+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

This report is intended to offer financial strategy in terms of conducting financial projections, investment appraisal as well as examining sources of finance for initiating business ideas. The organisation applicable for this report is “Greidys Strips and Wings” (GSW) which is identified as a renowned restaurant offering innovative dining experiences primarily in Birmingham. The main body of this report will be divided into two parts where part A will evaluate a comprehensive investment appraisal analysis to determine business expansion opportunities in Manchester. Part B of this report will evaluate working capital position prior to and after expansion in Manchester while additional impetus will be provided to evaluate viability of third expansion in Leeds.

Reference materials and sample papers are provided to clarify assignment structure and key learning outcomes. Through our assignments writing help, guidance is reflected while maintaining originality and ethical academic practice. The The Financial Projections, Investment Appraisal, Finance Sources For Business Answers highlights financial analysis, investment evaluation, and effective planning of business finance strategies. These resources are intended solely for study and reference purposes.

![Rachel Green]() Rachel Green

Rachel Green5 Years | PhD

The analysis provides a balanced perspective by examining both financial performance metrics and operational considerations. It incorporates quantitative calculations as well as qualitative evaluations to ensure that recommendations are grounded in realistic expectations and market conditions.

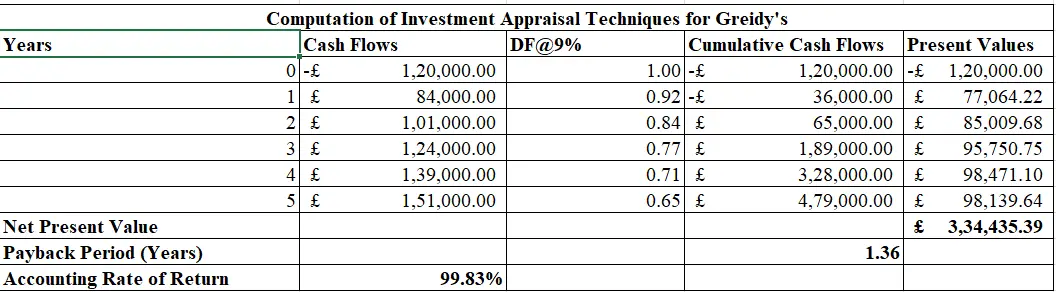

Figure 1: Investment Appraisal Calculations

Payback Period (PBP)

According to the above investment appraisal calculations, the “payback period” of the business expansion project in Manchester is calculated as 1.36 years. The identified numerical expression is considered to be significantly lower in comparison to the total estimated lifespan which is deemed to be five years. Therefore, the Manchester project could be chosen by the managerial concern of GSW since it meets the generic criteria of having a PBP that is less than five years. As per opinions and illustrations of Karnavas (2024), a low PBP for a project is considered to be beneficial since a faster recovery of initial investment costs could be contemplated.

The PBP method of investment appraisal is classified as a basic and a preliminary tool which has the advantage of being a simplistic approach in terms of establishing primary project feasibility. However, as per critical views of Broomhead et al. (2024), the PBP method is perhaps restricted to identification of cash flow composition that does not factor cost of capital or discounting factor influences. The PBP method of investment appraisal is also limited in terms of defining the monetary or percentile value of returns that a project could fetch and hence its investment decision making is perhaps given a low degree of priority.

Accounting Rate of Return (ARR)

From figure 1 of investment appraisal calculations, the “accounting rate of return” for the business expansion project in Manchester has been calculated as 99.83%. This figure denotes a high value of the “return on investment” (ROI) and hence project selection could be approved and accepted by the managerial concern of GSW. The high value of ARR also represents the fact that the project in Manchester is expected to generate high returns after considering a superior value of investment costs at the preliminary stages of the project. As illustrated by Gibb and Christie (2024), a high ARR is considered to be profitable since it can allow a company to gather more investors if urgent project funding is needed during the midway to later stages of project completion.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

The ARR method of investment appraisal is the second component after PBP which fundamentally establishes the proportion between average cash inflows and initial investment costs. Advantages of employing the ARR technique includes determination of ROI a project is likely to deliver during its entire lifespan. Andon et al. (2024), critically expressed and explained that the ARR project is perhaps limited in terms of including cost of capital influences in order to establish project feasibility. This method is also the easiest in terms of calculations and hence the lowest decision-making priority is offered to this method for selecting or rejecting a particular investment project.

Net Present Value (NPV)

In addition to the above analysis of PBP and ARR, the “net present value” from figure 1 has been calculated as GBP 334,435.39 for the business expansion project expected to be undertaken in Manchester. Hence, based on the NPV determined, it can be analysed that a positive value in high proportions is expected by GSW and hence the project meets criteria of selection on grounds of achieving a positive NPV. Vilani et al. (2024), explained and idealised that a positive NPV from a project is deemed opportunistic for a company to maximise future value of returns which could potentially translate into long-term project sustainability and profitability.

The NPV method of investment appraisal in addition to PBP and ARR is also a significant technique which expresses the monetary value of returns that could be obtained by a project during its lifetime. The advantages associated with employing NPV mainly allows companies to incorporate cost of capital influences due to which monetary values of projects after risk consideration could be obtained. As critically stated by Purnamasari and Adriza (2024), the potential demerits of NPV method mainly includes lack of determining percentile value of returns and the lack of ability to detect project profitability or facilitating comparison with cost of capital. In terms of decision-making priority, NPV is offered the highest weightage by companies since monetary returns can be observed and ultimate feasibility could be properly gauged for a project by companies.

Based on the overall investment viability calculated and analysed above, it can be expressed that the Manchester project is viable for GSW. This is further established in terms of determining a relatively low PBP in comparison to total project lifespan whereas the ARR and NPV also identifies high percentage and monetary values respectively. Therefore, based on the overall calculations and analysis, this project is recommended to be selected and extensive progress should be sought after in favour of expanding future business operations of GSW in Manchester.

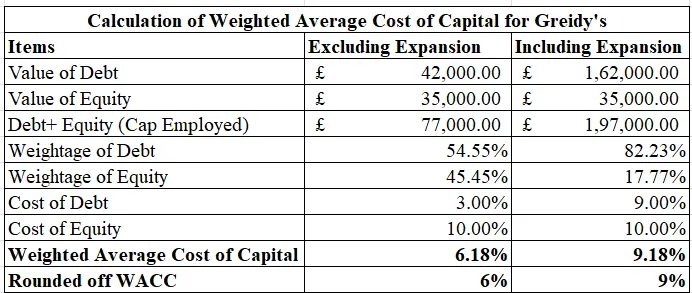

Figure 2: Computation of Weighted Average Cost of Capital

According to the above figure of “weighted average cost of capital” (WACC) computations, the rounded off figures excluding and including expansion have been measured as 6% and 9% respectively. In order to calculate WACC, cost of equity has been considered as the required rate of return which is expected to be 10%. Hence, an incremental WACC is recognised if expansion debt is added by GSW. As per critical explanations of Arhinful et al. (2024), a high value of WACC is an adverse proposition where challenges in the form of maximising project returns could be witnessed in future.

Evaluation of Market Sector

The market sector of GSW is identified to be the food industry where the company specialises in offering high quality chicken strips and wings to customers. The company is identified to exist in a competitive fast food and restaurant environment where extensive priority is offered to innovate with products as well as generate an influential customer experience. The market sector being competitive also requires GSW to implement product diversification in bulk quantities to stay relevant in the industry.

External Sources of Finance

The two external sources of finance that are not being utilised by GSW are crowdfunding and equity financing. As per opinions of Dinh et al. (2024), the crowdfunding source of financing allows companies to raise large capital volumes from individual investors mainly through digital channels and platforms. Similarly, the equity mode of financing allows companies to generate bulk capital volumes by issuing shares both in ordinary or preference forms (Liu and Gao, 2024).

Internal Sources of Finance

The internal source of finance not utilised by GSW is bootstrapping mode of finance. As per explanations and narrations of Rita and Nastiti (2024), the bootstrapping source of finance saves time and has a high flexibility where a company utilises its profits and retained earnings to fund projects and investment opportunities. The implementation of bootstrapping as a viable internal source of finance could have allowed GSW to retain complete ownership of project decision making due to which better financing strategies could have been employed.

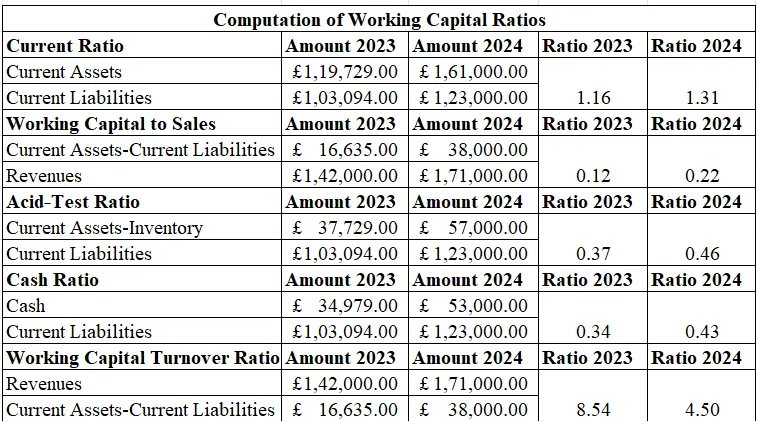

Figure 3: Computation of Working Capital Turnover Ratios

Current Ratio

“Current ratio” (CR) is the first working capital ratio and is formulated by considering the proportion between “current assets and current liabilities” (Tarighi et al. 2024). The above figure demonstrates numerical values of 1.16 and 1.31:1 indicating that the ratio has increased after business has been expanded in Manchester. The causes for increasing CR performances in 2024 can be reasoned to increase in “current asset” values in 2024 as compared to 2023. As per explanations of Yeboah and Kjærland (2024), an increase in CR is viewed as a positive attribute for an organisation due to which better operational stability and uniformity could be accomplished to undertake daily operations.

Working Capital to Sales

The second working capital ratio is “working capital to sales” (WCS) which is formulated by dividing revenue with working capital where the latter is the difference between “current assets and current liabilities” (Raza et al. 2024). The numerical expressions identified above are 0.12 and 0.22:1 which indicates a significant increase in performance in 2024 after the Manchester business has been expanded by GSW. Fundamental causes of increasing trends can be associated with increased value of working capital observed in 2024 as compared to 2023. The growth in WCS is identified as a beneficial proposition for a company in which better short-term asset utilisation is facilitated to scale products and services (Elgayar et al. 2024).

Acid-Test Ratio

“Acid-test ratio” (ATR) is alternatively known as the “quick ratio” which is the third working capital ratio calculated and is formulated by dividing “current liabilities” with the difference of “current assets and inventory” (Ramadan and Morshed, 2024). From the above figure of calculations, numerical expressions of 0.37 and 0.46:1 are identified in 2023 and 2024 which indicates that performance has increased after business operations have started in Manchester. The increasing trends are mainly noticeable in terms of determining incremental “current asset” values in 2024 as compared to 2023. As illustrated by Sogomi et al. (2024), an increase in ATR is perceived as a beneficial attribute for a company where higher cash reserves could be held to support critical business activities.

Cash Ratio

“Cash ratio” (CAR) is the fourth ratio which illustrates the relationship between cash and cash equivalents in proportion to current liabilities (Vlismas, 2024). Numerical expressions identified are 0.34 and 0.43:1 which indicates an increasing performance trend for GSW caused predominantly due to growth in cash values after commencing business in Manchester. As Habib and Dalwai (2024), expressed that an increase in CAR is profitable for a company to hold sufficient cash reserves after considering repayment facilities to trade creditors.

Working Capital Turnover Ratio

“Working capital turnover ratio” (WCTR) is the fifth ratio which illustrates the proportional relationship between revenue and working capital of a company (Deari et al. 2024). Based on the above figure, numerical expressions of 8.54 and 4.50 times are identified in 2023 and 2024 which indicates that WCTR has decreased significantly after business expansion in Manchester. This is predominantly caused due to a steep increase in values of revenues for 2024. Pant et al. (2024), critically demonstrated that a decrease in WCTR is an adverse characteristic due to which sales conversion could reduce if working capital is not efficiently managed by a company.

Overview of Third Expansion in Leeds

Based on the overall working capital analysis conducted, the third business expansion prospect in Leeds is deemed viable. This is justified in terms of determining strong growth trends for all ratios barring working capital turnover due to which GSW can efficiently manage short-term financing needs in favour of facilitating future business territorial expansion.

Conclusion

This report has signified that the investment appraisal analysis for the new project in Manchester is deemed viable on grounds of determining superior NPV and ARR as well as by determining a relatively low PBP. The sources of finance identified in this report are proud funding and equity financing as well as bootstrapping which are key elements of external and internal modes of finance. Part B of this report signifies favourable working capital ratio growth trends in 2024 and further business expansion in Leeds is also deemed viable for GSW in future.

Our assignment answer demonstrates how sources should be cited, and you can refer to a detailed Harvard Referencing Guide Example to ensure your work meets academic standards and maintains consistency throughout.

References

Question 1. An unidentified viral disease in St Kilda Field mice This question explores a viral disease in the St Kilda Field...View and Download

Introduction to Principles of Diabetes for Professional Practice Assignment This paper aims to discuss available...View and Download

Introduction - Contemporary Issues In Accounting Part A Take the stress out of your academic journey with our professional...View and Download

Question 1: Regulatory framework and financial reporting standards a) Need for a regulatory framework of accounting The need...View and Download

Q1. Further Laboratory-Based Diagnostic Tests for Identification of the Microorganism Effective treatment and management of...View and Download

2. Evaluate what necessitates a physical examination of the client prior to the aesthetic procedure Prior to the aesthetic...View and Download