+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Environmental, Social, and Governance (ESG) considerations are reshaping how investors approach decision-making in today’s financial landscape. As sustainable finance gains momentum, understanding ESG’s role in balancing profitability with ethical responsibility becomes crucial. With expert assignment writing help, students can effectively explore ESG integration, assess its impact on returns, and address challenges in applying these strategies to real-world investment practices.

This research study is going to discuss the consideration of Environmental, Social, and Governance (ESG) factors as an essential factor in sustainable investment. This paper properly establishes how the existing ESG factors are integrated into the processes of investment decision-making and the effects these strategies have on returns and risks. With the international community becoming increasingly aware of the social, environmental, and governance challenges in the present day society, it becomes even clearer that good investment practice can develop to financial benefits and positive change. However, the integration of ESG factors does not come without challenges; some include reporting methodologies, inadequate data, and diverse frameworks (Nasution et al.2022). The current research aims at analyzing the existing approaches to ESG integration, assessing its impact on returns, considering the main problems encountered in the process of integration, and indicating possible improvements to ESG considerations in investing. In that aspect, this study is targeted at expanding knowledge related to the concept of sustainable finance and creating a better ground for more sustainable approaches to investment.

Sustainable finance is rightly recognized as one of the most important changes in the investment-management practices in view of the rising significance of ESG factors for financial value creation and risk assessment. Since climate change, social inequality, and corporate governance scandals affect the market day in and out, investors are gradually integrating ESG factors into their investment choices (Pavláková Dočekalová 2023). This represents a change indicative of the rising trend towards sustainability, whereby investment goals are not only to make money but also to create positive social impacts in the process.

Traditional methods of long-term investing focused on specific accounting ratios and mostly neglected the complex issues of environmental pollution, social unrest, and poor governance structures. Though the concept emerged earlier, the full awareness was focused by the financial crisis of 2008 along with growing evidence of climate change and its impact on investments (Kocmanova et al. 2022). For example, institutional investors, regulatory authorities, and civil society came to realise that they had to encourage sustainable and responsible investments. Thus, the ESG integration encourages the use of different frameworks and methodologies in sustainability that have to be integrated into the financial system.

It is a complex process that varies from avoiding investments in shares of companies that do not meet certain criteria and work with the exclusion of industries to positive approaches such as impact investing and ESG integration. Historically, ESG integration, in particular, has been defined as the orderly inclusion of ESG factors into investment analysis and management (Weston and Nnadi 2023). Therefore, while there is a growing interest in this view, it has a number of problems. For investors, it is challenging to compare various ESG ratings and KPIs, combine disparate data sources, and measure the linkages between ESG and financial outcomes. There is ongoing debate on whether ESG integration is associated with a company’s financial performance statistics. Several researches have postulated that investment in ESG have the potential to display higher returns for risks incurred and higher recovery rates during troubled periods. Some of the ESG factors mention a reduced risk connected to environmental policies, social unrest, and governance challenges (Neri 2021). However, there is also an understanding of possible negative consequences and an exchange of performance with ethical metrics in the short term.

In this entire research aim the entire study is to develop all the integration processes based with entire ESG aspects that are to help to invest the entire decision-making processes that are to assess the potential impacts of all the sustainable finance practices based on entire risk management and financial performance.

Objectives

H1: Modern-day’s methodologies as well as frameworks are important that are implemented for entire integration of ESG factors

H0: Modern-day methodologies as well as frameworks are not that effective for the entire integration of ESG factors.

H2: Proper processes of decision-making that help to develop all adaptability, comprehensiveness as well as other effectiveness.

H0: Proper processes of decision-making that do not help to enhance all adaptability, comprehensiveness as well as other effectiveness’s.

H3: The main impact of risk management and financial performance based on entire investment portfolios

H0: The main impact of risk management and financial performance are not completely based on investment portfolios.

H4: Challenges and barriers are needed to identify the ESG factors.

H0: Challenges and barriers are not needed to identify the ESG factors.

ESG-based investment decision making is reflective of an unprecedented shift in the finance industry, bearing a global call to promote sustainable development. Thus, this research study has the potential to make considerable contributions and is crucial when considered with regard to the need to gain a better appreciation and solve key issues related to ESG integration across investment operations.

Addressing Regulatory and Market Demands

The basic need to respond to regulatory and market demands and pressures Basic need for wealth creation and the role of banks Financial markets as environmental pressures on consumers Theoretical framework Grand theory framework Ineffective regulation of the financial sector.

The increasing pressure globally from the regulations and the markets towards enhanced reporting of the sustainability efforts in business (Vianelli 2021). Modern governments and supervisory organizations are adopting measures and establishing legal requirements that would necessitate ESG reporting. The EU's SFDR requires firms that operate in financial markets to disclose how they examine, assess, and consider sustainability risks within their investment processes. To this effect, an all-rounded understanding of how these regulatory frameworks operate to shape investment practices is very pivotal in navigation of compliance measures and maximization of potential gains. Through the assessment of the current methods and theories applied to ESG integration, this paper will offer findings that portray possible future changes in the rules governing sustainable investing, which will be useful to investors and financial organizations in terms of compliance.

Enhancing Financial Performance and Risk Management

Thus, the effective utilization of assets and the probability of future returns for a given investment increase financial performance and risk management. Previous studies give ample evidence that ESG factors introduce positive effects on organizations’ performance and also make adjustments for risks. Organizations with sound ESG policies have a character of stability that reflects lower risk, coupled with increased earnings in the long run (Abhayawansa, and Mooneeapen, 2022). They are generally better governed, less vulnerable to outside disturbances, and most aware of new threats and opportunities. By analyzing the investment outcomes of the integration of ESG, research will make it possible to understand the effect of sustainable finance on return and risk. Hence, solutions to those problems will be formulated. This knowledge is essential for the investors who want to target investment returns as well as combination with the sustainability goals, and to prove that this sustainable strategy with the focus on ESG factors is appropriate for this business.

Overcoming Barriers to ESG Integration

It must be stated that despite current changes, such as the awareness of managers of the necessity to integrate ESG factors, there are still challenges regarding the implementation of this approach. Another very significant factor has come to the fore in relation to ESG reporting; these are such factors like proper ways of the assessment of ESG indices. ESSG rating relies on a wide number of methods, methodical decisions, and concrete factors; the discrepancies can yield various company valuations (Ziolo 2020). However, it is rather difficult to locate enough data on ESG factors in the first place since they are scarce, particularly for the small-sized firms and those doing business in the developing countries. All things considered, it becomes possible to state that the objective of the current research is to define these barriers and directions for their mitigations. Therefore, through addressing these challenges, the study will contribute towards the improvement of application and implementation of ESG practices, which will subsequently lead to an improvement in the standard practice and implementation of ESG investing.

Figure 1: Research Framework

In this entire chapter of the dissertation the content is to define integration of ESG factors into investment management and has a clear connection with the following aims ACO advancing SDG objectives. When it comes to social and environmental sustainability investment, they play critical in achieving and enhancing the purpose of society objectives like climate change solution, eliminating inequalities, and implementing governance principles through CSR and Labor. The position on the implementation of the principles outlined in the section supporting the Applicability of the Recommendations, this study expands upon the action plan of embedding ESG into financial activities to align with SDGs strategy. This social orientation is beneficial not only in the case of the broadly understood society but is also helpful in achieving greater reliability and stability of the FDIs that are socially committed in the long term.

ESG considerations within the investment management process have undoubtedly attracted growing interest over the last couple of years, illustrating awareness and the growing importance of sustainable finance. This change is due to enhanced awareness of the values of long-term commitment to high standards of investment activities, changes in the legal requirements, and demand for more transparency and ethical behavior from the sides. Extensive literature on ESG integration suggests that it has a prospect for improving financial performance and the management of risks while contributing to sustainable development goals, and many papers and articles have tried to understand and suggest the approaches and frameworks for considering ESG factors (Landi et al 2022). However, there are some limitations and drawbacks of implementing ESG factors; the big problems are connected with the lack of comparability between sources and lack of standardization in data reporting, and still the problems with traditional investment cultures.

This paper will provide a literature review containing information on the methods and ESG frameworks used in integration processes and their relevance to F/P and R/M, as well as invest-related impediments (Bengo et al. 2022). Through the analysis, the review will ensure that it presents a clear picture of the selective ESG aspects to guide the analysis and pinpoint the gaps in the literature that exist when addressing the research question. It shall pave the way for evidencing practical solutions on how the dynamics of ESG practices may be improved in order for a more sustainable and responsible investment culture to prevail.

According to Meng, and Shaikh (2023), all the factors based on ESG rank, values, and priorities represent the foundation of sustainable and ethical investment in the sphere of green finance. However, issues related to the evaluation of belonging to the ESG standards and the trustworthiness and effectiveness of such evaluation grow along with the number and variety of criteria (Meng, and Shaikh 2023). Thus, the paper aims to provide an understanding of the ESG factors for its evaluation and priority, and as well identify strategies for investments in green finance, which has recently become prominent for its promotion.

Although awareness about the importance of ESG factors in investment management has grown a lot, some research gaps can be identified, suggesting that this domain remains underexplored to a great extent. Therefore, further enhancement of the sustainability criteria connected to green finance is of major importance to close these gaps and to develop sustainable finance trends (Meng, and Shaikh 2023). To meet this aim, the present study uses the “Analytical Hierarchy Process (AHP)” methodology, a potent analytical instrument that can deal with the fuzziness and subjectivity that inevitably permeate this type of decision.

In the ranking of preliminarily important strategies in the sphere of green finance investments is performed using the fuzzy WASPAS method. The results obtained from the fuzzy AHP analysis are the following: Estimations of the importance of various ESG factors existing literature and questionnaire responses indicate that investors are interested in a range of ESG factors. Out of the various factors that result in the creation and formulation of green finance policies, environment comes out as the leading factor and portrays the necessity of sustainability in financing (Meng, and Shaikh 2023). Thus, the institutional and social factors have been put into the secondary position concerning the hierarchy of concern.

However the fuzzy WASPAS analysis shows that some particular green finance approaches are crucial in fostering the development of sustainable investment management systems. Green bonds, ESG integrated approaches, and infrastructure investments in renewable funds are the central ways to direct capital towards sustainable and sustainable impact investments.

According to Rusu (2020), Sustainability can be characterized as a critical issue of immense power in the world today, with immense impacts within society and business circles. The current work focuses on comprehensively examining the link between ESG, CFP, and investment behavior (Rusu, 2020). It opened up a vista on the expectations and expectations in the respective roles in the relationships. Surprisingly, the introduction of sustainability and responsible business into an organizational corporate strategy does not offer much leverage between investors and the stock prices or funds they decide to invest. These factors arrive at this conclusion consistently disregarding the overall financial performance of the analyzed business, its increasing or decreasing gross and net revenues/earnings. Further, there is no evidence of various demographic factors like age influencing the results, suggesting that what is seen is applicable to all consumers.

However, amidst this apparent uniformity, a notable mediating factor emerges: concerning ESG material distributed to the interest investors' perceptions about its relevance and reliability. This aspect makes them differently manage their long term investment strategy, thus compounding the overall story (Rusu, 2020). This underlines how the business aspects of sustainability, that is, the volume, quality, relevance, and accessibility of ESG information, influence investors' perceptions and actions in investment sustainability. Simply put, the present research reveals that the ways investors think and decide about sustainability and money are complex and diverse. However, even if ESG factors are integrated and may at times not visibly produce direct effects on stock appraisal or fund transaction, the nature and credibility of sustainability information are key determinants that define investors' long-term investment planning (Rusu, 2020). On the other hand, these notions provide appropriate waypoints for companies and investors venturing into the future of sustainability strategies where the financial and environmental concerns are intertwined.

According to Mathur, and Sharma (2021) in this integrated pillar of modern financial systems are sustainable finance and ESG investments. This is mainly due to the growing number of ethical investments and the need to foster long-term value. In this brief background, it becomes clear how sustainable finance and ESG investment are crucial and outlines how they work as the principles behind investing. However, it describes how the role of sustainable finance would impact future opportunities and risks, especially against the backdrop of countries' positions in the context of the rapidly evolving financial system influenced by Big Data.

Sustainable finance develops the range of financial activities and propositions that integrate positive social and environmental change into financial services delivery and wealth creation (Mathur, and Sharma 2021). They represent an all-encompassing approach to finance, in which the use of financial assets aims at building a sustainable result in terms of profitability and people's quality of life. Sustainable finance defines itself as the process of integrating financial operations with environmental and social goals with the aim of promoting sustainable development and improving the quality of the natural resources while boosting the societal well-being. On the other hand, ESG integration as part of the evolution of sustainable finance emerges as a definite feature outlining a coherent strategy for investment that incorporates the assessment and management of specific ESG threats.

This approach ensures that investors are able to have an appreciation on multiple perspectives of their investment, not only the financial quotients of an investment (Mathur, and Sharma 2021). Thereby expanding the approaches to integrate ESG into investment management to augment risk management and create the framework for sustainable economies. However, the entire sustainable finance process highlights all the potential scopes that highlight all the business, which is based on the different financial performance, their contributions as well as other profitability to contribute to all the social as well as environmental well-being. These perspectives are also focused on the traditional process of financial factors to maintain the proper accounts of the appropriate processes of business implications based on their appropriate business activities in the entire environmental sustainability and other social welfare (Mathur, and Sharma 2021). In the time of investigating the businesses activities through the proper processes of sustainable finance, and sustainability to focus on the particular incentives responsible that are focused on corporate behaviors as well as other positive outcomes.

In the time of integrating the ESG factors in the proper investment processes of decision-making based on these research activities that give an appropriate offer to give proper guidance that can help to formulate all the sustainable as well as ethical investment strategies to develop the green finance processes (Mathur, and Sharma 2021). The main aim of the entire factor is to contribute to all the sustainable finance processes and facilitate the transition of the entire financial system. The entire sustainable finance as well as an ESG investment also properly represent some essential principles based on ethical investments

According to Ditlev-Simonsen (2022), over the last five years, there has been a particular focus on environmental, social, and governance (ESG) investing and “socially responsible investment (SRI)”. It is worthy of note that these investment criteria are becoming important in the development process. While using terms such as ESG, SRI, and ethical investment is nowadays commonplace, it has its roots in the mid-1700s. In the past years, conscientious personalities have remained keen in dumping companies linked with civil rights, women rights, and political mishaps. Traditionally such exclusions were uncommon and considered based on one’s bias or preferences.

Since the beginning of the 21st century, though, tools based on ESG criteria have emerged and have been used as sources of risk management and new opportunities. Leading example is the Norwegian Government Pension Fund Global which has stepped in funding the improvement of awareness by following ethical standards (Ditlev-Simonsen 2022). Since investors also play an important role in sustainable development the United Nations introduced the “Principles for Responsible Investment (PRI)” in the same year that is 2006. This initiative helps create an international network of action that has more than 1,700 signatories with investors who manage more than half of the world value.

The investors’ dedication towards the ESG standards is escalating significantly, based on how many companies have ramped up on their sustainability frameworks. For instance in the United States, the amount of assets run by professionals to incorporate sustainable investment plans has increased dramatically (Ditlev-Simonsen 2022). Sustainable investment solutions were used for the further management professionally in 2012 as “$ 1 out of 9”. This had risen to one in six dollars by 2014 and one in four dollars by 2018 executed such strategies. Sustainable investment management techniques were in use by 2020 for a third of the total number of dollars of the assets managed by professional investors throughout the United States of America.

According to Liang and Renneboog (2020), CSR is defined as the process by which financial and non-financial information, commonly referred to as “Environmental, Social, and Governance (ESG)” information is incorporated into corporate management, investor decision-making and investment management. Companies, who embark on CSR practices, seek to manage the impact of their externalities like pollution and balance accountability not only to the stockholders but all stakeholders among them employees, consumers, vendors, and the community (Liang and Renneboog 2020). There has been a rise of numerous firm-level ESG performance indices over the last two decades and they have become popular among scholars and analysts. Still, a more notable issue for historical and future studies is that all these ratings remain inconsistent due to variations in preferences, weights assigned to factors, and methods used in the assessment by different agencies.

CSR also includes the areas of sustainable, responsible, and impact capital (SRI). Main areas of concern in SRI are calculating the financial gains to be achieved from investing in SRI stocks, defining what is meant by ESSG factor, and analyzing the performance of SRI funds. SRI funds use a negative approach in which certain sectors are dismissed because they are deemed to be socially irresponsible or negative on the environment, and a positive approach, which involves identifying companies that carry out excellent social, environmental, and governance practices, as well as proxy voting or direct intervention (Liang and Renneboog 2020). This “moral” dividend means the number of returns an investor is willing to sacrifice in order to gain the higher utility or satisfaction which comes under the umbrella of being an ethical and socially responsible investor.

In the past few years, the domain of CSR has witnessed interest in green financing, including the financing of environmentally sustainable initiatives through the Green Bonds. Green bonds do not necessarily entail carrying the label of “green” but are specifically financial instruments that are used for funding environmental projects like energy efficiency or prevention of emissions of pollutants. This can be seen as part of a larger push towards supporting the de-carbonization of the economy as an answer to the problem of climate change (Liang and Renneboog 2020). These changes can be threatening and hold numerous opportunities to global financial markets as well as the behavior of investors, which inspires the reconsideration of the efficiency of Main Street investing and the rising concept of sustainable finance.

They are critically linked with climate change in a way that influences varied aspects of financial markets. The climate risks should be integrated into the investor’s portfolios, and the stakeholders are getting to realize the importance of the risks. This has resulted in the innovation of new and creative financial products and investment solutions that would meet environmental needs. In addition, the prospects that exist regarding the deployment of the markets that facilitate change towards a low carbon economy are also known (Liang and Renneboog 2020). The investing in the Callable Project enables the investor to work towards the achievement of the environment objective by allocating capital to sustainable initiatives and other programs capable of addressing climate change and supporting sustainable positive economic change.

The implications that CSR has are that it is a comprehensive management model that embraces ESG in the organization of the business, as well as in financial operations of corporations (Liang and Renneboog 2020). Due to changes in ESG ratings, there are still discords that need attention; however, the field is progressing daily due to the enhanced aspects of sustainability and climate shifts. This paper demonstrates that responsible investing and green financing is an investment strategy that can be adopted by most investors and companies to help in the creation of a better world today and in the future.

According to Archer (2022), Sustainable finance mostly tends to coincide with the idea of integrating ESG factors into the investment management process. Based on the author’s analysis of the observations from a series of sustainable finance and impact investing conferences that took place between 2015 and 2020 and interviews conducted with the major European bank’s sustainability team and several portfolio managers during 2018 and 2019, this study examines how the very process of identifying and counting the sustainability indicators marks the shift in the role of the marketplace that defines the market and its agents as ethical subjects (Archer 2022). This role suggests that the market is considered more and more as able to provide not only the most rational but also the most ethical choices within the orbit of generating an improved ethical inter subjectivity within the spectrum of sustainability. This reads as situated within current debates of contemporary anthropology and geography which focuses on the transmutation of social or environmental equity into financial value. Further, it converges with the anthropology of ethics and finance, and brings into light the number of ethical considerations present within every financial affair as well as on the large repercussions they contain regarding sustainability commitments.

The research period of study from 2015 to 2020 has witnessed the emergence of sustainable finance strategies and ideas (Archer 2022). Specifically, conferences during this time offered important information regarding such shifts in discussion and tactics within the sector. It was observed from respondents of different sectors of the industry how difficult it is to address some aspects related to the integration of ESG factors in investments. These meetings highlighted the rising relevance of sustainable finance in these markets and the concern for a common framework of sustainable management metrics.

From the analysis of the large European bank’s sustainability report and specific interviews with members of the bank's sustainability team as well as portfolio managers, the insights to these themes were much more insightful (Archer 2022).. In these discussions, there was a clear trend to seek a method that will allow putting a number to sustainability. From the estimation of the measures and definitions of sustainability indicators, it is considered as a process of enhancing investment on the ESG factors. It is a distinct sign of the shift which has occurred in the financial industry to set definite measures of sustainability. From these observations and interviews, the idea of a market as an ethical subject largely emerges. This is the idea that the social mechanisms and players of the market can and should make choices which are both rational in economic terms as well as ethical (Archer 2022).. It modifies the previous paradigms of the market to be only a profit-mongering entity and gives more complexity to the approach of the market as an agent of good and sustainable works.

With the discussion of the results within the existing literature, the contribution of the subject can be connected through anthropology and geography to the analysis of how specific social and environmental values can be translated into specific financial terms (Archer 2022). Therefore, this research raises awareness and creates an understanding of this process and its relation to ethical decision-making within the financial sector as a complex and multilayered process. In relation to ethical approaches in finance using anthropology, the method sets light upon the ethical issues within financial work. Such an approach underlines the need to adopt ethical principles in the promotion and deployment of sustainable finance frameworks (Archer 2022).. This integration of the ESG factors into the investment process brings a paradigm shift in financial industry sustainability. Through identifying and quantifying sustainability measures, the market comes into view as an ethical actor who has started to reason. This transformation in the role of self-possession gives rise to significant questions about ethical inter-subjectivity and also the wider sustainability.

Sustainable finance, therefore, which concerns the inclusion of environmental, social, and governance factors in the investment management process, is a rapidly expanding academic area of study in business. It is fine to note that while much advancement has been made, there are still some gaps that are yet to be filled in understanding the impacts of ESG factors on investment strategies and their full execution (Yu et al. 2023). As such, the following areas are highlighted for further research: firstly, inconsistency in ESG ratings; secondly, measurement of sustainability a weakness in prior literature; thirdly, integrating ethical considerations into sustainable finance; and fourthly, further inquiry into operationalization of sustainable finance strategies is warranted.

Inconsistencies in ESG Ratings

One critical area of concern noted from the synchronizing literature is the unreliability of ESG ratings due to variations in ratings assigned by different agencies. However, that different rating agencies apply different methodologies, preferences, and weights to ESG elements, which results in a variety of ratings for the same firm. This is so because such a rating causes difficulty in the process of decision making for the investments that are supposed to be funded for sustainability (Farooq and Hanif 2023). For the criticisms noted above, there is a need to do more research either to set standards for ESG rating frameworks or to develop universals on what elements are more relevant for ESG evaluation and what weightage will be given to those elements. It may help to standardize so many comparable ESG ratings, which can finally improve the usefulness to the investors if standardized with increased reliability.

Challenges of Measuring Sustainability

There is a challenge of defining and measuring sustainability indicators according to several research articles. The reason being that there are a lot of factors in the evaluation criteria, many of which are qualitative in nature. According to Archer, future papers should give better focus to advanced frameworks like AHP and fuzzy WASPAS due to the vagueness attached to ESG scoring. Additionally, these tools themselves still require to be fine-tuned and calibrated to determine whether they are capable of supporting the measurement and prioritization life cycle of sustainability factors (Bettin 2021). Future research should encapsulate the study of new comprehensive approaches and tools for estimating the ESG factors mostly with reference to various industries and geographic locations.

Integration of Ethical Considerations

Archer has also highlighted another theme in sustainable finance in regard to the ethical subject status of the market. It is increasingly recognized that the proposition markets are and should be capable of taking ethical decisions other than rational economic choices. However, less is known regarding the practicalities of this perspective. To address this literature gap, there needs to be empirical research examining how ethical factors are integrated into managerial decision-making especially in the financial domain and the consequences derived from the incorporation of ethical factors (Zamfiroiu and Pinzaru 2021). This involves the assessment of the implications of ethical investing on finance and on the larger society. Also, the anthropology of ethics and finance is another research avenue that has potential for the study of how ethical values and principles can be integrated into the financial environment and investment processes.

Implementation of Sustainable Finance Concepts

The implementation of sustainable finance is encumbered with critical questions. In fact, sustainability has been described as being integrated into the corporate context without influencing the actions of investors and the stock values (Yu 2023). Therefore, even though today's organizations and investment firms have come to understand and appreciate ESG factors, their direct implications for financial results and the choices investors make are rather vague. Further research into ESG practices in terms of their impact on the performance of the firm and the behavior of investors, with regards to the availability, quality, and relevance of ESG information that is disclosed to investors, needs to be conducted.

There are some areas where practice-based innovation to integrate social and technical innovation as strategies need further research.

ESG integration has developed relatively fast over the last decade, specific questions and challenges remain open. The following areas of focus need to be managed within the framework of a complex project that intersects finance, ethical values, anthropology, and technology.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

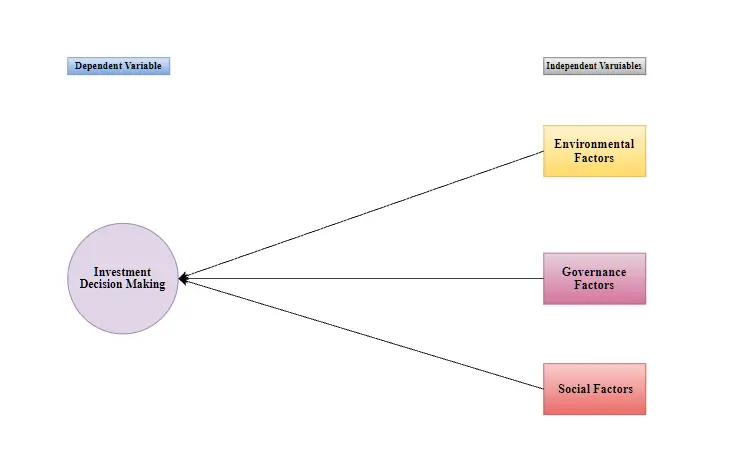

Figure 2: Conceptual Framework

ESG Framework and sustainable finance theories

The entire integration of ESG factors are mainly to invest in all the decisions-making processes that are focused on the several key models and theories to help properly explain all the sustainable finance. In this entire process the entire factors “stakeholder theory” are focused on the companies that serve only the shareholders but from all the stakeholders to include customers, employees, border community as well as suppliers. The entire theory is also connected with ethical considerations based on ESG investing that give an appropriate impact based on various stakeholders to consider financial decisions.

Analytical Hierarchy Process (AHP) and Fuzzy WASPAS Method

The “Analytical Hierarchy Process (AHP)” is one of the multi-criteria processes decision-making tools used to focus on the specific ranks based on their importance. This entire factor is primarily addressed based on subjectivity that evaluates all qualitative aspects based on ESG criteria (Liang and Renneboog 2021). The entire AHP processes are also mitigated by complex decisions that focus on the appropriate results to properly determine the rankings.

CSR and ESG Integration Models

Corporate Social Responsibility theories mainly covers “Carroll’s Pyramid of CSR”, which highlights all the integration of legal, economic and ethical responsibilities based on corporate strategies. This entire CSR strategy also reflects all the ESG frameworks that help to emphasize all applicable business processes and appropriate balance profit based on social norms. The “Triple Bottom Line Theory '' are mainly focused on to balance all the environmental, social, as well as economical results. The entire integration process also ensures sustainability throughout the organizational dimension.

In the above chapter the counter content is to define the ESG factors inside the sustainable finance that are one of the most essential aspects to promote ethical investment as well as other long-term values. In the time of utilizing the frameworks such as, “Analytical Hierarchy Process (AHP)”, Stakeholder Theory, Triple Bottom Line that provides all the crucial decision-making aspects to analyze all kinds of complexities based on the entire ESG process of evaluation. The entire process of standardization comes through SASBas well as GRI that develops comparability and transparency. The entire advancements process of this entire research is primarily needed to address several essential gaps based on measurements, ESG ratings as well as implementation to regenerate the approaches based on sustainable finance processes.

The entire section of methodology primarily defines all the potential procedures which is entirely based on the research that is conducted. The entire methodology also comprises several procedural aspects that are also adopted in the different stages to propel perform the research. This entire chapter is also given the brief outlines to properly involve in the several strategic planning based on the research methods, as well as implementing some other processes to collect the detailed information, perform all the potential analysis to obtain the results. However, this entire chapter covers all kinds of associated areas which are involved to properly perform this methodology which will properly provide a detailed overview of the research approaches, design, research approaches strategies as well as other methods. However these entire methodologies also provide entire details of data analysis and collection. Lastly, this entire section will also provide a detailed overview of ethical consideration to this research study.

The entire research processes follow a proper procedure, which was started from planning to obtain other appropriate results that are based on the research objectives that are created in the previous chapter (Ocaña-Fernández and Fuster-Guillén 2021). In the entire planning phase of the research are involved to identify and determine the several strategies and approaches, which should properly highlight the study goals to fulfil the objectives. In the entire process if selection of these sustainable methods, strategies, approaches, and the other data collection process is initiated. The data collection part is the most essential stage which gives appropriate accounts for all the potential information based on the entire findings and results obtained. After collecting the data from a particular primary source, the relevant data is recorded as well as analyzed with accurate techniques based on the potential outcomes to answering the research questions and hypothesis statements that need to be developed in these research papers (Newman and Gough, 2020). These entire method outlines primarily indicate the most essential five stages in these entire research procedures that involve identification of accurate research methods, planning, strategies and resources, approaches, data analysis and collection to find out the appropriate results.

Thus, in the present research, the ‘positivism research philosophy’ is applied to examine sustainable finance and ESG factors in investment decisions. Positivism is rooted in the assumption that reality is measurable through observation and by the use of statistics and therefore is factual (Alharahsheh and Pius 2020). Thus, this philosophy is adopted with the notion in mind that it seeks to discover facts and trends that are inherent in the process irrespective of the subjectivity of the researcher. Thus, within the context of ESG integration approach, eliminates the subjective approach of assessment and allows for systematic analysis of the impact figures, such as financial returns and ESG ratings (Al-Ababneh 2020). The positivist approach, as was to be expected, prescribes the use of packaged models to achieve the analyses having the guarantee of replicability and reliability. This philosophy also has close connection with the deductive approach of the study, where hypotheses are checked with the help of primary data like surveys or structured interviews with investment professionals (Ryan 2023). In this regard, the research complies with the principles of positivism that do not introduce the researcher’s interpretations and aims to extend the knowledge of sustainable finance to other investors.

The research uses deductive research approach, which involves development of hypotheses from the existing theories and then taking sample research data to test these hypotheses. Using the deductive approach in the context of this study, ESG factors impacting on investment decisions are analysed (Nyein 2020). The conceptual framework of the study starts with a brief literature review of research on sustainable finance and the variables that are believed to influence investors’ decisions. These hypotheses are later on examined through the conduct of survey questionnaires conducted among the investment professionals. Advantages of the deductive approach include the following: Altogether, this method is especially useful to verify or disprove previously postulated hypotheses concerning the integration of ESG risks and factors to financing, thereby, enhancing the understanding of sustainable finance.

A deductive approach, the study elucidates how the research process is consistent with rationality, order, and epistemological assumptions of positivism, and comes up with conclusions that are based on real-world experiences (Hall 2023). A deductive approach, the study explains how the research process is consistent with rationality, order, and epistemological assumptions of positivism, and comes up with conclusions that are based on real-world experiences.

This research uses only primary sources of data in the analysis of how ESG factors are considered in the investment process. Primary research is used in identifying the firsthand data specifically from managers, analysts, or any institution that is involved in the investment levels (Love and Corr 2022). The survey data collection tools are closed questions to obtain numerical results and open questions for an explanation of the participants’ approach towards ESG integration and their experience with it. These enable the accumulation of well formatted data that allow for statistical analysis for trends and relationships of different ESG factors with investment returns. However, interviews offer more depth and breadth of information which gives the researcher the edge in trying to understand the motivations, barriers, and approaches to sustainable investing (Faems 2020). The above content primary methods are determined and chosen well to make the collected data reliable and nuanced to the objectives of the research study. However, attempting to collect as much primary data as possible the study aims at providing the up-to-date and relevant insights into the application of ESG factors while making investment decisions which can present significant contributions to the field of sustainable finance.

The main research strategy utilised is quantitative research therefore the positivist philosophy and the deductive research approach described above. Quantitative research strategy is appropriate in this case because the study will involve the quantification and establishing the level of the incorporation of ESG factors in the selection of investments (Nur 2020). This design makes it possible to measure a large number of subjects, and therefore search for relations of variables that can therefore be generalised to the entire population of investment professionals. In this respect, the use of the quantitative research methodology will involve the use of structured questionnaires in an effort to obtain information on how investment professionals integrate ESG factors at the decision making level (Okoli 2023). Structure of the survey makes the data gathered more consistent, hence possible statistical analysis can be made on it.

The most effective application of the quantitative strategy is in confirming the hypotheses developed from the existing theories, for instance, the effect of the ESG ratings on investment performance, or the salience of some of the considered ESG factors compared to the other ones in the portfolio management (Wardani and Kusuma 2020). To this effect, the research will take a quantitative approach through which information regarding the different segments of the investment industry will be ascertained to be reliable and generalizable. This makes the data and the conclusions being made empirical and easily comprehensible (Danilov and Mihailova 2021). Furthermore, the use of quantitative approaches reduces the degree of the research-related subjectivity, to a certain level, so that a researcher impacts the research with reduced magnitudes, and provides general conclusions on ESG parameters to be taken into account in the investment management process.

The survey process will be based on a structured survey that requires the use of a well-developed questionnaire. In this light, the study chose such a type of approach in order to extract primary data obtained from investors who work on the integration of the ESG factors into practice (Younus and Zaidan 2022). The process of the survey starts with the construction of a highly detailed questionnaire equipped with both closed and open questions. It is meant to acquire quantifiable and qualifiable data from the participants on the state of ESG integration in the companies.

These range from different scale, forced and multiple choices: the closed ended questionnaires are used to get information that will later on be put to statistical analysis. By extension, these questions relate to aspects of ESG integration for which aspects refer to the importance and relevance of particular ESG factors, the magnitude to which, and the frequency with which, they are utilised to inform investment decisions and, finally, the effectiveness as deemed by investors (Tracy 2024). As such, for instance, some questions, such as open-ended questions, are included to allow the participants to give more meaningful information concerning the experience and perception which would provide more light on the quantitative data.

In the survey, the sample consists only of highly qualified investment professionals, and the respondents are randomly selected across the major roles and organisations and locations again. To attain a large population sample and realise the convenience of the respondents, the questionnaires are distributed and collected through the internet (Remler and Van Ryzin 2021). Other follow-ups are then given in an attempt to raise the response rates and the participants are also advised of the confidentiality and anonymity of the responses.

This will be a structured survey for it systematically ensures reliability and relevance of the information to be collected to respond to the research objectives.

Standardised Data: In this kind of sampling technique the researcher uses a questionnaire to give the respondent or sample of the study a set of questions that appear in the same format and the data collected is uniform and can easily be compared by the researcher (Bell 2022). It also allows a large amount of data to be collected within a relatively short space of time and is therefore good and suited to data collection in this research.

Regarding quantitative data analysis in this study the survey data was analysed using a statistical tool called Microsoft Excel. Excel tools are used because of their general applicability, and ease and convenience in data management and analysis (Mohajan 2020). The main strategy of data analysis is to study the regularities in the management of ESG factors and their integration into investment decision-making.

The first operation in data analysis is data entry and this is where the survey responses are transferred to the excel where the data is formatted into structures tables for the purpose of easy manipulation. After the data is entered into Excel, the utilities and functions available in Excel are employed to make the basic descriptive statistical analysis such as mean, median, standard deviation and others (Jamieson et al. 2023). These measures give a general picture of tendencies and fluctuations, allowing to define primary trends in ESG integration among the participants.

For better understanding of the findings there is the use of excel to produce different forms of charts for example bar charts, line charts and pie charts. Hence these infographics can be very useful in displaying the nature of response to major survey questions such as ESG factors that international investors consider as most important when assessing a company or the frequency with which these factors are considered in investment decisions (Rahman 2020). To mention a few examples, pie charts can best illustrate the distribution of participants’ focus on one or another ESG factor, and bar graphs can be used to define the differences in perceiving the impact of ESG integration on investment returns between different segments of the sample.

The main opportunity that it provides for data manipulation and organisation of the data collected, the practice of using Excel also underlines an increased effectiveness in the presentation of results in the course of the research (Taherdoost 2021). The study presents a clear, easily understandable knowledge of how ESG factors are applied in the decision-making process on investment, and beneficial findings to the field of sustainable finance.

The ethical importance are crucial in this research as the investment professionals are used to administer the questionnaires that gather the primary data (Kara 2023). The study complies with the various ethical principles advanced throughout the research to protect participants and their rights. All subjects are pre-screened before they respond to the survey and are well explained the aim of the study, they are told that their participation is voluntary and they can withdraw their response at any one time (Karthikeyan et al. 2024). This is to ensure that participants’ identity remained anonymous and privilege granted was protected till the end of the research process where all recorded data might be safely and securely archived and only retrievable by the research team. This research also makes sure that the questions set are not embarrassing or bias making to any participant and are relevant to the study. These ethical protocols ensure that the work done in this study is true to the most acceptable standards of ethical research.

This chapter provides information on the method used in this study, and this is done in the following areas: The philosophy of the study is positivism, the research approach is deductive, and the research method is quantitative. In this study, the main approach of data collection involves the administration of a structured questionnaire, and the data analysis by Microsoft Excel is an important aspect of the research techniques. The participants’ rights are respected to minimise the ethical problems and to increase the reliability of the study. The ESS integration in investment decision-making can be studied conveniently using this methodological framework.

The analysis and findings are one of the most essential parts of a research study. In this section the entire chapter are analyses several data which they are gated from the survey results and analyses those results in Excel.

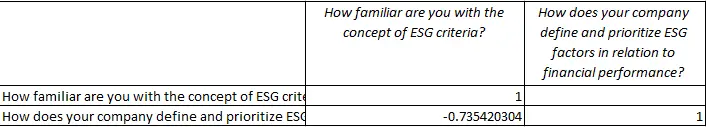

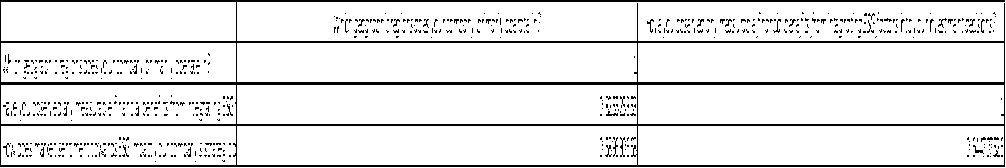

4.2.1 Correlation

Figure 3: Correlation Table

Diagonal Values: The diagonal values are equal to the one, which is because of the perfect correlation between each variable and itself, which is standard with the correlation matrices.

Off-Diagonal Value: However or rather, the off-diagonal value is equal to “-0. 7354” refers to the integration of two factors (Schmuller 2021). Such negativity suggests that there might be an inverse relation between the extent to which business organisations are aware of ESG criteria and how such organisations define and implement ESG factors for performance.

A negative mark “– 0. 7354” indicates that the more the awareness with ESG criteria increases, the more the attentiveness that the companies pay to determine and categorise ESG factors in relation to performance is likely to decrease. This may mean that people or firms that are more sensitive to ESG factors will be least likely to consider ESG factors as being different from financial ones or on the other hand the least sensitive ones will be most likely to see ESG factors as fully integrated with the financial statements.

This matrix could be employed for assessing the correlation between, on the one hand, knowledge of such notions as ESG, on the other hand, as well as application of the ESG factors for elaborating and implementing business solutions.

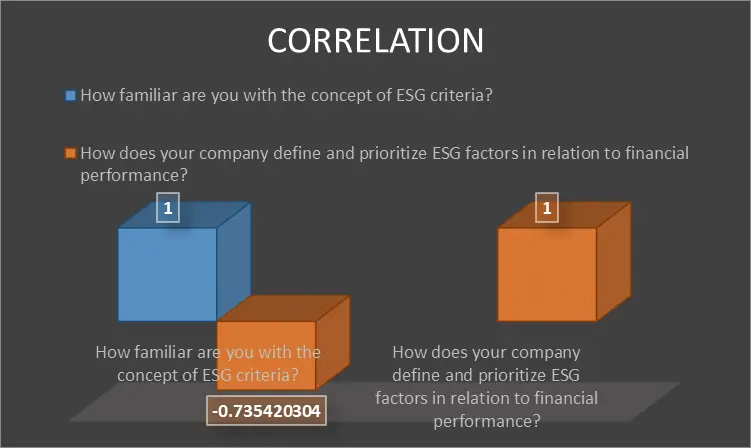

Figure 5: Correlation Graph

This above graph shows a correlation analysis between two questions related to ESG (Environmental, Social, and Governance) criteria in business:The displayed image presents a correlation matrix of two questions referring to the ESG factors in operational companies:

The graph is made of two 3D bars, each of them corresponding to one of the questions. Primarily results are shown in the chart, where the blue bar represents respondents’ awareness of ESG standards and the orange bar denotes their understanding of the emphasis the firm puts on ESG factors.

The last one presents a conclusion in terms of a negative value of correlation coefficient as “-0.735420304” is the correlation between the said two variables (Remenyi 2022). A negative relation that is this strong means that, indeed, degrading the company’s ESG factor importance relative to measurement against financial indicators is directly linked to the growth of the level of familiarity with the ESG criteria.

This graph also analysed some other relationships that clearly indicate some disconnection among organisational practices and other individual knowledge regarding the entire ESG process to properly analyse all kinds of developed and more essential views to focus how the company’s implement these ESG factors inside their workforce.

4.2.2 Regression

Figure 6: Regression Table

Multiple R (0.4507): This particular factor helps to signify some coefficient process of determination which analyses an appropriate square that gives a proper factor of positive degree based on the appropriate relationship among the independent and dependent variables.

R Square (0.2031):

This entire process is focused on more than twenty percent of the organizational employees who are having all kinds of cognitive abilities reduced through various organizational methods that are using some management stress of all the working employees (Salkind, and Frey 2021).

Adjusted R Square (-0. 0246):

These entire adjusted values take a potential consideration of a particular number of all the predictors which are used in a proper model as well as from the entire outcomes that are closer after proper adjustment (Nath 2021). This model also focuses on the variances to offer appropriate dependent variables to analyse a negative in this R square case.

Standard Error (1. 2118):

Thai values are properly estimated to an appropriate average to observed values which come from the entire regression line (Rusli et al. 2020). If these entire standard errors are small then in that case all the observed values are very close to the other fitted model.

ANOVA (Analysis of Variance)

Regression (“F = 0. 8922, Significance F = 0. 4517”):

The F-statistics test comes from at least one predictor which is statistically significant. In these tests the entire model is primarily indicated by an appropriate P-value which is 0.4517 and is not given a most significant in this entire study according to the entire “conventional level of 0.05” (Derindere Köseoğlu et al. 2022).

Coefficients

Intercept (“2. 2314, p = 0. 0053”):

This entire intercept is one of the most significant statistical factors, as it focus on a particular independent variable and the other dependent variables are expected to beat about 2.2314.

In Residual Output graphs primarily shows a particular observation, residuals as well as predictors which come across 10 data points, in the blue bar are primarily increased from left to right on the other hand, orange bars represent predictors which show less variation (Lisin et al. 2021). The grey bars represent all kinds of difference among predicted and observed values, which comes from both negative and positive residual present. On the other hand, the profitability graph represents a clear positive correlation among percentile rank as well as other ESG priorities based on values that improve different percentiles. These graphs also suggest that the general trend is to increase all ESG factors based on the company rankings and their improvement process; there are also some other discrepancies among the predicted and observed values.

4.2.3 Correlation

Figure 8: Correlation Table

Diagonal Values:

Each variable is properly correlated with the potential aspects which comes from the actual values of 1 which comes along all the diagonals of this entire matrix, and the matrix maintains a proper standard to these correlation matrix processes.

Correlation among Financial benefits and geographic region (0.8255):

This entire correlation table is also focused on coefficients which are quite high and also suggest a proper positive relationship among all the regions where the organisations also operates as well as measure different financial benefits to observe and integrate ESG factors (Mairing 2020). This entire process also suggests that the organization’s area comes from a certain region which might be more successful in the entire ESG factors for all kinds of financial improvements.

Correlation among Market sentiments impact and geographic regions (0.5896):

This moderate positive correlation process indicates all kinds of geographic regions based on the companies who can operate some related market sentiments towards ESG aspects of all kinds of organizational strategic decisions (Kelvin et al. 2024). The entire relationship process also does not analyses the proper financial benefits which are most significant.

Correlation among Market Sentiment impact and financial benefits (0.6447):

This entire moderate and positive correlation primarily suggests all the important connections among observing the financial benefits as well as other ESG integration which are clearly stated as “how market sentiments come towards ESG that can affect all the strategic decisions”.

This entire correlation table primarily highlights all the potential relationships among all kinds of geographic regions that operate on all kinds of financial benefits which comes from ESG integration as well as the actual impact of the market sentiment based on the strategic decision (Lee and Lee 2023). This entire strong process of correlation comes among several geographical regions as well as financial benefits which suggest all kinds of potential location which plays an appropriate role to realize different financial returns based on the entire ESG efforts. These moderate processes of correlation indicate the financial benefits and market sentiment which comes from ERG factors that are also connected with this entire extent.

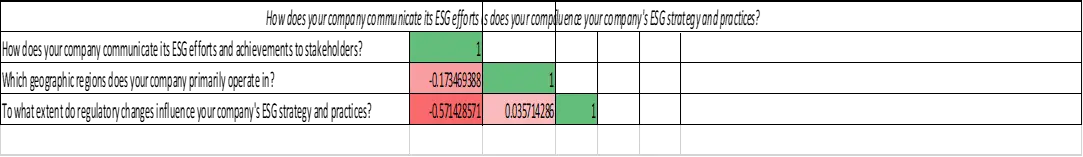

4.2.4 Correlation

Figure 9: Correlation Table

Diagonal Values: It is always somewhat shocking to see that the diagonal elements are 1 as it is the correlation of each variable with the variable itself.

Correlation between Communication of ESG Efforts and Geographic Regions (-0. 1735): This negative correlation however is not very strong showing a negative weak relationship between the geographical areas the company is present and availability of information on the effort the company is taking towards ESG (Evans and Evans 2020). The negative coefficient suggests that in some geographical location, the company might not be very active, or perhaps not very efficient in reporting its ESG activities, but the relationship is not very significant to accuse the company.

Correlation between Communication of ESG Efforts and Regulatory Influence (-0. 5714):

This has a moderate negative relationship which gives a stronger relationship between how the company expresses the ESG activities and how changes in regulations affect the ESG plans (Rebman et al. 2023). This implies that in situations where regulatory changes significantly affect the firm’s ESG plan the firm may issue fewer communications on ESG to stakeholders.

Correlation between Geographic Regions and Regulatory Influence (0. 0357):

This value is surprisingly close to zero, which means that for the company the geographic distributions of their operations virtually have no impact on how and to what extent they are affected by regulation changes in their ESG frameworks and policy (Kar et al. 2023). This implies that the company’s geographic span does not impact how it manages changes in regulations referring to ESG.

The matrix reveals a nuanced view of how different factors interact within a company's ESG strategy:

The negative and weak coefficients are revealed between geographical locations and communication, it can be concluded that the location influences the ways and efforts to communicate ESG efforts slightly (El-Awad et al. 2022). The relatively moderate negative correlation between communication and regulatory influence indicates that firms with more pronounced communication of their ESG concepts may be less sensitive to shifts in regulations, perhaps because they have determined their patterns on their private ESG standards beyond regulatory influence (Tambunan et al. 2021). The very low level of association between geography and regulation suggests that a firm’s geographical location does not heavily constrain its reaction to ESG related regulations. 544

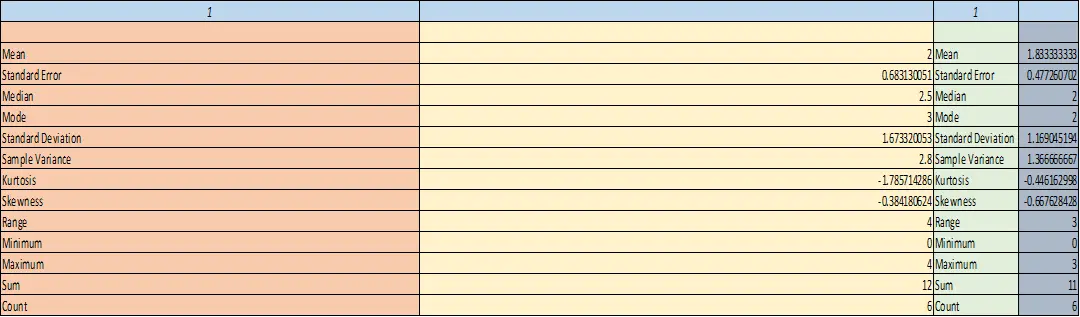

4.2.5 Descriptive

Figure 10: Descriptive Table

Central Tendency Measures

Mean:

The mean for this data set 1 is comes 2 and in data set 2 is less than 1.83. In this entire findings process are primarily calculated by all kinds of central values based on the potential datasets which are quite higher than the second data set (Kazuo 2020). This entire process of descriptive tables is primarily focused on the appropriate average values in their first dataset and their average values in the data set is 2.

Median

In the median dataset 1 is follows 5, on the other hand, for data set 2 has been primarily categorized as 2 (Montgomery et al. 2021). This entire median represents all kinds of appropriate values when the data is pointed properly to both data sets that have focus on similar medians which are suggesting the proper values in both datasets that are implemented.

Mode

At the time of defining the mode value data set 1 is 3, and data set 2 is 2. These entire mode processes represent the most frequencies to properly occur all the values in every dataset (Lindauer et al. 2021). This entire process also shows that 3 are primarily occurring one of the most frequencies in their chosen data set 1 and data set 2, and in that case this entire data set 2 indicates several values which are very common in these two dataset.

Variability Measures

Standard Deviation and Variance:

In this entire data set 1 has properly focused on the standard deviation 1.67 as well as a variances of 2.8. On the other hand, dataset 2 has shown some minimum standard deviation values that are 1.17 as well as the “variance of 1.37”. These entire measures primarily reflect how these entire processes analyses the exact values in every dataset which the study is chosen in their analysis part (Pandey 2020). The data set 1 shows some higher variability that are meant to point to the exact data which are more important from the actual mean as compared to dataset 2.

Standard Error

At the time of defining the standard deviation error in “data set 1 is 0.68” and for dataset 2 it is 0.48. In the time of analyzing the standard error the actual measures of the accuracy based with the sample the actual mean value represents the actual population of the entire mean (Morrin, and Diamond 2022). On the other hand, the lower standard error in dataset 2 primarily indicates a more precise estimate of the actual population mean as compared to data set 1.

Range

The main range of this dataset 1 is 4 on the other hand of dataset 2 it is 3. The actual range which shows the entire analysis is different among the minimum and maximum values, which suggest the actual dataset 1 and this area comes from borderline values as compared to dataset 2.

Distribution Shape Measures

Kurtosis

In this Kurtosis of the entire “dataset 1 is -1.79” as well as for “data set 2 it comes -0.45”. The entire Kurtosis measures factor distributions. On the other hand, negative kurtosis comes from both datasets which indicate all the minimum number of tails which compared a normal process of distributions based with dataset 1 that are benign more prominent in these perspectives.

Skewness

In dataset 1 has a skewness of -0.38 as well as in data set 2 the skewness of -0.67. The entire measure of this skewness is focused on the irregularity of the entire distributions (Hussain et al. 2021). In the both chosen dataset are inappropriately skewed and the entire meaning of this tail on the left side of these entire distribution is no longer that the other side dataset 2 are properly shows a most appropriate skew in a negative manner, that are indicate more information which is concentrated on the right side distribution of descriptive table.

Summary of Key Insights

The entire comparison of these two chosen dataset are reveals some important aspects such as,

Summary of Key Insights

Central Tendency

In dataset 1 are shows higher median and mean that are compared in dataset 2, to indicate that is focus on the general values which is quite higher than others

Variability

The entire dataset 1 analyses more variability, which are properly evidenced by the higher number of standard deviation as well as range to properly suggest their actual values that need to be analyzed.

Distribution Shape

In the entire research study the both dates are negatively skewed and in dataset 2 it suggests some more negative skewness that involves all kinds of heavier concentration based on proper values of the entire distributions (Kumar 2023). This entire statistical analysis provides all kinds of comprehensive understanding based on actual characteristics as well as other differences among these two datasets.

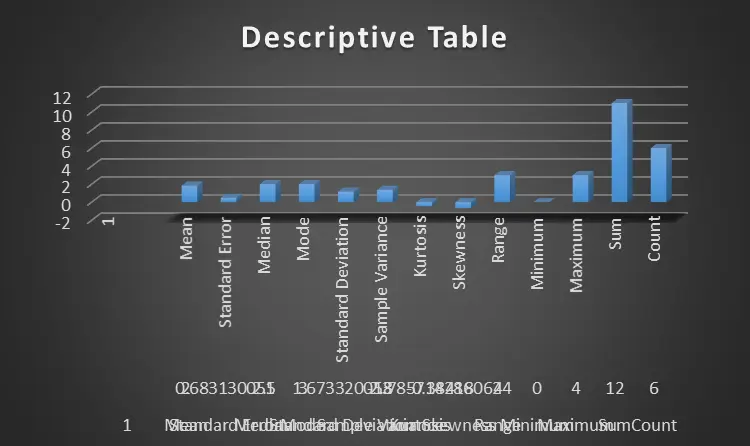

Figure 11: Descriptive Graph

These above descriptive gaps primarily represent the “x-axis” which shows various statistical measures based on the “y-axis” to properly represent these values.

The main key observations of the entire process are focused on the actual mean that are approximately 2.5, the median and mode indicate the right-skewed distribution. After this two the next part is a range which is 4 based with the minimum number of 0 and maximum number of 4 (Di Lullo et al. 2020). The total sum of this entire process is 12 which is the highest bar of these above charts. Not only that, this entire factor indicates 6 data points. The entire present measures such as kurtosis and skewness also suggest the actual distribution which is normal. The minim differences between median, mean and mode are analyzed with some moderate standard deviation which indicate all the reasonably balanced of the entire dataset process without the improper outlines. This above descriptive graphs primarily provides some comprehensive overviews based on dataset which focus on “central tendency, shape and dispersion” to follow a continuous understanding of the key characteristics.

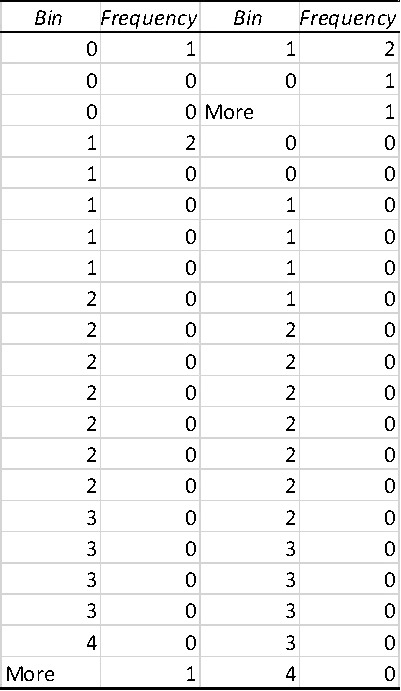

4.2.6 Histogram

Figure 12: Table of Histogram

In the above table bin 1 has referred to an appropriate range of frequency of 2, which means that the actual values are primarily associated with the actual bin that appears in these two chosen data sets (Ghosal et al. 2020). On the other hand, bin 0 also has a proper frequency of 1, which clearly indicates all the appropriate values which are associated with the entire bin. The “More” factor analyses other frequencies of 1, which indicate a particular category that comes beyond their range, and these values are also one of the highest bin based on a specific aspect. This entire factor also appears in a single dataset.

The main key aspects of these entire processes are focused on an appropriate distribution which is concentrated in Bin 1, which is focused on a particular aspect that is present in Bin 0 (Rusli et al. 2020). This lack of frequencies and some other bins also suggest that the entire data is not distributed as well as skewed to some minimum values or a particular range. The data might also represent some appropriate situation based on some certain values and results which are more common than some others which are primarily categorized as 1, 0 or “more”. This simple process of distribution are suggest only some few specific values that clearly dominate all the chosen datasets, which are given most possible number of values.

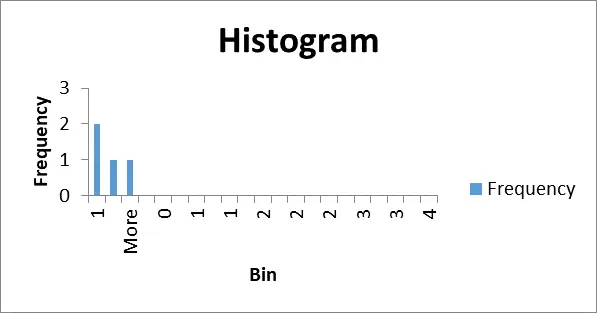

Figure 13: Histogram

This above histogram shows the actual range of frequency distribution of a chosen dataset. The “x-axis” are rep[resent some different bins or some other categories based with the “y-axis” which shows some appropriate frequencies based with the occurrences in every bin (May and Looney 2020). The main key observation of this above histogram are segregated in to several aspects such as,

The entire processes of distribution also appear to be right-skewed based with the most number of values based on the gathered data which comes from the lower level of the scale (Aydin and Yassikaya 2022). This entire process also suggests the maximum number of majority which presents all the actual data points based on a small number of values, based on the minimum number of values to properly represent the “More” category. In the given number of the bruins it comes to the zero-frequencies, and the datasets also seem to be most small to possibly contain only 5 points or sometimes contain 4 points in the total.

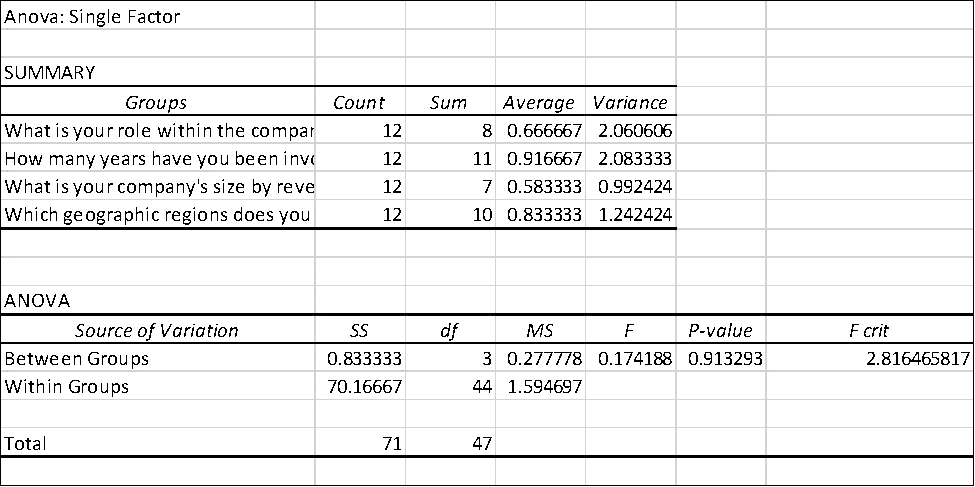

4.2.7 ANOVA

Figure 14: ANOVA Table

The above ANOVA tables provide a proper investigation based on the proper variations among different groups as well as the variation within these groups.

Summary of the ANOVA table

Groups

The entire analysis process is compressed among the four groups, and every group represents several aspects based on the participants of all kinds of professional profiles (Gemechu 2020). In this Anova analysis in each group there are 12 observations available.

Sum, Average and Variance

This entire sum refers to the total values for each group that indicate an aggregate with responses across these 12 participants. This entire Average area shows an appropriate value of mean of every group (Kumar 2020). This process also varies between two groups, who can contain the “highest average of 0.9167” for the finance and investing involvement process, and the “lowest number is 0.5833”. All these variances reflect some appropriate aspects based on the data which are present in the data set group. The higher variance indicates more depth variability based on the responses (Okunev 2022).

ANOVA

SS (Sum of Squares):

This entire measure is focused on the total variation. The “between groups”, where SS is 0.8333, while in these sections it also shows the most number of variation within the groups among these two datasets (Aminatun 2022).

F-Value:

The entire F-value of this analysis is “0.1742” which is much lower than the other critical aspects of “F-value of 2.8165”, which indicates some significant differences among these group means.

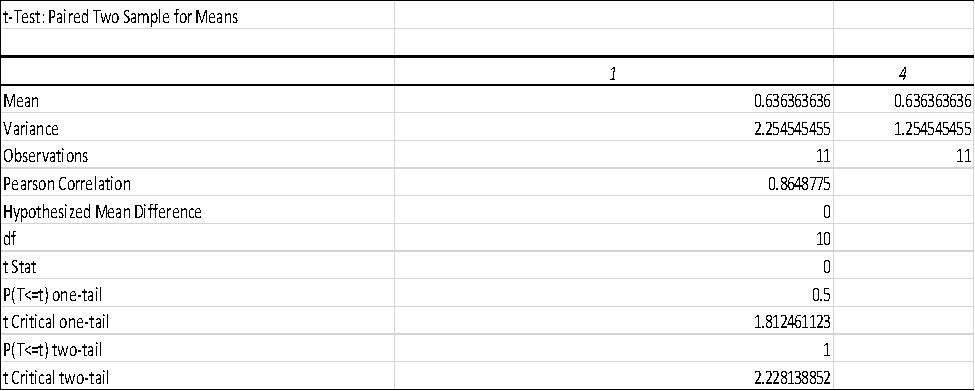

4.2.8 t-Test

Figure 15: t-Test Table

This entire t-test is to compare two most appropriate paired samples based with identical “means in 0.6364”. The main variances differ quite differently, with 2.2545 for the dataset sample 1 and 1.2545 for sample 4, which clearly indicate some other variability inside the data (Chiu et al. 2021). The “Persona Correlation of 0.8649” shows a proper and positive relationship among the entire paired samples. This t-statistics is 0, and the actual meaning of this entire process is different among the sample means. In the “one-tail and two-tail” p-values are 0.5 as well as 1 those indicate no such statistical significance (Agustina 2021). The critical values are “1.8125 for one-tail as well as 2.2281 for two-tail” to confirm that in this statistical calculation the entire null hypothesis cannot be rejected.

4.2.9 Pivot Table

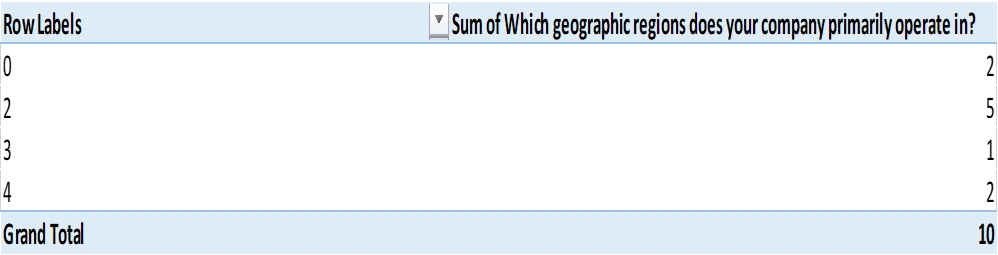

Figure 16: PivotTable 1

The pivot table primarily summarizes all the number of geographic regions based on the company’s primary work operations. This above pivot table clearly indicates 2 company’s cooperation in 0 regions that is suggesting no geographic operation.5 companies are operated in 2 regions, 1 companies operate in 3 regions, and 2 companies are operated in 4 regions (Tambunan et al. 2021). This table is to suggest that all the majority of the companies are engaged in the entire businesses operations which come across no geographic operations.

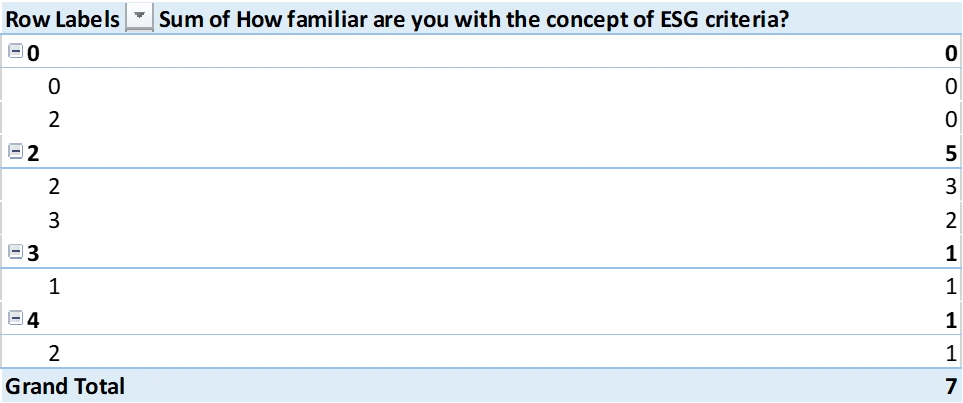

Figure 17: PivotTable 2

This second pivot table shows all kinds of familiarity based on the respondents with the actual concepts of ESG criteria. This entire table reveals all the total 7 respondents (Wu et al. 2021). In this part most of the respondents have an appropriate step based with their majority to properly indicate all kinds of moderate level of understanding.

This gave an implied negative correlation coefficient of (“-0. 7354”) between Awareness of ESG criteria and the definition of ESG factors by organisations to the implication of the performance of the organizational entities. That the percentage of the studies reporting a positive relation between increased awareness and concerns regarding the ESG factors and the categorization of ESG factors as being separate from the financial returns does not rise indicates rather discouraging signs (Rijanto and Rachmawati 2024). It may be for this reason that higher degree of ESG awareness causes these factors to be more fully incorporated into the overall assessment of the organisations performance rather than as discrete factors.

On the basis of the above observation, one could predict that it is the Geography that greatly determines the extent of total financial benefits realized from ESG activities as reflected by the high ‘R’ coefficient values which are positive. In the time of representing 0.8255 of total financial benefits from ESG initiatives and of the regions (Muflihah et al. 2021). This goes a long way in supporting the thinking that variances such as region to region should be considered prior to deployment of ESG initiatives.

There appears to be a moderate positive correlation between the market sentiment impact and the financial benefits realised from ESG integration with a “coefficient of 0. 6447”. This has proven that corporations that saw good market response for their ESG activities involvement, had the possibility of getting more concrete, financial gains for higher investment in ESG (Gong et al. 2020). In the case of ESG awareness and its implementation, we get a relatively non-committal signal of negativity through the regression analysis (“p = 0. 4517”). This is evidenced from the low value of the “R-squared coefficient” which is equal to “0. 2031” indicating that there are other variables that have not been incorporated in this model that might influence implementation of ESG.

The bar chart and the histogram reveal an agenda that the approaches used in the research are positively skewed with many ‘yes’ responses accumulating at the base of the scale. It means that there might be many firms who are not even involved or have very limited understanding of ESG engagement (Duz and Tas 2021). The ANOVA of the perceptions of ESG show that there is a significant variation among the different professions with the financial and investing profession at 0. In ESG involvement or awareness, the mean score was 0.9167.

Chapter 5: Conclusion and Recommendation

5.1 Introduction

This entire chapter analyses some potential findings in the entire research study, that offer one of the most comprehensive aspects of the conclusion based on the research objectives at the beginning of the study. This entire research is focused on an appropriate relationship among ESG awareness as well as financial performance, which are considered the actual role of market sentiment as well as geographical variations (Lee 2020). However it also analyses some potential opportunities and challenges which are associated with ESG implementation in the entire organisations.

5.2 Linking with objectives

Objective 1: Analyzing Modern Methodologies and Frameworks for ESG Integration

The outcomes reveal the ideas that the present-day practices of applying the integration of ESG factors concern the utilization of such factors as the benchmarks for the application in the general organizational and managerial system of the firm. Key methodologies include: