+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Inflation and exports could be considered as two key aspects that possess certain impact on the overall performance of an economy of a specific country. For students seeking help writing assignments, this topic offers rich analytical scope. As the general price level of goods and services rising or falling on an annual basis the inflation is commonly described as the measure of purchasing power of currency and stability of the economy. This paper aimed at analysing the relationship between inflation and export with a hope to establish how inflation varying rises the production costs, affects exchange rate and hence export competitiveness.

Since Germany is one of the biggest export-oriented countries in the world, the analysis of the relationship between inflation and exports can be made using the country as an example. The export market has been an important aspect of the German economy since the past and in trading, manufacturing, automobiles, and industrial products. Evaluating the relation between inflation and exports is extremely important to policy makers, organizations and economists wishing to enhance the stability of their countries’ economy and global standings.

Research Question

Dataset Overview

The evaluation is done using the historical data ranging from 1970 to 2023 with two independent variables.

Specifically, in this study, correlation analysis and regression modelling would be used in an attempt to offer long-term assessment of the links that exist between inflation and exports for Germany.

Data Collection: In this research, data has been obtained from the World Bank website. It contains data of inflation rates (independent variable) and exports and imports (dependent variable) for the year 1970 to 2023. This data was selected for this purpose because there is a need to examine increasing inflation levels and their relation to trade over time.

When preparing the data for analysis, the data was tried out on missing values, outliers, or errors. As with all the other variables, no values were missing in this case as well, although there were some small oscillations. To check the effect of outliers on the results, box plots were performed.

Tool

Microsoft Excel is very much suitable for data analysis because it is a very powerful tool especially for data analysis and it could help to get accurate outcomes and better visualization of data.

Statistical Methods

Based on the three research questions, the statistical methods which will be used in the excel to get the outcomes from the dataset which has been collected from the World Bank. All the methods.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

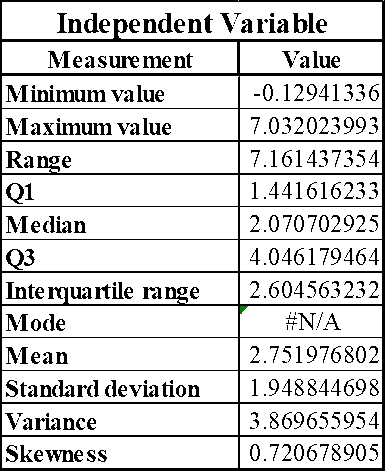

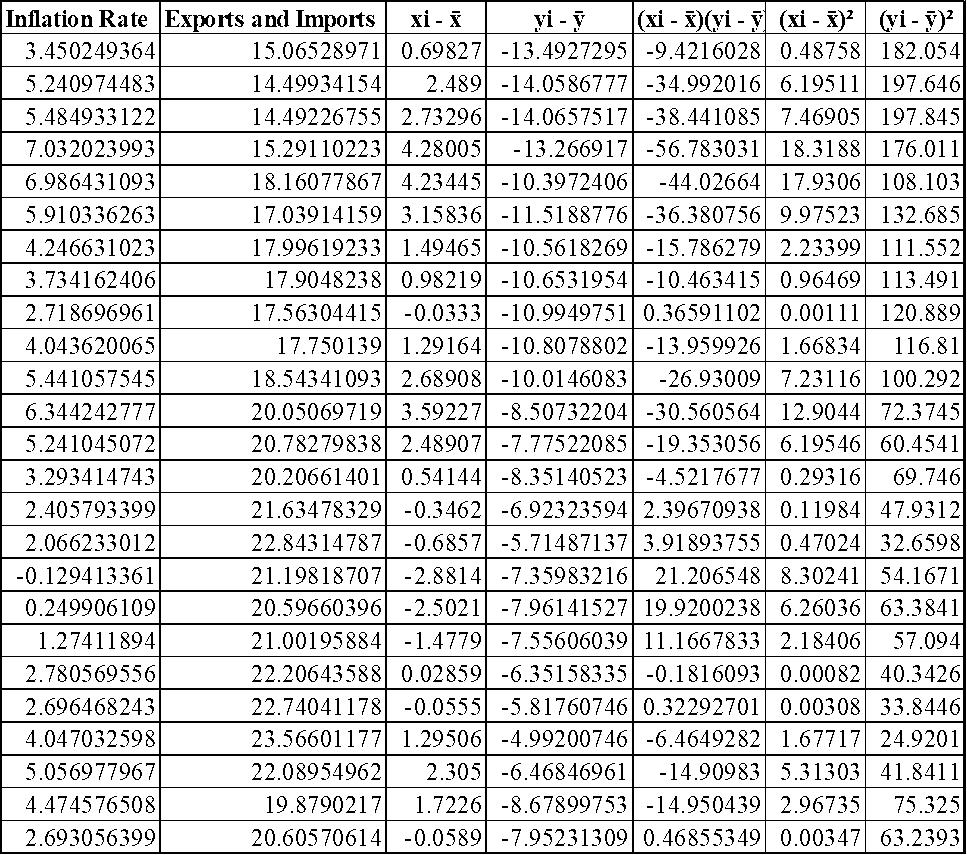

Figure 1: Independent Variable

What is noticeably here is that these numbers do depict some sort of trend. The range of the data obtained is calculated as 7.16 when the minimum value is at -0.13 and the maximum is 7.03 (Margarian and Hundt, 2023). These values are gathered mostly around the mean value of 2.75 and half of the values range from 1.44 to 4.05. The statistics are rather right-skewed with the skewness coefficient equalling 0.72 and moderately dispersed with the standard deviation of 1.95. As it can be observed, there is no mode, null and each value seems to be distinct.

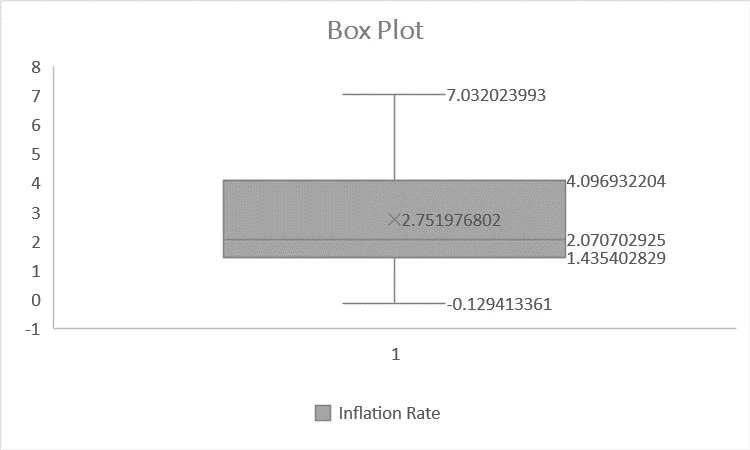

Figure 2: Box Plot

From the box plot, inflation rates lie in the range of -0.13 and 7.03. It is between 1.44 in Q1 and 4.09 in Q3 with an average of Q2 equal to 2.07 (Geyer et al. 2023). By looking at the box, one can observe that the graph shows good symmetry about the median in regard to the given box (Urrehman Akhtar, 2022). The upper horizontal line, 7.03, is a bit longer than the lower one which is 0.13.This pointed out an existence of higher inflation rate to some extent while the lower whisker is not that long.

Figure 3: Dependent Variable

The results vary from 14.49 to 45.78, which is 31.29 units wide. All values are percent higher than the mean and vary between Q1 (20.30) and median (28.56), and Q3 (40.35). Thus, there is significant variation in the data which is evidenced by the standard deviation at 10.17 (Krulicky et al. 2022). The distribution is positively skewed, 0.30 while this indicates that it is slightly inclined towards the higher values. Where mode is equal to nil, each value is also represented just once.

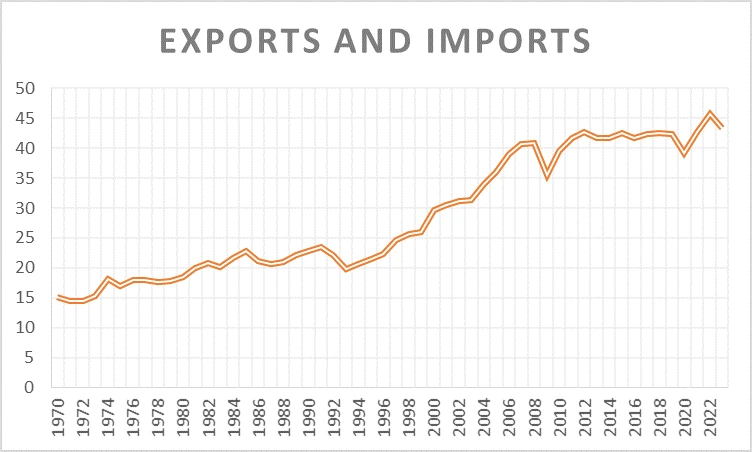

Figure 4: Line Chart

From the given graph, export and imports depict an upward pattern over the years, and it ranges from 1970 to 2022 (Koppany et al. 2023). It was estimated that around 15 from 1970 then slightly increased until the middle of 1990s in the range between 15-20. After 1995, there is a sharper incline and the figure reaches to about 40 units in the year 2010. The last decade oscillates between 38-45 units and goes down to approximately 45 units in the year 2022 [Referred to Appendix 1].

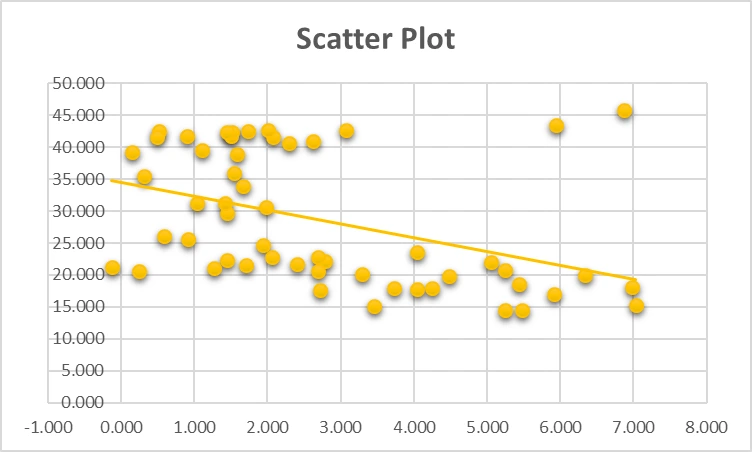

Figure 5: Scatter Plot

This chart represents a graph called scatter plot which portrays the independent variable on the X-axis and the dependent variable on the Y-axis (Ciftci and Karadag, 2024). The end points of a straight line represent the scores of a specific respondent for both the variables under consideration. As it could be seen from the chart, the points are not all clustered together, and therefore, are not heavily interrelated, or, in other words, are not strongly positive if not negative. For the values on the Y-axis, there is a difference between the profiles, both with increase and decrease of the values across the X-axis (Cai et al. 2021). For instance, some have high values on the Y-axis even when the values on the X-axis are low, or they reduce to almost negligible levels when the X-axis values are high. This irregular pattern indicates that independent variables do not have a significant effect on a particular dependent variable.

Figure 6: Pearson Correlation

Analysing the information about inflation rate and exports and imports this has established the value of Pearson correlation coefficient is equal to -0.415. It is also evident that this type of value reveals a fairly mild though negative relationship between the two variables. This implies that during inflation, imports and exports decrease but the extreme levels cannot be obtained.

This is portrayed to be negative implying that elevation of inflation Interior could lead to minimal levels of foreign trade (Ademmer et al. 2022). This might also be due to the fact that due to inflation the cost of production goes high and therefore export becomes expensive hence do not favour the international markets.

However, due to the fact that the coefficient of the relationship representing per capita income is not so close to -1 as it is close to zero (- 0.415), it is not very sure that this is the only reason why exports and imports ratio are deteriorating (Algieri et al. 2024). Some of these may include exchange rates, government policies, and the general state of the world economy.

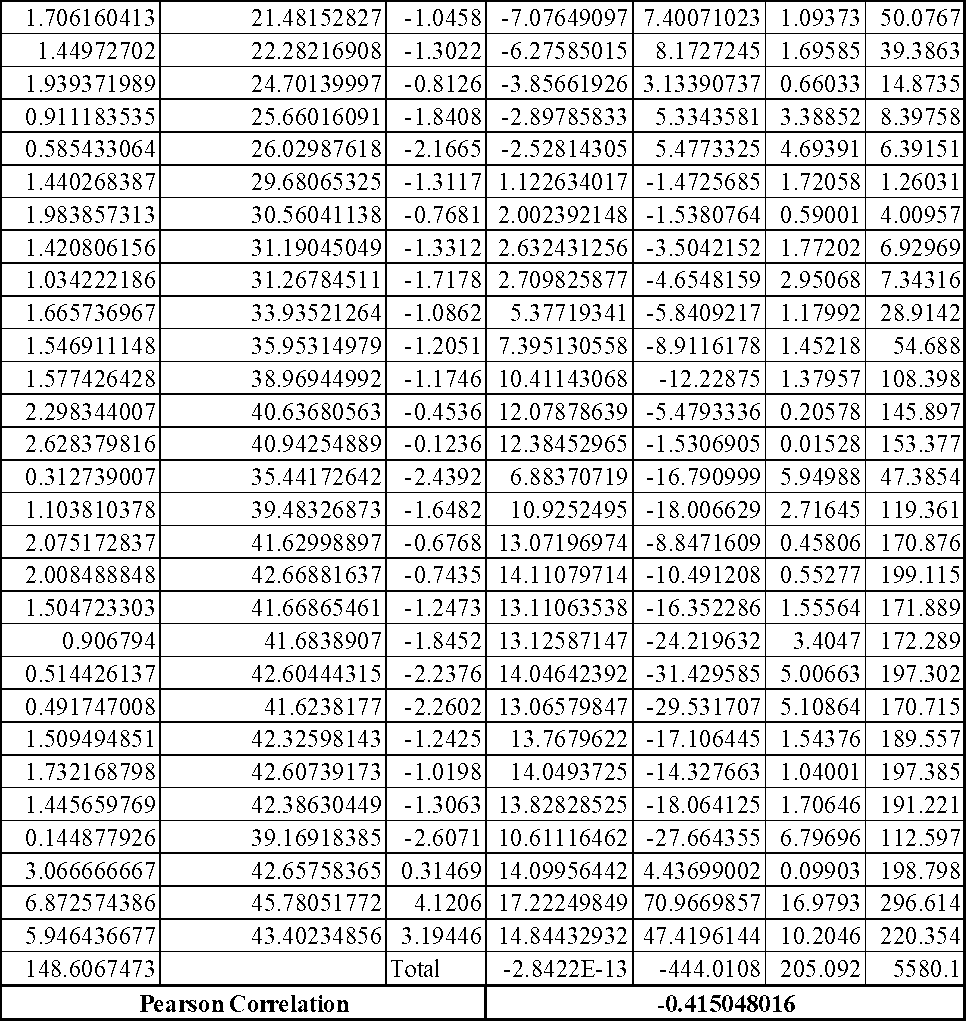

Figure 7: Linear Regression Analysis

This represents the relationship between the inflation and the exportation level of Germany. The points in the graph represent the many years whereby the inflation rates on the bottom and the exportation rates on the left side were measured.

When joining the dots and having a number of short wedges on the line, it is referred to as the regression line (Fritsch et al. 2023). As a result, it helps in predicting the behaviour of exports in relation to a change in inflammation level. In the case of the increasing inflation, the line shifts from the left to right which suggests that exports also rise in Germany.

The coefficients from the top equation, indicating that a perceived inflation leads to exports, have a value of 0.6471 showing that exports are positively affected in the ratio of 0.65% of GDP per every one percent of perceived inflation. Thus, having calculated R square = 0.9096, it can be stated that this relationship is very high; that is, changes in exports are observed to be equal to 91% of change in inflation.

When it comes to the visibility of the dots, this can identify that they follow the line drawn through the middle part of the figure rather well. Thus, one can also establish rather high stability regarding the relationship between inflation and exports (Margarian and Hundt, 2023). These are pegged at one percent for the low inflation rates ranging from 0 – 5% and are 45% for high inflation rates of between 20-30% for any given country.

The correlation shows that exports or imports have a moderate negative relationship because the value of the Pearson’s coefficient of correlation (r) is -0.415. This means the projected relationship is a negative one, meaning that when inflation rises, trade declines although the magnitude of the effect is rather small (Braggion et al. 2023). This is because; cost of its products rises hence leads to low export while its ability to purchase foreign goods is improved due to higher inflation.

This plus the analysis of coefficients suggest that a better relationship is shown in the regression analysis. When using the R-squared value, it stands at 0.9096, which means that 91 % of the export variation has an association with the variation in inflation levels (Von Meyerinck et al. 2022). From the regression analysis, the coefficient sign is positive 0.6471 indicates that exports equivalent to 0.65% of GDP increases for every one percent of inflation in the economy.

It also observed higher exports for a high inflation image at 20-30 % point whereas for low inflation ranging between 0-5% were observed to have a slow exports growth (Ademmer et al. 2022). It also explained that inflation in Germany has been accompanied by an increase in the export of goods but other factors may affect this relationship.

_693657a731a57.webp)

Figure 8: Time Series (Inflation Rate)

The figures have changed after forty-two weeks from the year 1970 to 2022 as shown in the following graph. It is drawn as a blue line during the former and indicates areas with rising prices and areas that had slow rising prices (Algieri et al. 2024). What is more, it is clearly seen that by using a straight slim line shifting upward to the left and making a sharp turn upward at the year 2022, it means that the prices were gradually moving up over some period of time. The minimum inflation rates occurred in the mid of 1985 and mid of 2020 where the prices remained nearly similar.

_693657bcc6dd9.webp)

Figure 9: Time Series (Exports and Imports)

This graph shows the imports and exports of Germany starting from the year 1970 to the year 2022. It is further evident by the progression of the white line in the vertical axis that trade had risen to a greater extent (Fritsch et al. 2023). From this line, one could see that the increase of this line moves up gradually at the initial period and accelerates from the year 1990. There was a slight dip in 2008 and again in 2020, when the trade slightly dropped but the rate was quickly on the rise. The volumes of trade by 2022 quite naturally exceeded the indicators of 1970.

7. Conclusion

This report is required to determine the effect of inflation on the exports of Germany. It also concluded that the domestic level of inflation tends to exert a negative effect on exports through increasing production cost and therefore make export prices high. The situation with rates in the foreign countries and other several factors influence exports as well. The correlation and regression methods were employed to assess this research work. Despite this, there are other factors that affect the situation, apart from inflation. Several economic factors that one ought to consider when carrying out the planning include the following. In general, it can be concluded that it is crucial for Germany to maintain a stable economy to be competitive in export markets.

Reference List

Journals

Introduction - Reflective Writing Struggling to meet deadlines? Rapid Assignment Help provides fast, reliable, and affordable...View and Download

Introduction - Strategic Marketing Entrepreneurship Get free samples written by our Top-Notch subject experts for taking online...View and Download

Introduction to Predicting Garment Worker Productivity with ANN Assignment The goal of this study is to create predictive...View and Download

Introduction - Contemporary Issues in Business Management Rapid Assignment Help delivers excellence in education with tailored...View and Download

Introduction to Professional Teaching Practice Assignment Sample Main Body Observation report using one method of...View and Download

Introduction to Evidence-Based Practice In Nursing Assignment Sample Contemporary nursing aims to present a review of the...View and Download