+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Managing risks plays a very important role in financial institutions since it provides them with stability, addresses the regulatory requirements, and allows coping with the conditions of the fluctuating market. Being a G-SIFI, Standard Chartered Bank has the responsibility of contributing to the financial system stability in various parts of the world. This is a global bank with its operations mostly in Asia, Africa, and the Middle East to mention but a few and the following risks are realised interest rate risk, foreign exchange (FX) risk, operation risk, and fraud risk. This paper critically analyses how Standard Chartered Bank addresses these risks through analyzing the bank’s latest Annual and Pillar 3 reports. The first section is on Interest Rate and FX Risk, which emphasises the ALCO practice on interest rate and foreign exchange risks through tools including VaR, duration gap, and hedging. It also addresses the effectiveness of the techniques in light of the Basel III and other standard requirements. The second section deals with the operation and fraud risks, focusing in the table on Standard Chartered Bank’s risk identification, risk management and compliance. These risk categories can be incorporated in the report instead of presenting them as individual sections that would allow the company to provide an integrated view of Standard Chartered Bank’s risk management system. In the end, preventive measures that should be adopted to improve risk management to counter the new threats in the banking industry are provided.

Assignment samples are provided to help students grasp coursework expectations and key topics. With our uk assignment support, guidance is shared while keeping all work original. The AF6037 Risk in Financial Institutions II Assignment Sample provides a detailed exploration of risk management practices, including assessment techniques, regulatory compliance, and operational strategies used in financial institutions. These materials are intended solely for study and reference purposes.

Standard Chartered Bank effectively manages financial risks such as interest rate, foreign exchange, operational, and fraud risks through robust assessment tools, regulatory compliance, and practical mitigation strategies. These measures provide valuable insights into real-world risk management practices in a global banking environment.

Standard Chartered Bank operates in a high credit-risk environment in the international financial markets, and; therefore, needs to have measures in place to prevent threats. For the management of risks in the bank, the institution has a well-developed structure that may be considered, the company has a well-delineated risk management structure anchored on the Board of Directors responsible for setting the scope of the organization’s risk appetite as well as compliance with international standards (Kamara, 2024). The significant governance committees that aid the Board are the Risk Committee, Audit Committee, and the Asset-Liability Committee or ALCO, which are major players in controlling risk matters influencing finance and operations.

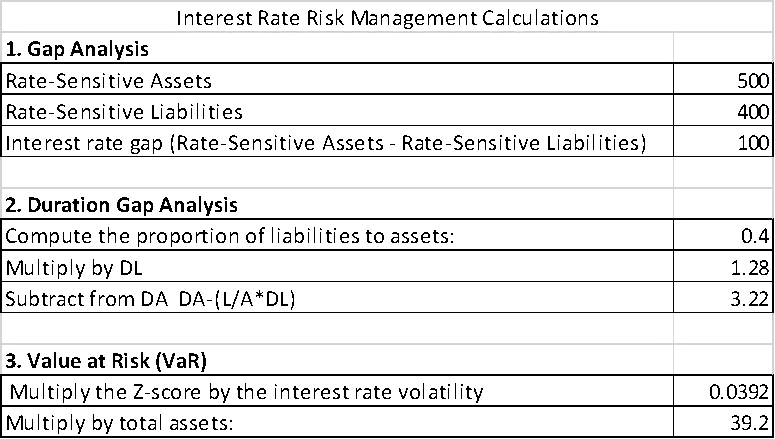

Most of the ALCO’s responsibility is focused on the keeping of checking and managing the interest rate risk and also the foreign exchange risk within the bank’s balance sheet. Some of these include Value at Risk or VaR, sensitivity analysis, duration gap analysis as well as stress testing to determine the extent of the vulnerability of the bank to movements in market prices. Furthermore, Standard Chartered also complies with the latest regulatory requirements called Basel III which set standards for adequate capital to handle the possible credit and market risks. The bank also follows the IFRS 9 financial reporting framework that adopts forward-looking assessment with the help of the expected credit loss model.

Another important consideration is the operational risk, for which a number of internal measures, including IT-based risk evaluation, and compliance with regulatory guidelines are applied (Sishumba, Saidi and Milupi, 2022). The Basel ORMF is also adopted by Standard Chartered to detect potential and emerging risks involving cyber-attacks, IT outages and operational, errors, and non-compliance. Currently, the bank has adopted the use of artificial intelligence and machine learning in detecting fraud and avoiding any financial crime targeting customer information. Business lines are considered to be the first line of defense, risk and compliance functions as the second line of defense, and internal audit as the third line of defense according to its operational risk management framework.

Standard Chartered Bank since it operates in many countries, faces a big problem concerning interest rate changes and more so foreign exchange risk. Fluctuations in interest rates have an impact on the amount of interest income of the bank and foreign exchange risks are obtained because the operations of the bank are done in different currencies across Asia, Africa, and the Middle East region (Ingabire and Ronald, 2023). To stabilize the company’s financial position and meet all the legal requirements specific methods of risk measurement and strategic approaches to its minimization as well as following the rules and regulations of the International standards are used by the bank.

Interest rate risk is therefore derived mainly from gaps between assets and liabilities in the balance sheet of the bank. At Standard Chartered, this risk is managed using the Earnings at Risk (EaR) and the Economic Value of Equity (EVE) measures. In line with concepts discussed in AF6037 Risk in Financial Institutions II, EaR measures the quantity of income a bank earns from the changes in interest rates for a certain period while EVE analyses the long-term implication of the rates in the overall value of the banking institution. Besides, duration gap analysis is used in estimating the exposure of assets and liabilities to interest rate change to strike a balance for the bank (Khadka, 2024).

Over the years, Al-Baraka has had a lot of operations in different parts of the world which has exposed it to foreign exchange risk resulting from transactions, translations, and any other similar exposures. FX risk management at Standard Chartered is done using VaR whereby it estimates the amount of loss, that can be incurred in the foreign exchange market at a fixed level of confidence after a certain period of time. While VaR models analyze past indices of currencies and provide forecasts of volatility in the market, the bank is put in a position to protect it from unfavorable movements in the market (Chamangwa, 2022). Besides, stress testing and scenario analysis are used to estimate the effect that extreme fluctuations of currencies have on the bank’s capital position and earnings. With the above risk assessment techniques, interest rate and FX risks are well identified, measured, and managed at Standard Chartered.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Table 1: Interest Rate Risk Management Calculations

The interest rate risk called for an effective and dynamic approach in Asset-Liability Management (ALM). A key component in managing assets and liabilities in relation to interest rate movements is the Asset-liability management committee fondly referred to as ALCO in the bank’s operations. Interest rate risk is also an important area whereby the bank may employ interest-rate swaps; the bank swaps fixed interests for fluctuating interests or vice versa. Such types of derivatives as caps, floors and swaptions are used to hedge the interest rate risk of Standard Chartered (Ahmed, 2023). Also, due to the world’s complexity on their loan and deposit rate, they are also able to manage the rate risks in such a way that it will not have a negative effect on the net interest income on their balance sheet.

To address FX risk, the bank's natural hedge, it use derivatives and has a policy on currency diversification. To overcome this, natural hedging is a common policy in which foreign currency assets are paired with Plan B liabilities with the same currency. To mitigate the risks that arise from exchange rate fluctuations, Standard Chartered uses FX forwards, options, and currency swaps if natural hedging is not possible. The bank also holds insurance against excessive volatility as well as having cash across various regions. Moreover, management of FX exposure is done by setting position limit, stop loss basis, and constant market surveillance of such risk so that accumulation of large value does not take place at any given time.

A very important safeguard within the interest rate and the forex exposure is the stress testing that aids the bank in seeking the extent to which risk management would be liable in case of a crash (Kimani and Kibera, 2023). As a result, while using interest rate and currency shock scenarios, Standard Chartered can adjust its hedging plan and improve some capital reserves.

Interest rate and FX management policies laid down by Standard Chartered fully complied with the Basel III, IFRS 9, and PRA regulations. To address this issue Basel III has compelled the banks to hold a good capital adequacy ratio (CAR) to effectively mitigate these losses occasioned by interest rate and forex variations. The bank also maintains adequate LCR and NSFR to provide general control over the liabilities side of the balance sheet and controlling of funding during strained conditions.

The bank also obeys International Financial Reporting Standard 9 which calls for forward testing of risk and expected credit loss (ECL). By using this approach, it is easier for the bank that dealing with contingent losses due to either a change in interest or currency rates and apply measures to reduce them (Ngotho, 2023). Furthermore, the Financial Conduct Authority (FCA) and the Bank of England (BoE) which makes them conduct stress testing, report capital adequacy, and make more disclosures on market risks than a normal bank also closely monitor the management of risks in Standard Chartered.

Interest rate and FX are directly correlated as movements of the interest rates will lead to currency rate movements; the following discussion elaborates in detail about Standard Chartered, a multinational bank. For instance, when the U.S. Federal Reserve increases the interest rates, the value of the U.S. dollar increases leading to an impact on the bank’s USD based on assets and liabilities. Like this, established and growing market economies of SC operation might face the issues of currency fluctuation and capital flight leading to higher FX risk and liquidity danger.

There are areas where these risks intersect in an organization, and one of them is in funding and liquidity management. An increase in interest rates means that the cost of borrowing also goes up and this puts the cost of proactively managing the FX exposure by the use of derivative products in a more expensive point for the bank. Thirdly, changes in exchange rates are highly influenced by wider interest rate differences between the countries the bank operates and affect its carry trades (Abu, et al, 2021). These challenges are contained by having the bank’s interest rate and FX risk strategies managed by ALCO so that hedging of these risks is coordinated with each other.

Standard Chartered Bank uses efficient practices in, assessing, monitoring, and controlling interest rate and FX risks with a view of adhering to international standards and at the same time protecting itself financially. Through VaR, stress testing, hedging strategies, and some of the regulatory compliance measures, the bank is cushioned against the shocks in the market.

As you will find Standard Chartered Bank is a global operation bank branching out in numerous countries, therefore the operational and fraud risks remain amplified in the company. The bank has put in place necessary measures that check and prevent business interruption’s and embezzlement of funds which may occur due to these risks. These strategies are also validated by references to real-life cases as well as the consideration of further development in the future. This discussion on these risk factors and the way they have been managed gain knowledge on how Standard Chartered Bank is able to operate under various risks within the banking system.

Banking operational risk refers to the inherent risk due to the inability to provide efficient solutions and delivery through an efficient system of overall organizational factors. Fraud risk, on the other hand, is associated with deceit for monetary benefit and this may include fraudulent cyberspace, money laundering fraud, and insider fraud. AF6037 Risk in Financial Institutions II highlights the importance of regular evaluation and monitoring of such risks to prevent financial losses and reputational damage. Standard Chartered evaluates these risks regularly and also through audit reviews as well as stress tests. To monitor the risk and also forecast potential weakness, Key Risk Indicators (KRIs) are used by the bank. Also, the use of sophisticated algorithms like data analytics and machine learning helps in identifying some transactions that may contain fraud (Mwanzia, 2021). The same is done in a broader view by the integration of the scenario analysis in assessing the repercussions of future probable operations failure and fraud events.

Other operational risks include third parties, supply chain, and relations with the digital platform. In light of the innovation in through the use of digitally-based banking services, firms have become more vulnerable to incidents of data theft, phishing scams, as well as system downtime. These are managed by the organization through cybersecurity audits, penetration testing, and system redundancy annually at Standard Chartered. One of the most important aspects that affects the evaluation process of risk is the element of regulators since most compliance issues may lead to legal or even severe monetary consequences.

To address these operations and fraud hazards, Standard Chartered has established internal controls, security measures, and other compliance requirements. It adopted the 3 lines of defense to make it easy for the operational units, risk management teams as well as internal auditors to identify risks that may occur within the bank. Real-time transaction monitoring, automated fraud detection, and biometric form of identification secure against fraud (Ewool and Quartey, 2021). AML and KYC policies are also strictly observed to reduce incidences of money laundering and other illegal activities within the company. Other measures that enhance the risk management efforts include ongoing training of regular staff on cybersecurity awareness and fraud.

The bank has also emphasized dealing with operational risks that involve cybersecurity, and it spends in acquiring firewall systems, encryption technologies and intrusion detection systems. This means that consistent risk evaluation is something that should be carried out to ensure that security threats that may be present in a computer-based system are identified and corrected before they become a problem. Other measures include the use of behavioral analytics that pinpoints unusual activities of clients within a bank by analyzing their behavioral patterns. Besides this, to avoid the leakage of financial data to unauthorized personnel, the access steps and multifactor authentication processes are put in place.

Standard Chartered has been subjected to fines and regulation fines resulting from failure to implement good compliance compliance standards. One of the major known issues was related to the lack of sufficient implementation of AML measures which earned the company a rather large fine by the UK and US authorities. This event made the bank realize the relevance of tight compliance measures and as a result, boosted the transaction monitoring procedures and the efficiency of the regulatory reporting. There was also an attempt at cyber fraud in which the bank fraud team prevented a big loss of the company’s money. Such events demonstrate the importance of constant improvement of fraud prevention measures and timely risk identification.

In another case, Standard Chartered faced problems with their shortcomings in the processes of identifying PEPs. It resulted in the replacement of the bank’s customer screening guidelines in order to properly identify and evaluate high-risk clients. These cases as such call for the need to address one crucial issue, among other things, the ideology of risk assessment and monitoring on a real-time basis in addition to consequent intervention to curb financial misconduct.

The bank has also experienced some operational challenges such as system breakdowns that almost halted some of the digital banking services (Ojeka, Adeboye and Dahunsi, 2021). In return, standard chartered incorporates improved IT systems with proper operational and recovery systems to manage the uncertain scene. Such steps are cloud backup to ensure that any potential failure does not lead to longer downtime and the setting up of other operational facilities.

Table 2: Operational Risk Management Performance Analysis

Evolving types of financial crimes and the development of information technology pose threats to Standard Chartered despite effective measures toward managing its operational and fraud risks. As emphasised in AF6037 Risk in Financial Institutions II, integrating emerging technologies such as AI and blockchain can significantly enhance fraud detection and operational resilience. The level of cyber threats continues to rise hence the need to adapt through AI’s for fraud detection and security through blockchain (Alsharari, 2022). Furthermore, changing regulations from one country to another requires one to be on the look to be able to adjust accordingly. Integration of the said platforms with other financial authorities and the effective use of real-time sharing capabilities will also be vital in future risk mitigation exercises.

The deeply concerning problem is the formation of deepfake technology and synthetic identity fraud which is a new threat to the banking systems. To enhance the identification of fakes and scrutiny, it was revealed that Standard Chartered is keen on employing more complicated species of artificial intelligence in account identification. Moreover, as the use of digital technology and solutions progresses further, maintaining business continuity in the new work model becomes essential (Ahmed and Alam, 2023). The bank has to improve the process of Risk management based on new and unknown scenarios in the financial world.

Standard Chartered also needs to manage climate-related financial risks that are always likely to present themselves. It has therefore become the norm for regulatory authorities to demand for evaluation and management of operational risks that include environmental and social aspects (Altaf, et al, 2022). It, therefore, involves ensuring that climate risk becomes part of the radar of risk management of the bank, and that the organization becomes compliant with sustainable laws across the globe.

Conclusion and Recommendations

It is possible to note that Standard Chartered Bank uses numerous methods for operational and fraud risks, which include using both technologies and internal controls, and compliance mechanisms required by regulators. Similar incidences that have occurred in the bank have highlighted the importance of constant assessment of risks as well as enhancement of security measures. It has several defense measures, yet there are threats like cyber fraud, shifts in regulations, and environmental factors.

Therefore, to improve the risk management system, Standard Chartered should consider embracing emerging technologies like AI in threat detection and blockchain for secure monetary transfers. Also, the continuous training of the staff as well as ethical measures of corporate governance shall also enhance fraud control frameworks. There is a need to enhance cooperation with international banks and ministries because information exchange in the field of financial crimes will be real-time. Last but not least, integrating sustainability risk management into operation will enable Standard Chartered to adapt and be ready to respond to different regulations and markets concerning climate finance. In this way, the company can ensure that it continually adapts its approach towards the management of risks, and thus protect its solvency in light of the evolving banking systems across the world.

References

Introduction This report demonstrates the application of networking concepts by completing three tasks: developing IP schemes,...View and Download

Introduction Get free samples written by our Top-Notch subject experts for taking online Assignment...View and Download

Introduction to Corporate Social Responsibility Template Assignment In the current competitive environment, companies need to...View and Download

Introduction Global business environment refers to the term utilised to explain the challenges along with the opportunities...View and Download

Main Body With technological advancements and evolving work patterns driving entrepreneurship, the UK interior design market...View and Download

Introduction Get free samples written by our Top-Notch subject experts for taking online Assignment...View and Download