+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Corporate tax is a kind of direct tax where which was imposed by the government of the country and is specifically targeted at both domestic and multinational businesses. In this assignment, the concepts related to corporate tax evaluation are going to be applied for North S.L. identifying the effects of corporate tax rate on the liquidity of the company. For students seeking UK assignment writing service, this analysis offers helpful academic support and clarity on complex taxation concepts. Those analyses of the financial aspect of the company are also going to be used to identify suitable approaches to the international market expansion of the company.

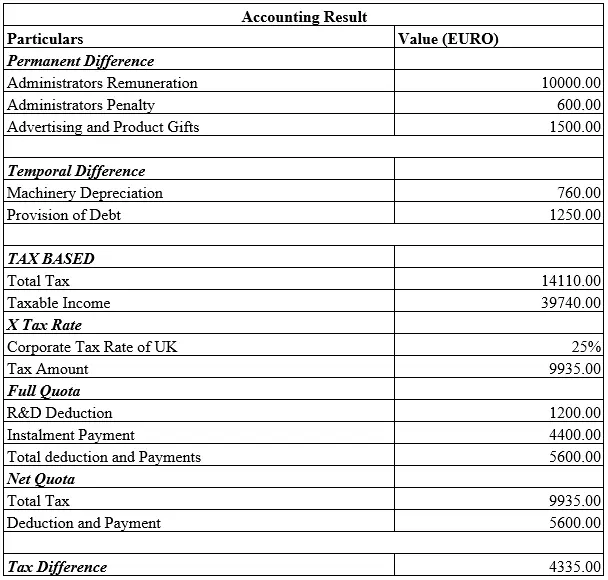

Task 1 focuses on analysing the corporate tax implications for North S.L. by reviewing depreciation adjustments, provisions, administrative expenses, and deductible versus non-deductible items. These tax treatments highlight temporary and permanent differences that affect the company’s taxable base and overall fiscal obligations.

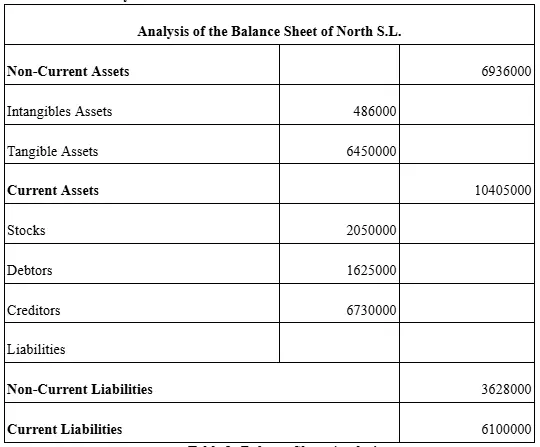

Balance Sheet Analysis

Table 1: Balance Sheet Analysis

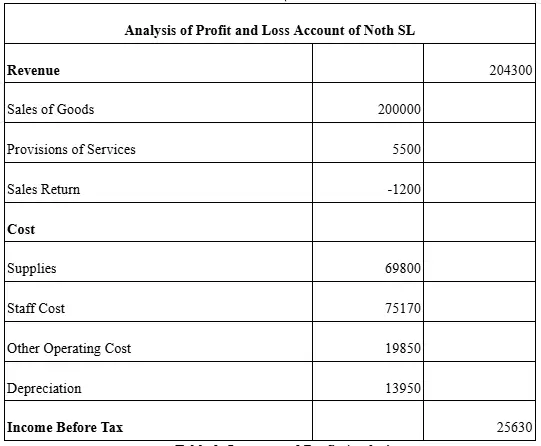

Table 2: Income and Profit Analysis

The machinery was acquired by North SL for 52000 euro in January 2014. The recorded accounting depreciation of the machinery was 7000 euro. As part of the Final Project International Corporate Tax analysis, calculating the fiscal depreciation helps identify temporary differences affecting the company's taxable base.

Calculating Annual fiscal Amount

| Particulars | Value (EURO) |

|---|---|

| Asset Cost | 52000 |

| Amortization Coefficient | 12% |

| Years | 18 |

| Annual Fiscal depreciation | 52000 * 12% = 6240 |

Table 3: Annual Fiscal Amount

However, by connecting the depreciation amount with the amortization coefficient rate of 12%, it has been identified that the tax rate of the machinery was 6240 euros. In this process, the variation amount of depreciation was 640 euros.

Temporary Difference

Accounting Depreciation Expenses = 7000 euro

Fiscal Depreciation = 6240 euro

This additional and delivered amount in the present depreciation represents a deferred tax asset for North SL. As it is included in the balance sheet of the company, it indicates an additional tax payment of the company for this particular year. This process can lead to a decrease in the overall tax payment obligation of the company for the current year however, the difference is temporary and might not be reflected in the future time.

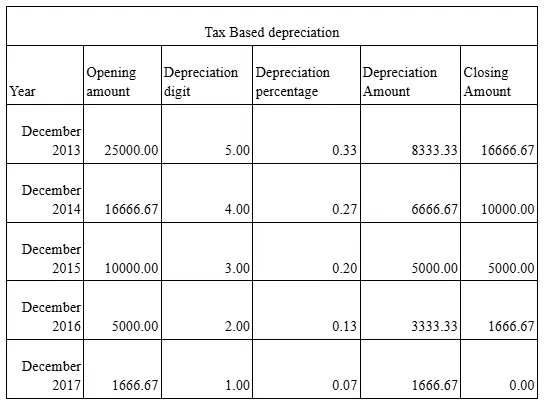

Table 4: Decreasing Digit Method depreciation

At the time of buying the transportation elements by the company, which is particularly the cars, the initial value was the same for both the accounting base and tax base which was 25000 euros. With a depreciation lifespan of 5 years, the yearly depreciation amount was expected to be 5000 euros per year. This analysis forms part of the Final Project International Corporate Tax evaluation as it highlights how different depreciation methods create tax adjustments. With the use of alternate depreciation methods of decreasing digit numbers, the company's tax legislations need to be evaluated using the straight-line method. With this new method clear difference was identified in the depreciation amount.

Tax Adjustment

For instance, in the first year, the tax-based decrease presented the closing value of the vehicles at 20000 euros, however, the accounting base depreciation valued the vehicles to be 16666.66 euros. This difference was particularly generated because of the variations in depreciation methods. However, by the end of the five years of the lifespan of the transportation elements, both the tax-based and the accounting-based were assembled to zero value.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

As 1250 euro was provided as a debt for that occurred in the current year. This is going to be presented in the profit and income statement of the company. This amount specifically reduces the tax based on corporate tax.

Tax Adjustment

Accounting Provision: 1250 euro

Tax Provision: 0 euro (This amount is not allowed for tax deduction)

However, for tax purposes, the provision of debt was only allowed to be accepted when those debts were probable or measurable. As the liability of 1250 euros was not claimed, this provision cannot be allowed as tax expenses.

Temporary Difference

After the legal claim of the obligation, this amount was going to be added to the profit and loss statement. This particular accounting treatment reflects the importance of recognizing income and its deduction of tax for legal claims.

As the liability had already been judicially claimed by the company, the provision was allowed as a tax deduction.

Tax Adjustment

Accounting Provision: 3000 euro

Tax Provision: 3000 euro (This was allowed as deducted expenses)

The amount of 3000 euros is going to be involved in the evaluation of the company income and loss statement. This can increase the overall corporate tax base of the company.

No temporary Difference

As the accounting provision and the tax provision were the same there was no difference and the company's taxable income is going to be decreased by the amount.

For the payment of administrators for senior management functions, the huge payment might be respected for the tax limitations. Assuming the 10000-euro payment exceeds the allowable limits of tax proposed, the non-exceeded amount of payment is going to be considered as deductible expenses.

Tax Adjustment

Accounting Expenses: 10000

Tax Expenses: 0 euro (Because the amount does not exceed the allowable limit)

The permanent difference was going to significantly enhance the taxable income because North SL was not allowed to deduct the payment of the administrator for the tax proposed.

For tax proposes, the administrative penalties generally do not consider expenses, thus it was not deducted.

Tax Adjustment

Accounting Expenses: 600 euros

Tax Expense: 0 euro (Not a deductive expense)

As no difference is going to have occurred with the administrative penalties, the company is going to face a higher taxable income. Therefore, no difference occurred in income tax assets or liability of the company.

The adjustments related to the expenses of sports conferences are presented below:

Advertising Expenses

The total advertising expenses of the company were 1200 euros which was considered an advertising expense that can be fully deductible.

Gift To Customers

As per the tax regulation of the UK, the product expenses related to gifts to customers are considered the representation expenses of the company. In this process, a portion of the amount of 2200 (generally 50%) euros was considered deductible (taxsummaries.pwc.com, 2025).

Gift to Employe

The expenses related to the gift of the corporation to its employees are generally considered personal expenses. This personal expense of 400 euros was considered non-deductible.

Tax Adjustment

Account Expenses: 1200 + 2200 + 400 = 3800 euro

Tax Expenses: 1200+ 2200 * 50% = 2300 euro

Difference: 3800 - 2300 = 1500 euro

This huge difference in the expenses results in a higher taxable income as the expenses are reduced significantly due to tax deductions.

The company announced a decrease in the investment amount of 1200 euros in the field of research and development. This deduction is going to directly minimize the taxable income of the company which decreases the corporate tax liability of the company.

The company was connected with an installment payment obligation of 4400 euros. This payment was directly integrated into the corporate tax liability of the company (gov.uk, 2025). The payment method of installments is going to decrease the corporate tax liability of the company, and any overpayment will be refunded in the future time. However, it does not have any permanent changes in the corporate tax of the company.

Task 2 evaluates the liquidity position of North S.L. by examining the company's ability to meet short-term financial commitments. Through the analysis of liquidity ratios and financial indicators, the impact of corporate tax obligations on cash flow stability and operational efficiency is assessed.

Table 5: Liquidity of North S.L.

North SL’s decision to expand internationally and select an initial foreign market was conducted by identifying the respective opportunities and challenges that the option possesses.

Advantages

The targeted North American market particularly the United States is one of the largest consumer markets in the world. If the company can achieve success in this market, it can have a sustainable profit with high revenues. Also, both Canada and the United States have a strong and stable economy which makes the market entry of North SL safer and more reliable (wolterskluwer.com, 2019). The North American market has divorced customers with different preferences of their own. This can help the company to make its unique customer base in this region. The biggest advantage rated to the North American market is its high technological infrastructure. This high level of technological advancement can provide a boost to the growth of the company in this market.

Disadvantages

The biggest challenge the company can face in the North American market is the high level of competence. This can significantly decrease the growth of the company in most of the top regions. Both of the countries have some regulatory difficulties and complexities which makes navigating their landscape complex and time-consuming (gigcmo.com, 2024). The two markets are also complex due to increasing compliance costs, regulatory intricacies, taxation, intellectual property laws, and other associated legal expenses.

Advantages

The biggest advantage of selecting the Portuguese market was its pre-knowledge and market research done by the North SL. This knowledge can help to reduce the risk of market entry. Brazil also has a growing economy with its high population makes it suitable for the growth of business. The Portuguese-speaking market has fewer competitors compared to the North American market and also has cultural and language similarities between the two countries Portugal and Brazil. This makes the business expansion process more effective and efficient. The fiscal condition of the Portuguese market was expected to decrease at a range of 0.3% in the upcoming year (economy-finance.ec.europa.eu, 2024). The related corporate tax rate was also expected to reduce.

Disadvantages

Despite the growing economy of the country, Brazil also faces significant problems due to economic instability in the past time (bbc.com, 2019). Economic instability was very risky for new and foreign businesses and reduced the speed of the business expansion process. Although the country's market has growth opportunities, the overall size of the market was smaller compared to the North American market.

Recommendation

After considering both the advantages and disadvantages of the two markets, it has been identified that, for North SL, the entering Portuguese-speaking market is suitable as it enables the company to make a more stable and safer expansion opportunity. The knowledge and familiarity with the market and Brazil’s growth potential make a balanced scenario for the company to grow while maintaining business risks.

Conclusion

Through the evaluation of Nort SL’s fiscal condition and tax obligations, it has been seen that there is a substantial difference in the tax payments of the company related to corporate taxation. With the tax-based method, both the company’s tax payment obligations and profits varied. Also, a detailed analysis of the fiscal condition of the two selected markets North American and Portuguese, has concluded that the second option is beneficial for North SL because of significant benefits.

References

MGT40423 Introduction To Finance Financial analysis refers to the process of evaluating business, budget, project and other...View and Download

Explaining How I have Developed as a Learner During This Module Developing as a learner is essential for academic success. This...View and Download

Introduction Get free samples written by our Top-Notch subject experts for taking help from our assignment...View and Download

1. Introduction Get free samples written by our Top-Notch subject experts for taking online Assignment...View and Download

1. INTRODUCTION View this assignment sample to see how to clearly present research on sustainability issues in e-commerce...View and Download

Introduction Leadership is crucial in determining success within an organisation, influencing the development of people,...View and Download