+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

The two distinct companies of “Shockwave Medical Inc.” and “Johnson & Johnson” jointly announced to enter into a definitive agreement on 5th April 2024 from which “Johnson & Johnson” can acquire the outstanding shares from Shockwave and the value per cash share will be $335.00 including acquired cash which is discussed in detail in the following sections.

Reference materials and sample papers are provided to help students understand assignment structure and improve academic skills. We, as an assignment helper in UK, offer guidance while maintaining original work. The Acquisition and Analysis of Johnson & Johnson and Shockwave Medical Case Study highlights structured evaluation, clear comparison of business strategies, and critical analysis of corporate decisions. These resources are intended solely for study and reference purposes.

The Acquisition and Analysis of Johnson & Johnson and Shockwave Medical Case Study examines the growth trajectories and strategic positioning of both companies prior to the merger. It highlights Johnson & Johnson’s diversified healthcare operations and Shockwave Medical’s innovative IVL technology, providing a clear context for understanding why the acquisition was strategically important in the cardiovascular sector.

Before the situation of the acquisition announcement, the background information of both the two companies is discussed as follows.

“Johnson & Johnson” was founded by the Johnson brothers of “James Wood, Robert Wood Johnson, and Mead Johnson” in 1886 and emphasized on selling and manufacturing of surgical dressings. Initially, the company emphasized the selling of the surgical dressing absorbent cotton, sutures and gauzes (Caiazza et al. 2021). “Johnson & Johnson” abbreviated as JNJ is one of the global leading medical devices, pharmaceuticals, and other healthcare related consumer goods manufacturing and marketing company (Jnj.com, 2025). The company is among the world’s largest and more diversified health and Wellness Company. By the year 2024, the company is active in 60 countries and sells an extensive range of products and services across multiple sectors that include “MedTech, Innovative Medicine”, and “Consumer Health”. The Acquisition and Analysis of Johnson & Johnson and Shockwave Medical Case Study highlights how J&J’s diversified healthcare operations align with Shockwave Medical’s innovative IVL technology, providing a basis for understanding the strategic rationale behind the acquisition.

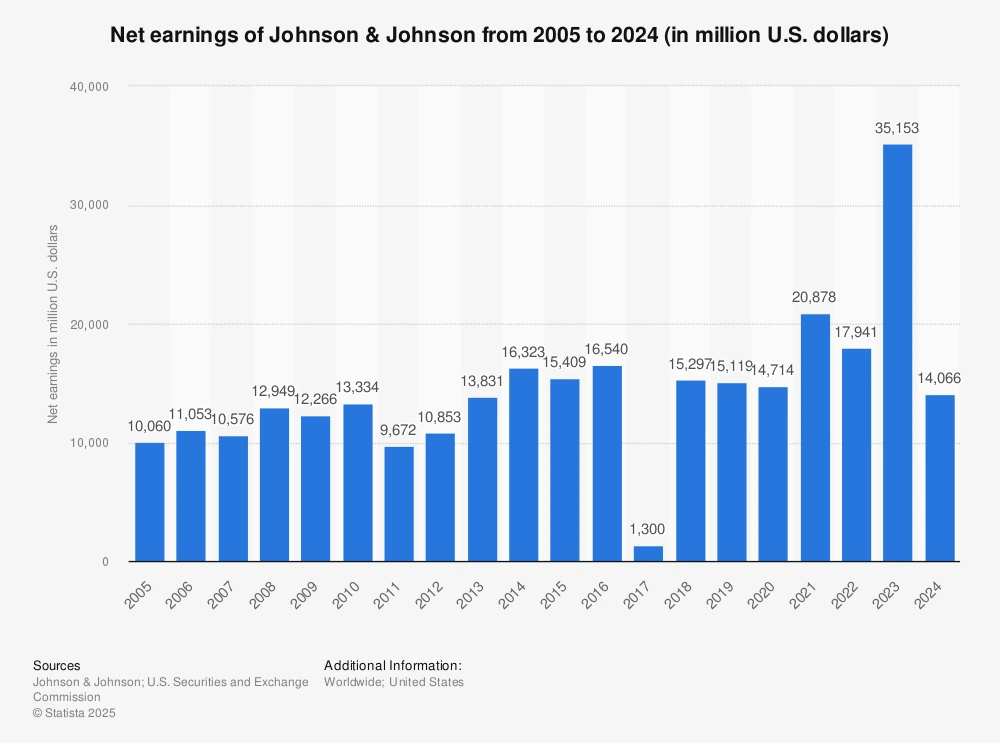

Financial information of JNJ

At the same time, “Shockwave Medical Inc.” came in 2009 by a cardiologist marketer who wanted to envision lithotripsy technologies for treatment of the cardiovascular disease.

Financial information of the two firms

The sum of revenue in 2023 was $85.1590 billion, with “net income” of $17.1 billion, in its multiple segments that year. J&J has had a good performance over the years with the company executing its role of providing value for shareholders by paying dividends (Feldman and Hernandez, 2022). The market capitalization in the year 2024 makes it to be at approximately $ 500 billion thus ranking the company among the largest health care firms. Its “MedTech’s segment” is one of the key segments and it is said to have earned approximately $27 billion in 2023 only.

Figure 1: Net earnings of “Johnson & Johnson” in 2024

This acquisition strategy fits the company’s long-term strategic planning since the objective of acquiring new companies is due to the fact that the company seeks to increase its portfolio in several evolving and innovation driven segments of the healthcare sector.

“Shockwave Medical, Inc” is a quite young but innovative company within the medical devices sector. Shockwave primarily focuses on creating and marketing “IVL Systems” for the treatment of calcific “CAD and PAD”. IVL is a “non-pharmacological interventional procedure” that employs catheter and sound pressure to fragment and wash away calcium in the “arteries” (Lu, 2021). Technology has remained a rising star for “Shockwave Medical” since it entered the market and made significant improvements in its growth as its technology was adopted by many medical practitioners as a standard procedure for addressing “calcified arterial disease” prior to the announcement of the acquisition.

Figure 2: Financial performance of “Shockwave medical”

“Shockwave medical” is still young as it has started making significant sales only in the last 5 years (Kannan et al. 2023). However, its revenue in 2023 was approximately $730.2 million, with a CAGR of over 50% in recent years. There exists information about it as a public company which floated in “the Nasdaq”. The market capitalization of the company was approximately $ 12 billion before it was acquired by “Johnson & Johnson”. The financials of Shockwave were quite healthy, owing to the increasing approval of its “IVL technology”, as its treatment patient touches 400 000 across the world by 2024. It had also got involved in a pipeline through the acquisition of “Norvasc Inc”. a company that focuses on a technology used to manage refractory angina.

Still, Shockwave was a rapidly growing firm that in the future had potential to become a market leader and face important issues in maintaining its leadership as well as expansion of its operations on the international level, which could be the reasons for its merger with another large and financially strong company “Johnson & Johnson”.

There are a number of factors that may have influenced “Johnson & Johnson” in deciding to acquire “Shockwave Medical”. The rationale can be viewed from tactical, efficiency, and operation-oriented point of view. Different factors like strategic fit, Innovation and “Technological Synergy”, expansion in the “High-Growth Markets”, Cost efficiency management, financial synergy market consolidation and competitive advantages are some key factors for the acquisition of “Johnson & Johnson” with “Shockwave Medical”. Now the detailed potential reasons

Strategic Fit in the Cardiovascular Sector: First of all, it should be noted that “cardiovascular diseases” are among the main reasons for people’s deaths at the present stage. The WHO has reported rising “cardiovascular interventions” and this has enhanced by aging population as well as high incidence of diseases of the heart and “blood vessels” across the world (Jnj.com, (2025). The “Shockwave” acquisition ties into “J&J” overreaching goals of establishing the company as a leader in “cardiovascular acre”, with focus on sectors that are rapidly developing and oriented on innovations (Lee and Yeh, 2024). The “IVL technology” would support J&J’s capabilities in the “cardiovascular segment”, including the “Abiomed heart pump” and the “Biosense Webster electrophysiology products”. This development strategy helps “J&J” to increase the number of the provided solutions for heart disease which in its turn contributes to the further strengthening of the company position in the global “cardiovascular intervention market”.

The news regarding the “Johnson & Johnson regarding “Shockwave Medical” announced on April 5, 2024, created interest in the financial markets mainly through its effects on the stock returns of the acquirer and target firms (Magistretti et al. 2021). The deal which was announced at $13. 1 billion, “Johnson & Johnson” decided to pay $335 per share in cash for Shockwave contrary to its closest rival with a 60% premium to the shockwave’s closing price before the announcement. Such a large premium usually means the acquiring firm believes that the target firm has long-term value that can affect market responses.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Discussion on the share price reaction of “Shockwave Medical”

On the 5th of April, 2024, when “Johnson & Johnson (J&J)” made an announcement for acquiring “Shockwave Medical” this led to a 2% dip in its stock price (Huang, 2022). This decline is normal in large acquisitions especially when the acquirer funds the acquisition through cash and a bit of debt (Jnj.com, 2025). This financing method can be concerned by investors due to the fact that it can worsen the acquirer’s financial leverage and influence the temporal, tangible profit. Astute stated in this regard that acquirers’ stocks tend to decline more often after the announcements due to such concerns.

However, J&J’s share price may regain its value over time as there are signs of struggle as well as strategic advantages (Borges, 2023). It enhances J&J’s “cardiovascular business” and places it in the significant growth areas such as”coronary artery disease (CAD)” and “peripheral artery disease (PAD)” categorizes. When synergies expected to begin manifesting themselves, investors’ confidence is expected to improve, making the decline in stock price a short term phenomenon with sound long term prospects.

For the shareholders of “J&J” effectiveness of this deal can be determined with the help of strategic fitting approach. The acquisition ensures that “J&J” gets a ready foothold in the promising “cardiovascular sector” and technologies such as IVL for treating calcified arterial lesions (Jnj.com, 2025). Although there are some short-term issues with financing and debt levels, this new deal is well-applied to “Johnson & Johnson’s strategic plan” of acquisitions. Past trends reveal that it is quite profitable to invest in high growth industries over long time horizons (Bounds, 2023). Thus, after integration and optimization of operations, the development of “J&J’s operations” may be conducive to generating and enhancing long-term value for its shareholders.

“J&J and Shockwave Medical’s” stock price surges with the acquisition news which has led to an increase in its prices by about 60%. To the shareholders of Shockwave it was therefore one of the most rewarding acquisitions that came its way (van Paassen, 2023). The 60% premium given to the shareholders in the deal means that there is an instant improvement on shareholder value, while the fact that it is an all-cash deal means that there is no credit risk after the completion of the transaction. It may help in market acceptance of products, and hence the company’s market growth is likely to be enhanced in the long-run.

Thus, it seems that both sets of shareholders are indexed in the deal. This added value would mean that Shockwave’s shareholders would receive an immediate 60% premium for their shares, enforcement of the fact that the deal would be lucrative (Tibbs, 2024). Despite the short-term decline in the stock price for “J&J”, the long-term benefits like superior positioning and cost savings of the intended merger are likely to provide value added to the “J&J shareholders” in future. On the other hand, naturally, this acquisition appears to be a long-term strategy to benefit both companies’ shareholders.

In recommending to Johnson & Johnson how much it should offer to Shockwave Medical Inc., the following valuation techniques must be applied. Two approaches that are of special importance in this assessment include the Discounted Cash Flow (DCF) and the Comparable Company Analysis. The Acquisition and Analysis of Johnson & Johnson and Shockwave Medical Case Study provides insights into valuation approaches such as DCF and Comparable Company Analysis, helping to justify the recommended acquisition price range and evaluate the deal’s financial feasibility.

2.4.1 “Discounted Cash Flow (DCF) Valuation”

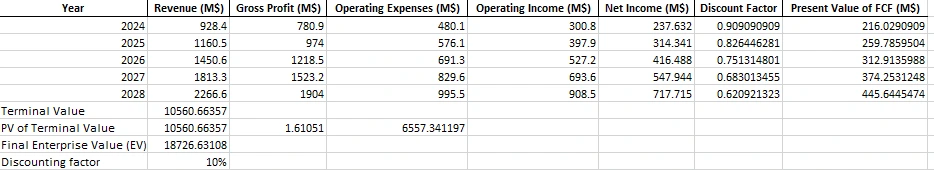

Figure 3: DCF Valuation

The DCF method mostly seeks to evaluate the value of a company through an estimation of adjusted cash flows that are then discounted at a certain rate. Here, looked at the five-year forecast of Shockwave Medical Inc.’s expansion finance ratios and computed the terminal value for it. The discount rate applied was 10%. With reference to the above analysis, the EV of Shockwave Medical was calculated to be $18,726.63 million.

It is one of the approaches that is used in business valuation in ascertaining the worth of a firm in present time through projecting on its future earnings. Based on this method, one is able to determine whether to invest or not to invest on a particular project (Janssen-Cilag et al. 2023). The core concept of DCF is that value of money received in the future is lesser than the value of money today. To provide for this, the future cash flows are then discounted at a specific rate of discount.

After that, the future revenue, operating income, and net income are predicted for several years ahead. In this case, the company was required to forecast the possible financial position to the tune of five consequent years. Therefore, it is determined for each financial year from the estimates of growth in revenue, operating costs, and net profit margins.

This is a discount rate that helps provide a solution for the probability of future cash flow. The discount rate is the cost of capital and this is what the investors expects in return (Sohag et al. 2022). In this case the Fl rate was taken as 10%. This implies stretching the future cash flows down to the present and making them considerably less valuable.

Each future cash flow is then divided by one plus the discount rate to the power of the time in years from now in the future. This process translate the future cash flows into the present value. The sum of all the cash flows which are expected to be generated and subsequently discounted is the total present value of foreseen earnings.

The terminal value is the implied value of the company after the forecasted period has been reached. This is important bearing in mind that companies make more sales within the time period not covered by the forecast. The terminal value is based on the perpetuity growth model or any exit multiple model.

Enterprise value can be defined as the value of cash that the firm is expected to generate in the future and terminal value. This yields the overall worth of the firm as valued by the market in today’s value at the growth rates considered for the firm.

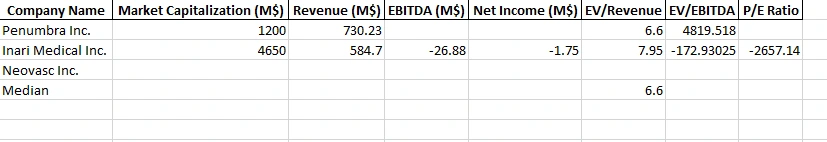

2.4.2 Comparable analysis of the company

Figure 4: Comparable Analysis of the companies

Industry analysis benchmarks a company on some Parameters of like firms within the industry. Assessment is also done regarding the similar companies such as Penumbra Inc. and Inari Medical Inc. by using the two valuation multiples namely EV/Revenue and EV/EBITDA (Investor.jnj.com, 2025). The average of the comparable companies operating EV/Revenue multiple was 6.6. Multiplying this multiple to the Shockwave Medical’s revenue gave an estimate of close to $18,000 – $19,000 million.

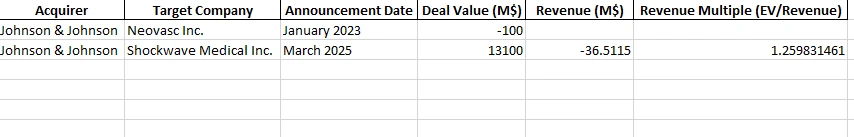

2.4.3 “Precedent Transactions Analysis”

Figure 5: “Precedent Transactions Analysis”

Another approach that can be used to set a reasonable price to offer for acquisition is the method that examines the previous deals that have occurred within the industry. The company’s actual acquisitions including that of Neovasc Inc. earlier supported the valuation of multiples in the market. The EBITDA multiple for the transaction of Shockwave Medical was less than the industry had an average at 1.26.

This analysis involves comparing present companies in terms of their similarities with that of mergers and acquisitions that were made in the same industry in the past. This assists in evaluating the amount of money that buyers have paid for similar firms (Prnewswire.com, 2025). From the prior stock acquisitions, the analysts are able to deduce a rational price to pay for a new security.

The first strategy is to search for prior acquisition of firm which is akin to the Shockwave Medical. This relates to the same industry business commonly with similar performance and standing in the market.

Here at deal details the most important financial factors that are incorporated include; value of the transaction, total revenue, EBITDA and net income. These figures assist in assessing evaluation multiples that have a greater influence on company’s pricing.

These multiples are mainly EV/Revenue and EV/EBITDA. These ratios enable one to gauge how companies have been valued in relation with their earnings.

In the present analysis, calculated multiples from past transactions are used on Shockwave Medical’s numbers. This assists in determining the possibility of a buyer’s willingness to buy the company because of the past indicators.

Generally speaking, based on prior M&A transactions in the medical technology industry, that multiple stands at 6.6 of Enterprise Value to Revenues. However, the multiple of revenues for the Shockwave Medical’s transaction was 1.26, which is still below average. This suggests that Johnson & Johnson has possibly locked the deal at a lesser price as compared to past M&A agreements.

2.4.4 Final Recommendation

Based on the DCF analysis, competitors and precedent transactions, it is logical for Johnson & Johnson to bid at a value between USD 18 to 19 billion for acquiring Shockwave Medical Inc. This price range is reasonable and corresponding to the industry values, thus Johnson & Johnson will not overpay for the acquisition.

After the value of the Shockwave Medical Inc. has been estimated using the DCF and other value models it should be important to compare the values with the actual market value at the time of the acquisition.

2.5.1 Estimated Value vs. Market Value

The value is estimated of Shockwave Medical Inc. between $18 billion and $19 billion analyzing the stock based on the DCF method and CCA. However, the extent of the deal that Johnson & Johnson placed was 13.1 billion dollars (S203.q4cdn.com, 2025). This clearly indicates that there is disparity between the value given through the appraisal and the actual value of the market.

About $18.7 billion as was calculated by employing the DCF method on Shockwave Medical. This was done through Expected future cash flows method by discounting them to arrive at the present value. Nonetheless, the actual value deal was said to be $13.1 billion as announced by Johnson & Johnson. This implies that the company was bought at a cheaper price than the appraised valuation by the firm that bought it.

There are present possible reasons for the lower purchase price. The reasons could be market related such as stocks fluctuating in the stock exchange market, debtors paying lower prices than the recommended retail prices and so on. Had the stock market was declining, investors might have been apprehensive hence contributing to lower valuation of the company (Prnewswire.com, 2025). The third factor might be risks particular to the company that increases its risk ranking according to the proposed model. Shockwave Medical could have been affected by some of the risks, for example, risks relating to regulations, competition, or even unpredictability of the revenue generation. Also, the negotiation strategy is part of the final pricing model. Perhaps Johnson & Johnson was basically forceful to negotiate with Aim Despite a comprehensive research, Johnson & Johnson could have forced the acquisition on the company at an unfavorable valuation.

Market value with DCF Valuation is the ultimate comparison that provides with a clear understanding of how the former correlates with the valuation models used in the latter section.

The DCF method also has the assumption that all the projected future cash flows are expected to occur in a prescribed manner. Consequently, economics, legislation, or changes from the consumer side of the health industry can come and affect the predicted revenues (Jnj.com, 2025). Many times, investors compensate the risk through using a discount, and this is possibly the rationale why the actual value of the deal was less than the figure estimated.

Johnson & Johnson made a deal with Shockwave Medical in which they bought it for $13.1 billion below the calculated DCF value of $18.7 billion (Jnj.com, 2025). There could be reasons that are associated with the current status in the market, risks involved with each company, and bargaining powers. Since the deal values differ from the estimated values, the investors should consider multiple valuation approaches so that they can be able to understand why such differences exist.

2.5.2 Reasons for the Difference

There are quite a number of reasons why Johnson & Johnson took less than the expected amount:

Despite this, the estimated value of the Shockwave Medical Inc was higher than the actual deal price through which Johnson & Johnson acquired the company, the company may have got the company at a reasonable price depending on its strategic value in the market. This is an important contrast between appraisal methodologies and real-life deals, in which the price is discussed, conditioned by the general market conditions and defined by such factors as negotiations and future strategic plans.

Conclusion

Johnson & Johnson bought Shockwave Medical for $13.1 billion, which appears to be lower than the determined DCF value of Shockwave Medical as $18.7 billion. Potential reasons for the difference in price may range from marketing forces, bargaining power, risk factor, among others. The paper also could be influenced by factors such as market movements, business trends or the state of the economy in the final decision regarding the value of the deal. Moreover, it actually could have some strategic rationale, cost savings, operating synergies and risks to the regulatory approval that the Johnson & Johnson might have considered before setting the purchase price. It might also be a long term win-win situation for Johnson & Johnson to include Veran Medical Technologies, Inc. in its list of medical technologies. Generally, different approaches provide investors and firms with valuable information regarding the process of determining value of deals. The acquisition price is also an amalgamation of financial rationalization and business strategy of Johnson & Johnson in acquiring Shockwave Medical.

References

Online

Section 1: Data Analysis Basics Q1: Importance of Data Analysis in Modern Business In the current world, information has been...View and Download

Introduction to Algorithm Efficiency Assignment Answers Focusing on data manipulation as one of the key concepts of computer...View and Download

Question 1: Discussion about Sepsis Definition Sepsis is known as an infection that is bacterial in nature and enters into the...View and Download

Question 1. An unidentified viral disease in St Kilda Field mice This question explores a viral disease in the St Kilda Field...View and Download

Introduction Technological innovations are very important in today’s health care because they help in diagnosing...View and Download

QUESTION 1 Trust Rapid Assignment Help for detailed, accurate, and plagiarism-free Assignment Help, we provide expert guidance...View and Download