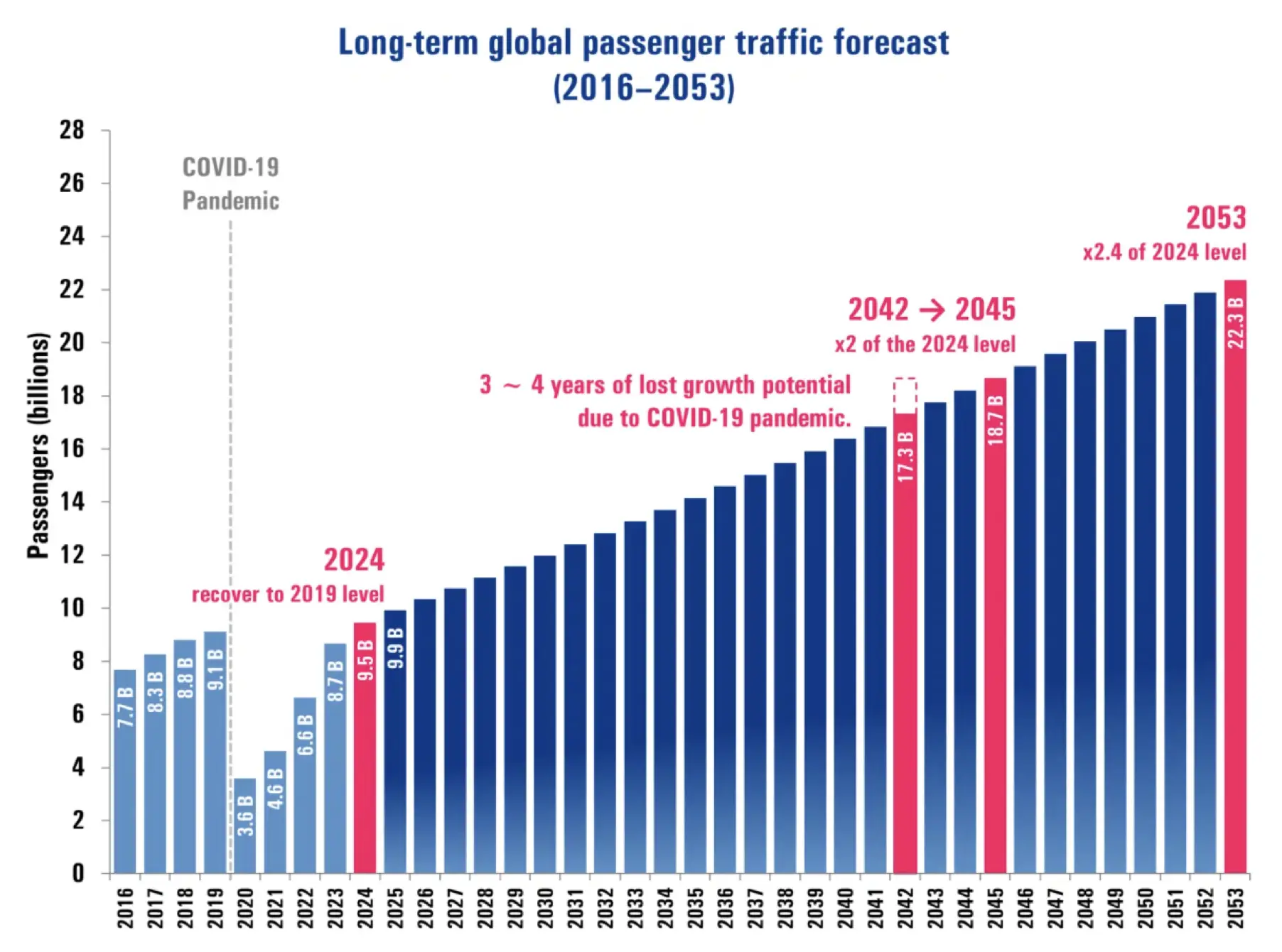

During Covid outbreak, the airline industry experienced a significant decrease in passenger arrivals. However, people have started to use flights more frequently in the post pandemic time period. For instance, the Global air passenger traffic rate can experience a 3.4% year by year annual growth rate between 2024 and 2043. In 2043 the average Global passenger traffic rate will be 17.7 billion passengers[12]. The passenger numbers will reach 18.7 billion in 2045 and it is nearly double the level of 2024. The interconnected nature of the global economy is one of the major influencers of air passenger growth rate. The flights market in China can experience a 5.30% year by year annual growth rate between 2025 and 2029[13]. The growth rate for India is 7.99% for the same time period.

Figure 3: Long term growth of the air traffic industry

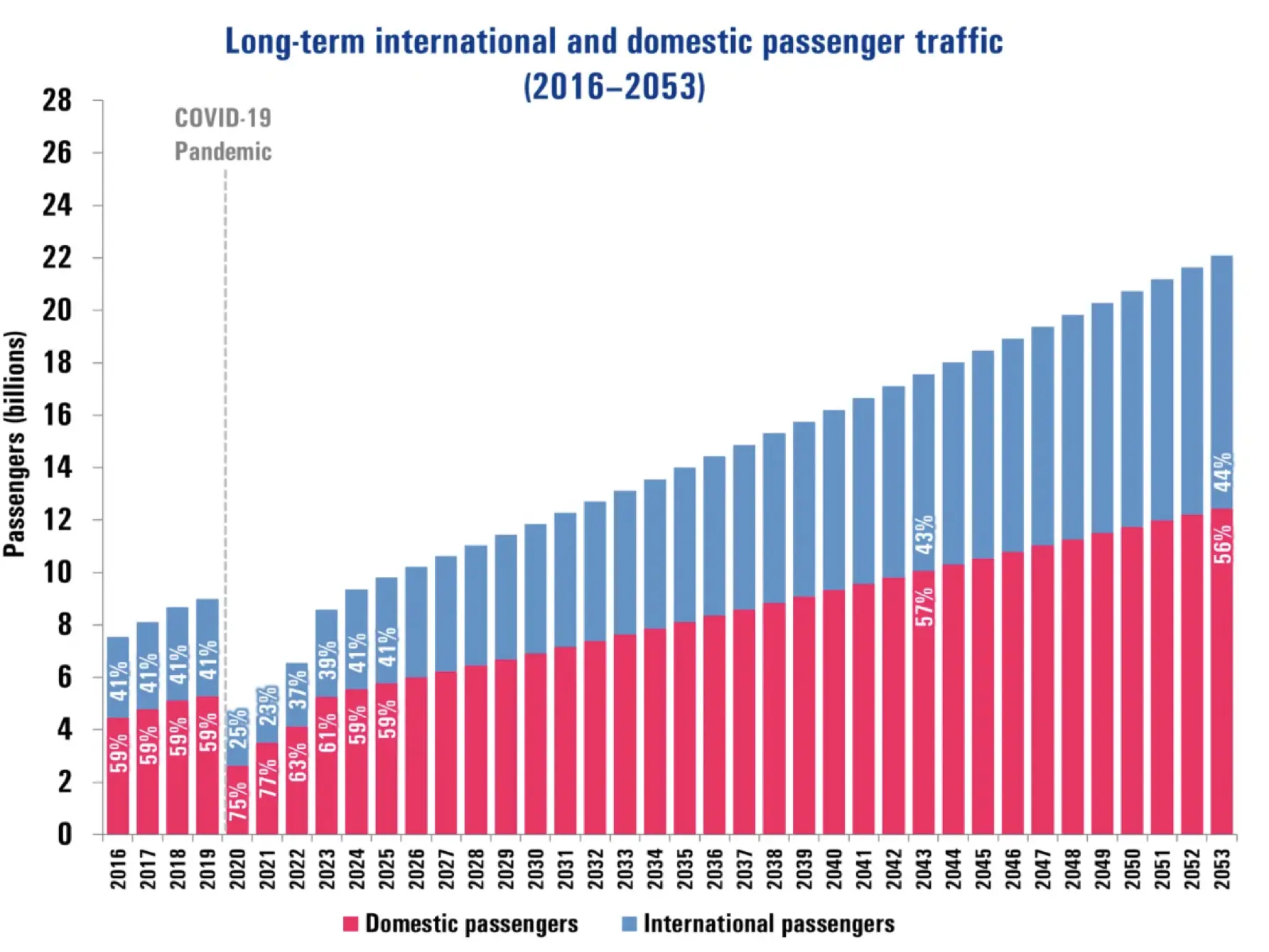

The UK is one of the most profitable markets for airline companies. For instance, the aviation industry of the UK can experience a 5.12% annual growth rate between 2025 and 2029. The projected market volume of the industry will be 33.6 to billion US dollars by the end of 2029[14]. The number of customers within the aviation industry is increasing day by day. The number of users of flights can reach 27.93 million by the end of 2029 in the UK. The current user penetration rate in the aviation industry is 35.6% and it will reach 40.5% by the end of 2029. Customer purchasing behaviours are changing in the aviation industry as customers have started to use digital platforms to purchase their airline tickets. For instance, 91% of the total revenue within the aviation industry will be generated through online sales by the end of 2029 in the UK. The strong digital infrastructure of the UK will promote continuous innovation as well as adoption of digital technology.

Figure 4: Long term domestic and internation traffic projection

Critical success factors

| Opportunities | Threats |

|---|---|

|

|

| Ansoff Matrix | Strategy | Execution |

|---|---|---|

| Market penetration | EasyJet is highly focused to significantly enhance its overall market share within the European markets through offering frequent low-cost flights on popular locations and it has implemented loyalty initiatives to promote repeat purchasing | It helps the company to experience organic growth |

| Market development | EasyJet has enhanced its operational territory through entering into new markets. For instance, it operates in more than 160 airports across 36 nations[15]. | Strategic collaboration with airport authorities |

| Product development | The inclusion of EasyJet holidays is a major example of product development strategy within the airline industry. It includes both hotel accommodations and flight offerings in the travel services sector. The comprehensive travel packages of EasyJet are helping to diversify the overall revenue streams. | Strategic collaboration with hospital organisations |

| Diversification | The company has the primary focus on air travel activities but it is successful to include diversification by offering services such as holidays. | Diversification potential is limited but collaboration with third party companies can be helpful to gain cost advantages |

The primary strategy of EasyJet is aligned with the low-price characteristics of Bowman's strategic clock. The company is capable of offering low-cost tickets to the customers without affecting the overall service quality. Generating attraction within price sensitive customers is the main source of competitive advantage for EasyJet.

The management authority of the business organisation applies the Synergy role. Synergy is forecast on developing value through the integration of multiple business services or units[16]. The business principles of easyJet Holidays are a major example of the strategic approach. The transnational strategy has been applied by EasyJet in its International strategies. Local responsiveness and global efficiency have been balanced effectively within the international strategies of the brand. The company is known for standardizing operations to ensure its cost-effective nature. Making proper adjustments within flight schedules as well as services according to local regulations and preferences is a strategic alternative for the brand.

The BCG Matrix is a highly useful tool for business organisations to critically analyse as well as access multiple services or business units[17]. The flight operations are the core element for EasyJet and it can be described as "Cash Cow" as it offers consistency in market presence as well as revenue generation. The holiday services of the brand can be recognised as Star as it highlights the high growth opportunities within the holiday package industry. The management authority can allocate resources based on BCG matrix analysis.

Analysing current strategies of a business organisation can be helpful to understand the future position or potential of a brand. It is important to recognise the strength of a company while identifying the specific industries challenges[18]. The FINA 1035 External Report EasyJet demonstrates EasyJet’s commitment to offering low-cost services and its proactive approach in diversifying into the holiday package industry to ensure resilience and growth. It has a commitment to offer low-cost services to the users and it is the main strategic market expansion of the brand. It has successfully diversified its business in the holiday package industry and it indicates the proactive approach of the brand to ensure resilience as well as growth.

The current fleet management strategies of the brand are focused on operational efficiency. For example, the company took a strategic direction to operate an all-Airbus fleet and the fleet includes only CFM engines. The major competitors of the brand like Ryanair have experienced disruptions due to the Boeing aircraft. Financial performance of EasyJet highlights the growth projections in a strategic manner. For instance, the company experienced a 25% growth in its profit in 2024 compared to 2023[19]. It is a highly important strategic direction as the growth highlights that the current strategies of the brand are successful to generate attraction within the target audience. Current market expansion and diversification strategies are also attractive. For instance, the brand is successful to offer services in more than 36 countries and it enhances the overall portfolio of the brand. However, economic fluctuations and intense competition can negatively affect the dynamic nature and sustainability of EasyJet. The company has less focus on sustainability initiatives as it committed to reduce carbon emissions by 35% at the end of 2035 but the current strategies are not capable of reducing its carbon emissions in a strategic manner.

The proposed strategies for EasyJet focus on market expansion and sustainable innovation. Collaborating with Asian airlines like Air India can help the company enter high-growth markets, while investing in sustainable aviation technology supports long-term environmental goals and enhances brand reputation.

Revenue streams of EasyJet are limited and the company needs to diversify its revenue streams to reduce dependency on the existing markets. The Asian market can experience significant growth in air travel demand within the upcoming time period. For example, China and India can offer attractive opportunities to low-cost airline companies. It can make strategic collaborations with low-cost airline companies like Air India to enhance its presence in the Asian region. It will help to offer high quality services. The partner company has proper knowledge as well as expertise regarding the market expectations and the dynamic characteristics of the Asian business market. Cultural support and resource related support are also important for business organisations to experience success in market expansion strategies[20]. The risk factors can be reduced through making strategic partnerships with local companies.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Environmental sustainability is a major requirement within the aviation industry. Passengers have started to provide more priority to the airline companies who are following sustainable strategies. Making strategic partnerships with companies like Wright Electric can be helpful to introduce electric aircraft. It will help to reduce carbon emissions significantly and the strategic direction will help the business organisation to establish itself as a market leader in the sustainable aircraft industry.

Expanding business within the emerging markets through collaborating with local players is a highly effective strategic direction. EasyJet already has a strong financial infrastructure and it indicates that the company has the capability to make significant investments within its market development strategies. The company already has proper experience as well as infrastructure to run a low-cost business model. Asia is known as a price sensitive market and demand for budget airlines is significantly higher in the Asian region. There might be regulatory challenges in Asia but making strategic collaboration with local players like Air India can offer effective assistance to overcome the regulatory challenges. Market demand is significantly high in Asia and it can offer attractive financial opportunities for EasyJet. The company needs to allocate resources strategically as the partner company will also allocate research in this market expansion strategy. It will reduce the financial risk factors effectively.

Making investment within sustainable aviation technology requires significant financial investment and Technology advancement. Electric aviation can be recognised within the early stages and low-cost airline companies like EasyJet might find it difficult to make investment in a completely new technology. The business entity might face issues to describe the overall opportunities associated with the strategic direction to its stakeholders. Gaining positive input from stakeholders might be challenging in this aspect. Calculating ROI for this strategic initiative can also be challenging as it is in a completely new stage.

The accessibility and feasibility of both strategies have been identified and analysed. Expanding markets within the emerging markets should be the most suitable and profitable strategic direction for EasyJet. The FINA 1035 External Report EasyJet indicates that strategic collaborations with companies like Air India can help navigate cultural differences, regulatory challenges, and consumer expectations, ensuring successful implementation. The specific strategy is aligned with the strength of the company in low-cost operations. There might be regulatory barriers as well as competitive pressure in Asian countries like India and China. Indigo is known as the most profitable name within the low-cost airline sector of India. Understanding the business model of successful companies in Asia can be helpful for EasyJet to navigate the competitive landscape. The company might experience issues related to the cultural diversity and changes in consumer preferences. The strategic collaboration with Air India can be helpful to have clear information regarding the cultural differences and consumer expectations. Making investment in sustainable Technology can offer significant long-term benefits. However, business organisations who are followers of low-cost business models might not be ready to make long term investments in technology integration or innovation. They prefer to follow already tested business models and technology to ensure competitive advantages. It is a major responsibility for the management authority of EasyJet to develop appropriate outlines for the partnership policies with Air India. There might be cultural differences and differences within expectations. Developing a proper outline regarding the market expectations and cultural competency can be effective to offer significant success in this strategic implementation. Offering low quality services to the customers can negatively affect the overall brand reputation and the company needs to implement quality control strategies according to its internal characteristics. The policy should include the complete control of EasyJet in quality control measurements.

Conclusion

The overall discussion highlights that EasyJet follows a low-cost business model. External factors such as economic characteristics and political instability can negatively affect brand reputation. Understanding all external elements and internal characteristics are important to make the most effective strategies. The brand can experience significant opportunities to expand its territory in the Asian markets. The Asian markets can offer huge growth opportunities. Making strategic collaboration with Asian airline companies can be helpful to overcome the risk factors.

References

Introduction Struggling with deadlines or complex topics? Our tailored Assignment Help UK service delivers high-quality,...View and Download

Introduction: Brand Analysis and Market Positioning Brand refers to the name of product or service produced by an...View and Download

Introduction to Analyzing the impact of social media reviews: Case Study 1.1 Background and definition Within the current...View and Download

Introduction: Key Social Factors Enhance your grades with our premium-quality Online Assignment Help, carefully tailored to...View and Download

1.0 Introduction - AHS205 The Australian Healthcare System AHS205 The Australian Healthcare System within a Global Context...View and Download

1. Introduction In today’s rapidly evolving business environment, organisations are increasingly leveraging advanced...View and Download